Europe goes backwards: the anatomy of a political setback

Practical changes

In concrete terms, manufacturers will have to reduce tailpipe emissions by 90 % from 2035 instead of the initial 100%. The remaining 10 % must be offset by the use of low-carbon steel, e-fuels and biofuels produced in the European Union.

In addition, plug-in hybrids and vehicles equipped with fuel-extension systems will be able to run for longer periods of time.’autonomy could also be marketed after 2035. But to do so, they will have to meet certain emissions criteria. The «banking and borrowing» system has also been extended until 2032. This system allows manufacturers to spread their reduction efforts over several years.

The reasons for this U-turn

This decline is the result of a combination of economic, industrial and political factors that have converged in recent months. Pressure from the German car lobby has been decisive. Volkswagen, BMW and Mercedes have repeatedly warned of the difficulties facing the European industry in the face of Chinese competition in the electric segment. Germany, whose economy is heavily dependent on its automotive sector, threw all its weight behind this relaxation. The German Chancellor has even made it an absolute priority. In his view, overly strict standards would jeopardise hundreds of thousands of jobs.

The general economic context also played a major role. The European automotive industry is going through a difficult period. It is marked by production overcapacity, announced plant closures and demand for electric vehicles that is struggling to take off at the rate we had hoped.

Competitiveness with China is another key issue. Chinese manufacturers represent an existential threat to European industry.

Finally, fears about employment and the social acceptability of the transition weighed in the balance. Trade unions have warned of the risk of massive job losses in the combustion sector. Consumers, meanwhile, have expressed reservations about the price of electric vehicles and the limited range of some models. However, these concerns no longer really apply, as Solal Botbol, co-founder and CEO of Beev, explains in his interview for Smart Charging.

Divided Member States: a fragile European consensus

Countries in favour of greater flexibility

Germany has taken the lead among the countries calling for a relaxation of European standards. It argued that its automotive industry, with more than 800,000 direct jobs, needed more time to transform. The German government insisted on the importance of preserving technological diversity. In its view, imposing a single solution could weaken European competitiveness.

Italy also argued for a postponement, in particular to protect the interests of Stellantis. Several Italian production sites are still heavily dependent on combustion engines.

Eastern European countries, led by Poland, also supported this approach. These countries, whose recharging infrastructure is still in its infancy, consider that the 2035 deadline was unrealistic. The national electricity grid requires massive investment to support the electrification of the car fleet.

Countries staying the course on electrification

On the other hand, several Member States have expressed their disagreement with this relaxation. They consider that it sends out a contradictory signal and weakens Europe's credibility on the international climate scene.

The Netherlands, Denmark and Sweden have maintained their position in favour of the initial targets. As a reminder, these countries have set themselves even stricter targets than those of the European Union. Their adoption rates for electric vehicles are among the highest in Europe. What's more, Amsterdam and Copenhagen have announced that they will be banning combustion-powered vehicles from their city centres well before 2035, regardless of European decisions.

France is in a more ambiguous position. While Paris has not officially contested the European relaxation, the French government is nonetheless maintaining its national timetable for the deployment of Low Emission Zones (LEZ). The main French cities will continue to apply traffic restrictions for internal combustion vehicles.

Norway, although outside the European Union, is an interesting case study. The country is expected to reach its target of 100% sales of electric vehicles very soon. In fact, Oslo is demonstrating that a rapid transition is possible with the right incentives and infrastructure.

A mixed signal for businesses

This divergence between Member States creates a situation of uncertainty. Companies operating fleets across Europe now have to deal with a patchwork of national and local regulations.

The signal being sent out appears contradictory in several respects. On the one hand, the European Union is officially maintaining its ambition of carbon neutrality by 2050 and its intermediate climate targets. On the other, it is giving significant leeway to the automotive sector, which is responsible for around 15% of CO2 emissions in the EU.

This inconsistency is likely to slow down private investment in electrification. Some companies may be tempted to adopt a wait-and-see strategy to see how the situation develops. Manufacturers could also revise their industrial plans and reallocate some of their resources to combustion engines.

The financial world is also watching this situation closely. ESG rating agencies and investors who had been favouring companies committed to a rapid transition are now questioning the relevance of their evaluation criteria. There is a risk of a general wait-and-see attitude developing, with everyone waiting for their competitors to take the first step.

The companies involved: between incomprehension and determination

A discouraging signal for pioneers

For companies that have invested in the electrification of their fleets, the European Commission's announcement is a major blow. Pioneering organisations find themselves in an uncomfortable position. After having invested in the acquisition of electric vehicles and the installation of recharging infrastructures, this European U-turn risks creating a feeling of having «got ahead for nothing».

