Why LCVs are still lagging behind when it comes to electrification

While electric cars are rapidly gaining ground in Europe, electric LCVs are struggling to keep pace. This lag is the result of technical, economic and regulatory constraints that are holding back the transition of LCV fleets to zero-emission vehicles.

Key figures and analysis of the LCV segment

Light commercial vehicles represent around 20 % of the commercial vehicle fleet in Europe, but only 6 to 8 % of new commercial vehicle sales will be electric in 2025, according to ACEA data.

In France, the market share of electric 100 % LCVs is just over 10 %, despite tax incentives and increasing restrictions in low-emission zones (ZFE).

There are many reasons for this:

- Weight and autonomy An LCV has to carry up to 1.5 tonnes of payload, which greatly reduces its electric range.

- High purchase price The average extra cost compared with an equivalent diesel is still 30 to 40 %, despite the public subsidies available.

- Limited offer Some key segments (large volumes, refrigerated vans, 3.5 t) still have few viable electric alternatives.

As a result, companies are reluctant to renew their fleets without stable regulatory visibility or a guarantee of appropriate infrastructure.

Regulatory obstacles identified by ACEA

L'ACEA points the finger at a series of obstacles in the current regulatory framework. European Regulation (EU) 2019/631 imposes very strict CO₂ emission targets on manufacturers for 2025 and 2030The technical realities of commercial vehicles are very different from those of passenger cars. However, the technical realities of commercial vehicles are profoundly different.

Bottlenecks identified:

- Unsuitable emission standards LCVs are subject to CO₂ reduction targets (-31 % by 2030) while their duty cycles are more demanding.

- Fuzzy categorisation The distinction between categories N1 and N2 (based on total permissible laden weight) does not take account of the diversity of professional uses.

- Lack of targeted incentives : Unlike passenger cars, LCVs benefit from few super-credits or flexibility mechanisms to offset the additional costs of transition.

According to ACEA, these rules are holding back investment and limiting the competitiveness of European manufacturers in the face of new Asian entrants.

Consequences for fleets (TCO, supply, usage)

For fleet managers, these imbalances translate into :

- Heterogeneous TCO depending on the mission: excellent for regular urban services with depot charging, tighter for heavy interurban services.

- Sourcing sometimes focused on specific silhouettes (large volume vans, specific conversions, refrigerated vans).

- Operating the need for formalising the recharging strategy (depot/domain, roaming), to equip the energy management and adapt the HR management (eco-driving, redesigned routes, integrated charging time).

The good news is that these constraints are manageable with a methodical approach (usage profiling, data tools, choice of suitable body shapes/equipment) and should ease if the EU adjusts the framework as requested by ACEA.

ACEA's appeal: what concrete demands should Brussels make?

At European level, the Commission sets the CO₂ targets and the technical framework; the Parliament and the Council adopt/amend them. ACEA is therefore turning to "Brussels" to correct side effects that are slowing down the electrification of commercial vehicles. The aim is not to unravel the transition, but to make it achievable and economically sustainable for all players, including fleets.

Extended deadlines and revised CO2 targets for LCVs

ACEA requests :

- A a more gradual timetable for 2030This is to take account of utility development cycles (which include the bodybuilder-equipment manufacturer chain as well as the vehicle itself).

- A re-evaluation of objectives in the light of actual industrial capacity, useful autonomy under load and the availability of suitable infrastructure (depots, logistics areas).

Impact on fleets These include greater price/model stability, a more diversified range and more predictable residual values, all of which help to secure your LOA/LLD business plans.

Adaptation of classification (categories N1/N2, PTAC)

The weight of battery mechanically penalises payload and GVW. ACEA proposes :

- D'adjusting thresholds for electric LCVs (e.g. GVW exemptions of up to 4.25 t already envisaged in some countries), without loss of rights (licence, tachograph), in order to preserve payload and standard approval.

- D'harmonise approaches between countries to avoid cross-border headaches (logistics, chartering, subcontracting).

Impact on fleets A wider choice of electric body styles without compromising on payload, a critical point for tradesmen, couriers, food distribution and mobile after-sales services.

Incentives for electrification and super-credit subsidies

ACEA calls for :

- Reinforced super-credits for zero-emission LCVs to encourage local production and lower costs.

