Panorama of the automotive market in November 2025: key facts and figures

November 2025 is unlike previous months, with both pressure on overall volumes and a spectacular consolidation of electric vehicles. For fleet managers, this dual trend is particularly enlightening: it shows where demand is heading, but also where future tensions lie.

A decline in combustion engines and a surge in electric sales?

The French car market recorded 157,923 registrations, down 4.7 1Q3 compared with November 2024.

However, this fall does not affect all engines in the same way.

Here are the key trends:

- Diesel 18 % (continuous collapse)

- Petrol down 9 % (first real decline after months of stabilisation)

- Non-rechargeable hybrids : +4 %

- Plug-in hybrids : +7 %

- 100 % electric : +12 %

Electric vehicles are the only ones to post double-digit growth, a reminder that the market's energy transition is not based solely on regulations, but also on a fundamental shift in usage.

For fleets, this dynamic can be explained by :

- A more competitive electricity TCO; ;

- Increasingly strict EPZ constraints; ;

- internal CSR deadlines (CSRD) ;

- tax incentives maintained in 2026.

EV market share: a major milestone reached

With 24.2 % market share for BEVs, November saw a symbolic milestone crossed: one in four vehicles sold in France is now 100 % electric.

Even more interesting:

This ratio is higher for businesses than for individuals.

Why is this?

Because fleets think in terms of total costs, not immediate purchase costs.

The signals for 2026 are therefore clear:

- companies are the driving force behind electrification ;

- manufacturers give priority to professional orders; ;

- EV models are becoming more available, more autonomy and diversity of use.

Why these trends matter for fleets

For a fleet manager, the November figures are more than just a market indicator: they foreshadow the tensions and opportunities of the coming months. The rise in electric vehicle registrations heralds longer delivery times if demand continues to grow. At the same time, the residual value of electric vehicles remains solid, which automatically improves their competitiveness over the life cycle. TCO should continue to fall in 2026-2027, while the range of combustion-powered vehicles is shrinking, with rising costs and increasingly limited choice.

In short, electric vehicles are becoming a strategic choice for securing the fleet and stabilising costs.

Business fleets: what the November figures reveal

November's analysis confirms that 2026 will be a pivotal year for fleet policies. The market is electrifying, regulations are tightening and manufacturers are reorienting their range towards electric vehicles.

Benefits: TCO, residual value, CSR performance

This month's results confirm that electric vehicles are still ahead of the game for businesses. Energy is still less expensive than fuel, maintenance is easier and the favourable tax system makes it much cheaper to run than a combustion model.

Residual values are also rising, driven by sustained demand.

Lastly, guaranteed access to the EPZs facilitates operations in urban areas.

For a fleet, this means a lower TCO, greater attractiveness as an employer and immediate benefits in terms of CSR indicators.

2026 orders: a window of opportunity to be seized

November 2025 marks a turning point: EV prices are stabilising, 2026 order books are still accessible and 2025 models are benefiting from better commercial conditions. The tax system remains favourable, and the increase in residual value makes it all the more worthwhile to buy in advance. By ordering now, you can secure prices, avoid longer lead times and prepare for the arrival of the new EPZ constraints in 2026-2027.

This is a strategic window of opportunity to optimise fleet renewal.

The risk of waiting: lead times, prices and availability

Waiting presents 3 major risks for fleets:

1) Shortage of the most popular electric models

Manufacturers prioritise the companies that are quickest to place orders.

2),Longer lead times

+25 to +40 % observed on certain models in 2025.

3) Increase in heating costs

Because of taxes, penalties and the scarcity of supply.

Fleet strategy 2026: lessons from the market

The signals sent by November indicate what managers need to prioritise for 2026.

The market is electrifying, but each fleet needs to do so at its own pace, depending on its uses.

What uses should be prioritised when switching to electric?

The data show that certain profiles are now ideal for electric vehicles:

- regional commercial (300-400 km / day max) ;

- multi-site technician ;

- support/communication teams ;

- managers ;

- pool vehicles.

Why is this?

- sufficient range for all day-to-day journeys,

- night-time recharging possible,

- Lower TCO,

- increased reliability.

Combustion-powered vehicles are still useful in certain specific cases, such as when daily journeys are particularly long, when missions take place in very large rural areas, or when specialised commercial vehicles require equipment or uses that electric vehicles do not yet fully cover.

Renewal: aligning strategy with market dynamics

Electrified fleets plan better, earlier and pay less.

Beev recommendation:

- Order EV models from Q1 2026.