This situation also raises questions about the credibility of CSR commitments. If companies want to communicate their commitment to sustainable mobility, this European setback could discourage them from doing so.

Testimonies and reactions from the sector

Carmakers who have opted for electric vehicles are reacting in contrasting ways. Some, such as Renault and Volvo, are officially sticking to their target of becoming 100% electric brands by 2030. They believe that their strategy responds to market and image imperatives that go beyond regulatory constraints.

Other manufacturers, however, may be tempted to revise their plans. Some automotive groups may be able to keep thermal engines running for longer than expected, and some models that were scheduled to cease production may be given a reprieve.

A competitive advantage that remains

Despite this troubled context, companies that have electrified their fleets are still reaping tangible benefits. In operational terms, the savings made on maintenance and energy are real. On average, an electric vehicle costs 30 to 40% less to maintain than an electric vehicle. thermal vehicle equivalent. Energy costs remain significantly lower than those of fossil fuels.

These companies also benefit from greater resilience in the face of future regulatory changes. Because while Europe may be dithering, the underlying trend remains towards decarbonising transport. Low Emission Zones will continue to multiply over the coming years. Companies that are already electrified will not have to deal with the emergency access constraints that will be imposed in the future.

In terms of image, the competitive advantage also persists. More and more invitations to tender include environmental criteria in their evaluation. Client companies are demanding that their service providers make commitments to reduce their environmental footprint. carbon footprint. Having an electrified fleet is a real advantage in commercial negotiations.

Why electrification remains relevant despite the European U-turn

National regulations are not backing down

The easing of restrictions does not mean a relaxation of constraints on the ground. In France, the roll-out of Low Emission Zones is continuing in line with the timetable set out in the 2021 Climate and Resilience Act. By 2025, all conurbations with more than 150,000 inhabitants will have to have introduced a LEZ.

In Paris, Crit'Air 3 vehicles have already been banned since 2023. Crit'Air 2 vehicles will gradually be excluded from Greater Paris by 2026-2027. By 2030, only electric and hydrogen vehicles will have access to the centre of the capital. This gradual tightening will also apply to professionals, with timetables that are often more restrictive than for private individuals.

Lyon, Marseille, Toulouse, Strasbourg and other major French cities are following similar trajectories. For companies whose business requires regular journeys in dense urban areas, electrification is not an option but an operational necessity.

And this reality extends well beyond France's borders. London, Amsterdam, Brussels, Milan, Madrid... The major European capitals have also introduced or announced traffic restriction systems based on emissions.

So the reality is clear: The European target of 90% does not mean total freedom to drive combustion-powered vehicles everywhere. Local constraints are not weakening, quite the contrary.

An economic advantage that remains intact

The economic equation for electric vehicles remains favourable for business fleets. The Total Cost of Ownership (TCO) remains more advantageous for electric cars.

The difference in purchase price, which was the main obstacle a few years ago, is gradually narrowing. The increase in production coupled with the fall in the cost of batteries is bringing electric vehicles closer to price parity with their internal combustion equivalents. In some segments, notably light commercial vehicles and city cars, In some cases, parity has already been achieved.

Maintenance costs represent a major area of structural savings. By not having to change oil, filters, clutches, timing belts or exhaust systems, maintenance budgets can be halved or even trebled. On a fleet of one hundred vehicles, these savings climb rapidly.

The difference in energy costs also remains significant. In fact, the cost per kilometre of an electric vehicle remains 60 to 70% lower than that of a combustion vehicle. For companies that optimise their charging times during off-peak hours, this advantage is even greater.

In addition, the French tax system continues to favour electric vehicles. Companies can claim a tax deduction of €30,000 for the purchase of an electric vehicle, compared with €18,300 for a combustion-powered vehicle. The exemption from TAVT (formerly TVS) for electric vehicles also represents substantial savings. It is in the region of €1,000 to €2,000 per year per vehicle, depending on power.

Image and social responsibility

Whether they are private individuals or companies, customers are increasingly attentive to the environmental impact of their suppliers and service providers. This trend is reflected in tenders: more and more specifications include environmental clauses.

Non-financial reporting, which has become mandatory for many companies with the CSRD (Corporate Sustainability Reporting Directive), It also requires greater transparency on greenhouse gas emissions. Vehicle fleets are often the biggest source of emissions for service companies. Electrifying them can significantly reduce the overall carbon footprint.

Finally, investors and financial markets are increasingly integrating ESG (Environmental, Social and Governance) criteria into their capital allocation decisions. Companies that neglect their energy transition run the risk of devaluation.

Anticipating the future: how do we navigate this new order?

Don't give in to the temptation of the status quo

The European Union's retreat from the 2035 deadline could tempt some companies to postpone their investments in electrification. However, this wait-and-see strategy presents significant risks that need to be assessed carefully.