- Minimum harmonisation of professional aids between Member States to reduce competitive disparities.

- Targeted fleet incentives (SMEs, ETIs, local authorities) coupled with investment in deposit recharging.

Impact on fleets These include more competitive rents, a faster return on investment, and the ability to initiate or extend electrification plans without damaging cash flow.

Direct impact for fleet managers: what they need to anticipate

A revision of the European framework cannot be decreed overnight, but the lines are moving. Fleet managers who anticipate these changes will be able to secure their costs, professionalise their recharging model and enhance CSR performance in calls for tender. Here's what you need to start preparing now.

Review of electric vehicle/utility choices: technological maturity and costs

Three trends to include in your analysis grids:

- Useful autonomy New generations are making progress (yield, aerodynamicsenergy recovery), but the real difference lies in the way the vehicle is paired with its user. Map out your missions: dense urban? 250 km interurban? cold? heavy tools?

- Cost of the battery Alternative chemistries (LFP, LFP-M3P) and European industrialisation are improving the purchase price and durability, with expected effects on rents and residual value.

- Professional equipment These include on-board 230 V sockets, coupling, cold pre-wiring and integrated telematics. These are measurable operational gains (intervention time, safety, traceability).

A good idea is to divide the fleet into families of uses (urban, inter-urban, worksite, breakdown service) and test 1-2 models per family to determine the 'right' range and payload.

Charging and infrastructure strategy: what fleets need to plan for

The success of an electric commercial vehicle fleet depends on professionally designed recharging:

- Deposits For example: opt for 11-22 kW AC at night, controlled by smart charging software (load shedding, load shedding, tariff bands). Size the power subscription after simulation.

- Roaming These include: mapping DC 50-150 kW on routes, defining back-up slots (meal breaks), providing drivers with interoperable badges (and a "plan B" procedure).

- Home : right to plug, clear kWh reimbursement, control of charging declarations via telemetry.

The aim is to ensure reliable business continuity, smooth out energy bills, reduce energy consumption and improve the quality of service.carbon footprint. Clear governance (who recharges where, when, how, at what cost) removes 80 % of perceived friction.

Inclusion in CSR criteria, ZFE, ESG reporting

Electric LCVs produced in Europe with a high eco-score tick several boxes:

- EPZ Guaranteed access, no risk of downgrading.

- ESG/CSRD emissions traceability, CO₂ avoided per km, multi-site consolidation.

- Calls for tender CSR bonus, favourable weighting.

To be prepared: a standardised dashboard (kWh/100 km, CO₂ avoided, night-time charging rate, % AC vs DC), which can be used for your CSR reports and your commercial files.

Recommendations for structuring the transition of LCVs in fleets

Between 2025 and 2030, the companies that will succeed in the electrification of commercial vehicles will be those that proceed in stages, objectify the TCO, master recharging and get their teams on board. Here's a framework for action:

Updating the car policy and purchasing/procurement criteria

Car-policy LCV: key elements

- Authorised segments and silhouettes by trade (L1/L2/L3, H1/H2, floor cab, refrigerated).

- Minimum range required on a charge and in winter (realistic, not WLTP).

- Payload/coupling: thresholds per mission.

- Equipment (230 V socket, storage space, telematics, ADAS).

- Rules for recharging deposit/domicile/itinerant + refund.

- Eco-score or origin of production criteria (useful for eligibility).

Procurement: divide up calls for tender, incorporate operating KPIs (availability rate, recharge downtime, breakdown SLA) and include 1 to 2 years of energy review clauses.

Managing TCO in the commercial vehicle segment: tools and key indicators

The TCO for electric LCVs is controlled by the month :

- Energy: kWh/100 km, % AC vs DC, average cost per kWh, seasonal drift.

- Maintenance: avoidable breakdowns (tyre pressure, brake pads), preventive inspections.

- Operation: availability (in hours), revenue km vs. non revenue km, boot saturation.

- Finance: rent, estimated RV, conversion costs (fridge, fittings) amortised.

Tools A fleet management + telemetry + IRVE supervision suite. The best gains come from this combination: assigning the right vehicle to the right journeys, planning charging slots, alerting in the event of drift (over-consumption, excessive fast charging (DC)).