- Replace heavy thermals before the ZFE 2027 hardening.

- Secure budgets before the September 2026 tariff reviews.

Preparing the infrastructure: charging points and smart charging

Infrastructure is becoming a central element of the strategy.

By 2026, a high-performance fleet must include :

- internal AC terminals for slow charging at night,

- fast DC terminals if the fleet drives a lot,

- access to a dense public network,

- smart-charging to avoid price peaks,

- centralised supervision.

In 2025, 36 % of European fleets will suffer a loss of productivity due to poorly organised recharging.

A good infrastructure improves availability, TCO and operational peace of mind.

2026-2027: scenarios to watch for electric vehicles

November gives a likely outlook for the next two years.

There are three possible scenarios.

Scenario 1: a sharp acceleration in electric vehicles

In this first scenario, the market share of electric vehicles would continue to grow rapidly, reaching around 30 % by the end of 2026. This momentum would be driven by the steady improvement in range, the gradual fall in running costs and the now very positive perception of electric vehicles among fleet managers.

At the same time, increased demand would put pressure on internal combustion engines:

- price rises,

- reduction in available supply,

- tougher regulations in the EPZs and in CO₂ taxation.

For companies that are already prepared for this transition, particularly those with a recharging infrastructure and an appropriate car policy, this scenario represents a real opportunity. They will be able to secure a more competitive TCO, benefit from subsidies or advantageous depreciation and strengthen their CSR image.

Scenario 2: market stabilisation

In this case, the electricity market would grow more modestly, with a market share that would stabilise at around 25 to 27 %. The wait-and-see attitude of the economy, cautious budgetary choices and the volatility of the energy context could slow down some companies' decision-making.

This scenario would maintain a certain balance: acquisition costs would remain stable, but public subsidies could decrease, slightly reducing the immediate financial attractiveness of electric cars.

However, fleets that have lagged behind in electrification would be the most exposed: the gradual scarcity of combustion models, combined with fluctuating delivery times, could complicate their renewals.

For fleet managers, the lesson is clear: even if the situation stabilises, waiting too long means losing flexibility and negotiating power.

Scenario 3: Increased regulatory pressure

In this more demanding scenario, the public authorities could accelerate the pace of the ecological transition, in particular through stricter restrictions in Low Emission Zones, an increase in the CO₂ malus, or even extended obligations under the European Union.he Mobility Orientation Law.

The consequence would be immediate: owning or acquiring a thermal vehicle would become much more expensive, both to buy and to run. Thermal models would gradually be driven out of the market or confined to very specific uses.

Companies would then be forced to speed up their electrification, sometimes in a hurry, which could generate additional costs and put pressure on internal organisation. Those that had anticipated, with an infrastructure in place and contracts already secured, would enjoy a clear competitive advantage.

Beev tips for adjusting your fleet strategy in 2026

On the basis of the November analysis and the needs identified in the field, Beev recommends :

- Start the fleet audit in January 2026,

- Switching simple uses to electric (managers, sales staff, pool),

- Preparing the infrastructure in parallel,

- Simulate TCO over 4 years,

- Integrating electrics into the car policy,

Securing orders before the summer of 2026.