The first risk concerns saturation of the second-hand thermal market. If many companies delay their transition, they will get rid of their internal combustion vehicles on a massive scale in 2033-2034. The market could then become saturated, with residual values plummeting as a result.

The second risk is linked to availability of vehicles and infrastructure. Carmakers plan their production capacity several years in advance. A late rush to electric cars could put pressure on delivery times.

Finally, there is the risk of technological and regulatory obsolescence. Even if the total ban on combustion engines is postponed, combustion vehicles will gradually be excluded from city centres and will suffer accelerated depreciation. In fact, investing in combustion engines in 2025 is tantamount to buying a technology that has reached the end of its life.

The recommended strategy for companies

The first recommendation is to maintain a trajectory of gradual electrification. This approach will enable us to benefit immediately from the economic advantages of electric vehicles, while managing future budgetary and operational constraints more flexibly.

Urban and suburban use should be given priority for electrification. Vehicles used mainly in towns and cities, where regulatory constraints are greatest, are the natural priority.

For long-distance use, a hybrid approach may be maintained temporarily. This type of vehicle represents a transitional solution for significantly reducing emissions. However, the hybrid solution must not become an excuse for indefinitely delaying the transition to the electric 100%.

Companies also need to adopt a segmented approach to their fleet. Not all vehicles have the same uses or the same constraints. A detailed analysis of needs, vehicle by vehicle, can identify those for which electrification is immediately relevant and those for which it is preferable to wait a few more years.

Converting your fleet to electric: the complete guide

Infrastructure as a sustainable investment

In addition to the vehicles themselves, investment in the’recharging infrastructure deserves particular attention. Unlike vehicles, which depreciate rapidly, charging points are a durable asset whose value is maintained over time.

L'installation of recharging stations on site offers a number of strategic advantages:

- It guarantees the fleet's energy independence

- It allows you to be partially independent of the public network, whose availability and prices can vary.

- It gives you the opportunity to optimise your costs by scheduling recharging during off-peak times.

Charging infrastructure is also becoming a long-term asset. With the proliferation of electric vehicles, demand for recharging points will only increase.Even if the deadline for 100% electricity is postponed, it will eventually arrive. Companies that have invested progressively in their infrastructure will not suffer a brutal shock when the transition becomes inevitable. They will have acquired the know-how, trained their teams, tested and optimised their operational processes.

Finally, from a technical point of view, intelligent control solutions provide real-time visibility of consumption and make it possible to anticipate future needs.