Training, supporting and communicating with drivers and technicians

The success of a commercial vehicle transition depends not only on technology, but also on the commitment of the teams on the ground. Drivers, technicians and team leaders are the first ambassadors of electric performance.

Putting drivers at the heart of change:

- Organising trade workshops dedicated to the use of electric LCVs: route planning based on range, payload management, good driving practices.

- Offer applied eco-driving sessions, adapted to the real constraints of commercial vehicles: regenerative brakingThe system can also be used to optimise heating and air conditioning.

- Distribute simple digital media (mini-videos, mission cards) on energy-efficient driving: preheating with the ignition switched on, checking the charge level before setting off, choosing the right driving mode.

- Setting up a collaborative feedback system monthly exchanges between drivers, supervisors and fleet managers to identify irritants (recharging, range, charging points) and work together to make adjustments.

This participatory approach encourages rapid, sustainable and positive adoption of new vehicles. The teams feel valued, consumption is naturally falling, and the overall impression of electric mobility is clearly improving.

To remember: the regulatory review as a strategic opportunity

Summary of the major impacts on fleets

- Better adapted range: electric silhouettes that preserve payload, more available pro conversions.

- Clearer economic trajectory: lower TCO for well-profiled uses (urban, structured routes, depots with AC).

- Sustainable compliance: ZFE and ESG reporting facilitated by standardised indicators.

Why acting now gives you a competitive edge

- Learning effect: the sooner you structure your data (kWh, costs, CO₂), the faster your TCO will be optimised.

- Better purchasing position: first entrants = better framework agreements, priority access to certain silhouettes, better negotiated VR.

- CSR capital: increased profile with end customers and in calls for tender, stronger employer brand.

Call to action: audit, planning, investment

- Auditing the LCV fleet by type of use, simulating electrification scenarios (useful range, payload).

- Plan depot recharging (priority AC), define home/roaming rules, deploy smart charging software.

- Train drivers and team leaders, install monthly reporting (kWh/100 km, costs, CO₂ avoided, % DC).

Beev supports the utility transition, from start to finish

- Usage audit and roadmap LCVs by business and site.

- TCO simulation (rent, energy, maintenance, VR) and deployment scenarios.

- Selection of suitable models and conversions (refrigeration, workshop, tipper, floor-cab).

- Installation and supervision of pro terminals (depots, multi-sites, smart charging).

- Steering tools telemetry, IRVE supervision, ready-to-use ESG reporting.

Move from a limited fleet of commercial vehicles to an efficient, compliant and profitable electric fleet.