Conclusion

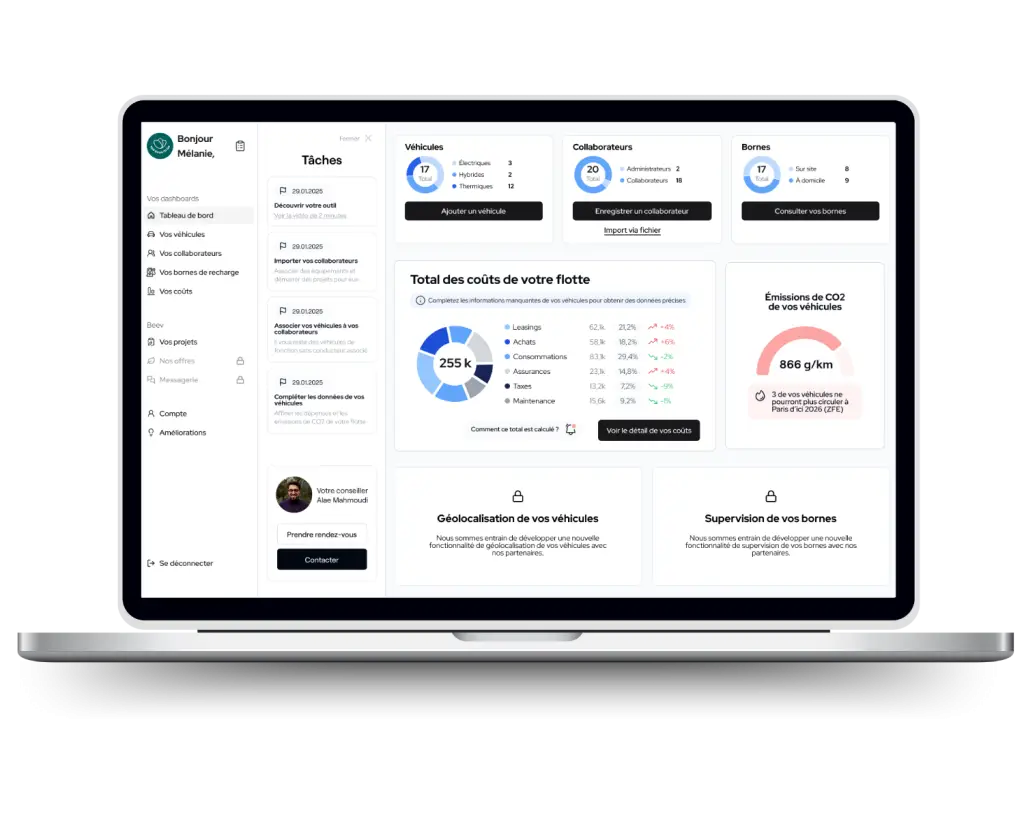

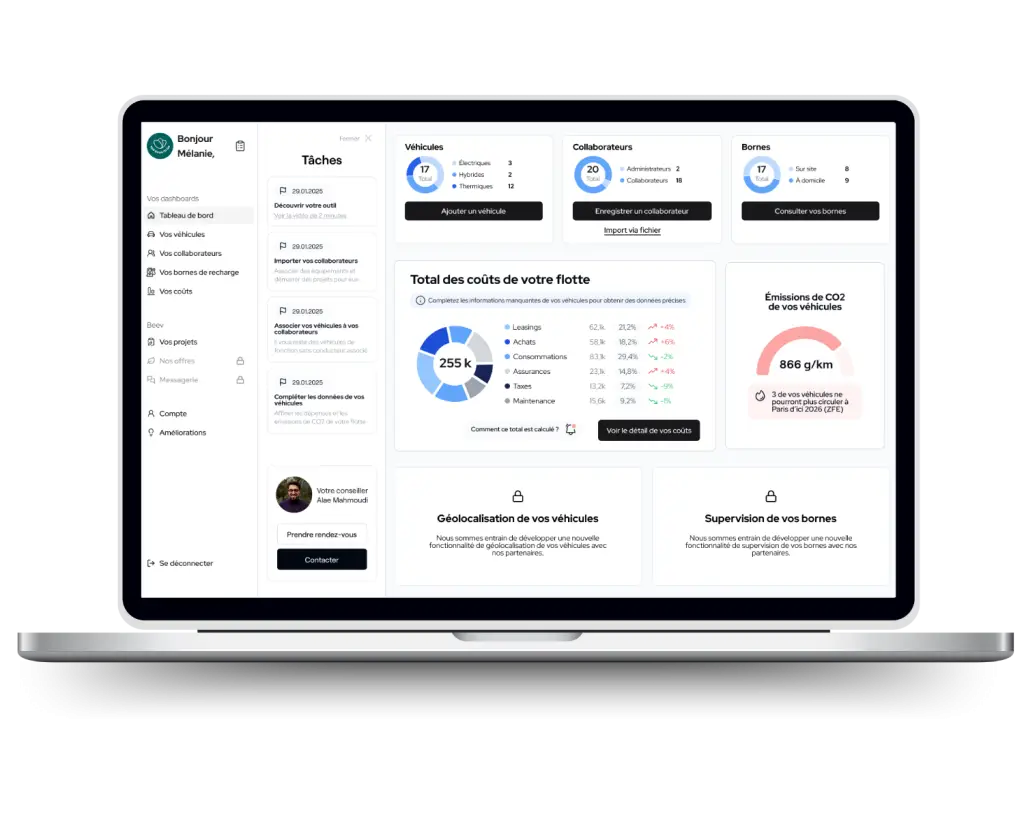

Manage your fleet easily with our dedicated tool

A fleet management tool from A to Z

- Add your fleet and employees in just a few clicks

- Plan your transition to electric vehicles and monitor your CSR objectives in real time

- Centralise your expenses