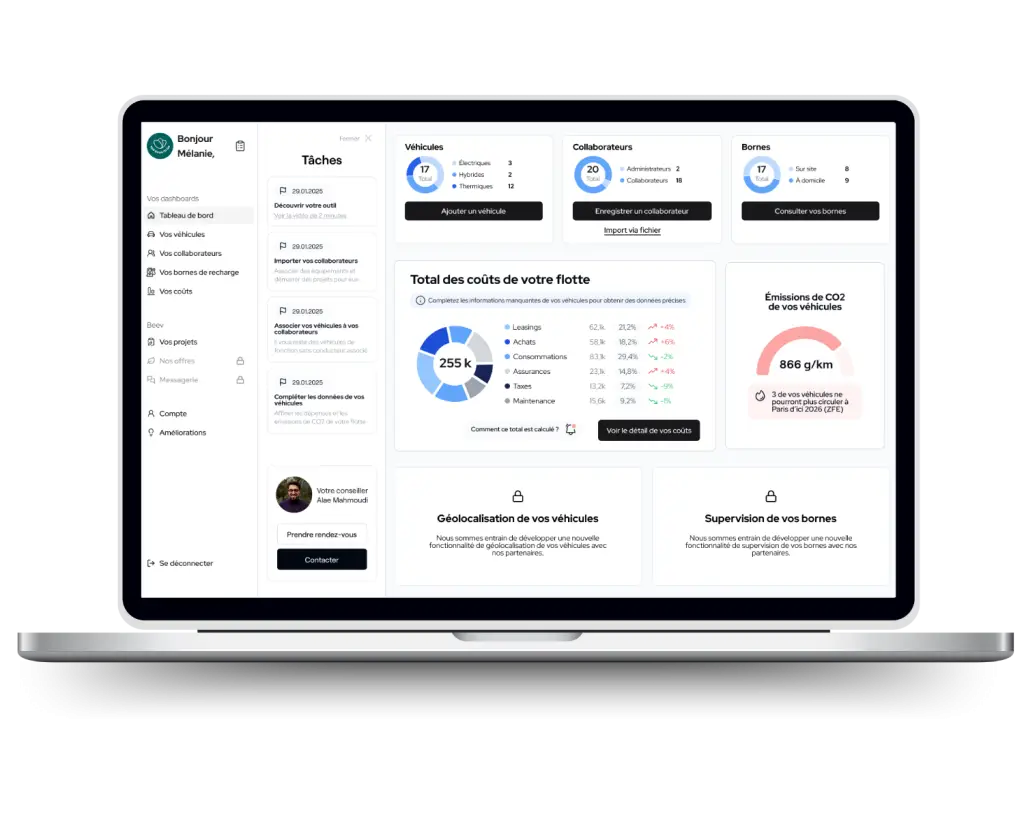

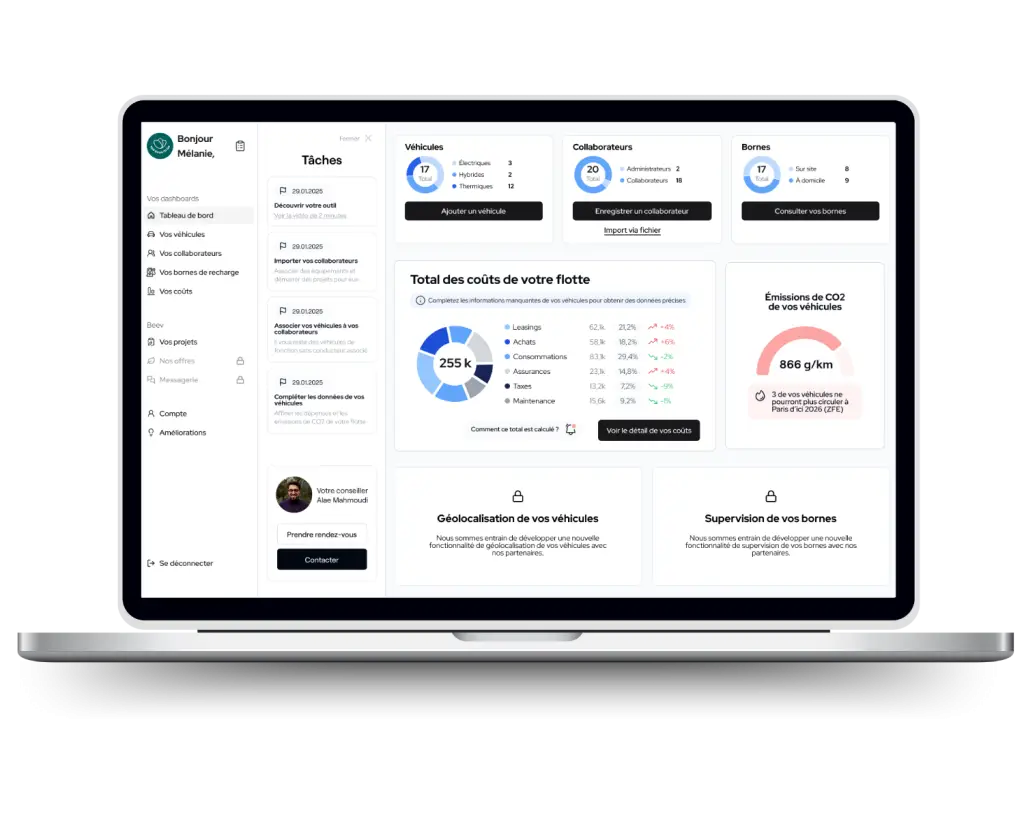

Manage your fleet easily with our dedicated tool

A fleet management tool from A to Z

- Add your fleet and employees in just a few clicks

- Plan your transition to electric vehicles and monitor your CSR objectives in real time

- Centralise your expenses

Conclusion

The European Union's backtracking on the 2035 ban on internal combustion vehicles is undeniably a landmark event in the history of Europe's energy transition. This decision reveals the tensions between the continent's climate ambitions, industrial realities and economic constraints.

However, this reversal does not fundamentally change the situation for companies considering the future of their business fleets. The underlying trend is still towards the decarbonisation of transport. Local regulatory constraints continue to tighten. On the other hand, the economic benefits of electric vehicles remain tangible. And society's expectations in terms of environmental responsibility continue unabated.

Companies that invested early in electrification should not feel that they were wrong to anticipate. On the contrary, they have gained valuable experience, made operational savings and strengthened their image.

If Europe procrastinates, electric power remains the future. Visionary companies do not allow themselves to be destabilised by short-term political ups and downs. They are staying on course, adjusting their cruising speed if necessary, but without straying off course. Because while the 2035 deadline has been relaxed, the 2040 or 2045 deadline will inevitably arrive. And at that point, the companies that have been able to anticipate will be the best positioned.