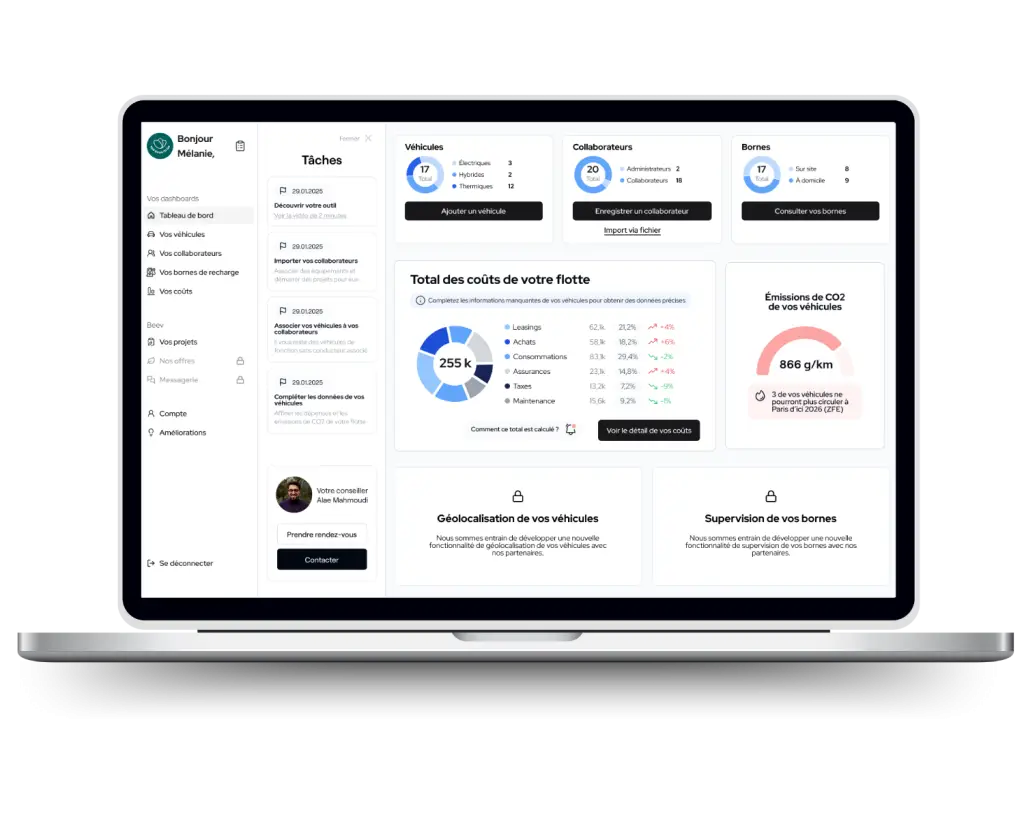

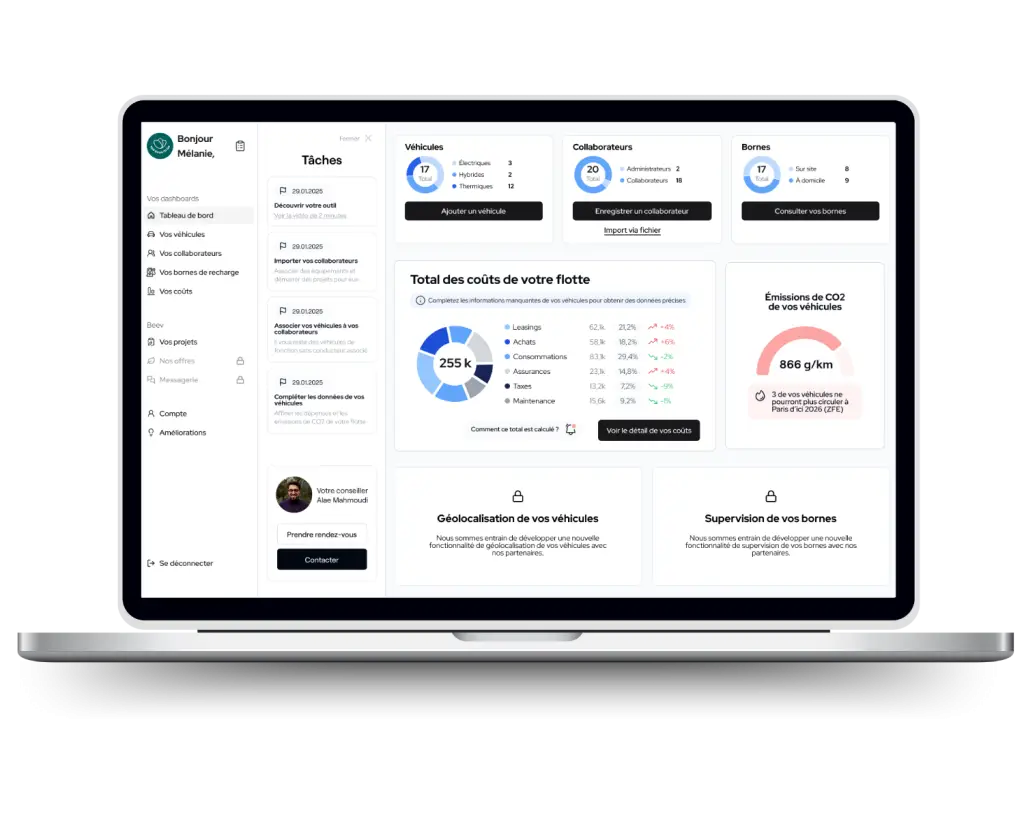

Manage your fleet easily with our dedicated tool

A fleet management tool from A to Z

- Add your fleet and employees in just a few clicks

- Plan your transition to electric vehicles and monitor your CSR objectives in real time

- Centralise your expenses