Monday to Friday 9am - 12.30pm - 2pm - 7pm

Oil-based fuels are becoming increasingly expensive

The rising cost of fossil fuels, including oil, is nothing new. In fact, oil prices have been on a rollercoaster ride for several decades, fluctuating with stock market speculation. But it has to be said that the trend is upwards. It has to be said that between 2000 and 2020, the crude oil price per barrel has almost doubled.

Against this backdrop, the conflict between Russia and Ukraine is only adding to the tensions in a tight market, already under pressure from supply and demand.

A staggering rise in prices in the space of a few weeks

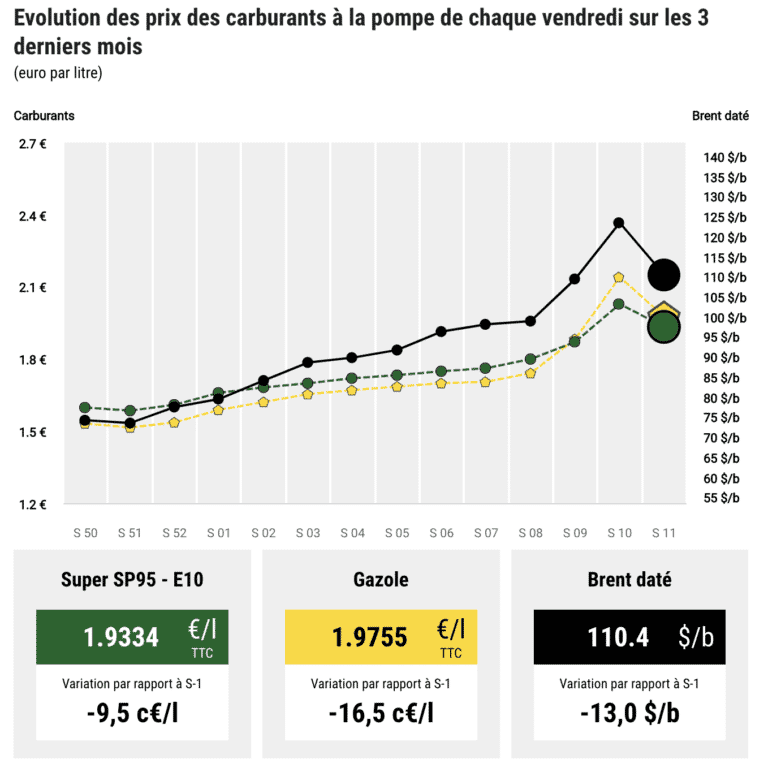

At the beginning of March, French drivers were in for a nasty surprise when they came to fill up their tanks. Visit fuel prices has soared above the record threshold of two euros a litre, including in shopping centre service stations that are reputed to be cheap.

A few days earlier, the price of a barrel of Brent crude from the North Sea had reached 110 dollars on the financial markets, a level that traders had not seen since 2014. The situation is sufficiently worrying to suggest a fourth oil shock, comparable to that of 2008.

Source : Ministry of Ecological Transition

The invasion of Ukraine by Russian troops is being blamed for this inflation. And with good reason: geopolitical upheavals in the main oil-producing countries have a direct influence on the cost of fuel. Just think of the spikes caused by the Yom Kippur War in 1973 or, more recently, by the second Gulf War in 1990.

The rise in prices brought about by armed conflict is therefore not a new situation. However, it is surprising in its intensity and brutality.

Russia is the world's leading exporter of hydrocarbons. In Europe, crude oil imports from this country account for 26 %. In other words, more than a quarter of the oil consumed on the Old Continent comes from Russian pipelines.

Origin of crude oil imported into France

In millions of tonnes

Source : Insee

| Provenance | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2020 (en %) |

|---|---|---|---|---|---|---|---|---|

|

Africa

|

19,8

|

20,4

|

16,2

|

15,7

|

17,7

|

16,2

|

10,1

|

30,5

|

|

of which

|

|

|

|

|

|

|

|

|

|

Nigeria

|

6,1

|

6,7

|

5,8

|

4,8

|

5,8

|

5,9

|

3,2

|

9,6

|

|

Algeria

|

3,9

|

4,7

|

4,5

|

4,8

|

5,1

|

5,7

|

3,4

|

10,3

|

|

Libya

|

3,1

|

2,1

|

1,5

|

3,7

|

4,7

|

2,6

|

0,9

|

2,7

|

|

USSR / former USSR

|

15,1

|

16,1

|

17,0

|

19,6

|

16,8

|

14,3

|

8,7

|

26,2

|

|

of which Russia

|

5,4

|

4,7

|

5,8

|

8,9

|

7,6

|

6,2

|

2,9

|

8,7

|

|

Middle East

|

12,9

|

14,3

|

14,0

|

14,0

|

12,6

|

10,2

|

5,1

|

15,5

|

|

of which Saudi Arabia

|

11,1

|

10,6

|

8,3

|

6,2

|

8,0

|

7,3

|

3,9

|

11,8

|

|

North Sea

|

6,5

|

5,7

|

6,6

|

7,0

|

4,1

|

3,7

|

4,3

|

13,0

|

|

Other

|

0,7

|

1,7

|

2,3

|

1,4

|

2,0

|

4,3

|

4,9

|

14,8

|

|

Total imports

|

54,9

|

58,3

|

56,0

|

57,8

|

53,3

|

48,7

|

33,2

|

100,0

|

|

of which OPEC

|

30,9

|

33,2

|

29,4

|

28,6

|

29,3

|

25,3

|

14,0

|

42,2

|

Note: oil is classified here according to the country from which it was extracted.

Reading: in 2020, crude oil imports from Africa will amount to 10.1 million tonnes.

Scope: including condensates and other products to be distilled and the non-bio part of additives.

The restrictive measures deployed by the United States to dissuade Vladimir Putin from persevering with his invasion plans have directly targeted oil imports. Although Europe is still refusing to impose the same sanctions, it is directly affected by this strategy because of its heavy dependence on the Russian market.

At the same time, to cope with the prospect of the US embargo and anticipate their stocks, importing countries have redirected their sources of supply by turning to other players, such as the Middle East.

This cascade of political decisions has had the effect of reshuffling the cards in the fuel supply market. While Russian oil prices have plummeted, indices on competing markets have risen sharply.

Other factors have contributed to the rise in the cost of petrol and diesel in Europe, such as fluctuations in currency indices. The weakening of the euro against the dollar has also played a major role, since the reference price is set according to the US currency.

Despite the freeze on oil production in Russia, a shortage is not yet feared. The other members of OPEC (the Organisation of Petroleum Exporting Countries) are planning to increase their production to 400,000 barrels a day. But this rate will probably not be enough to offset the Russian shortfall.

Especially as demand has increased with the economic recovery following the Covid pandemic.

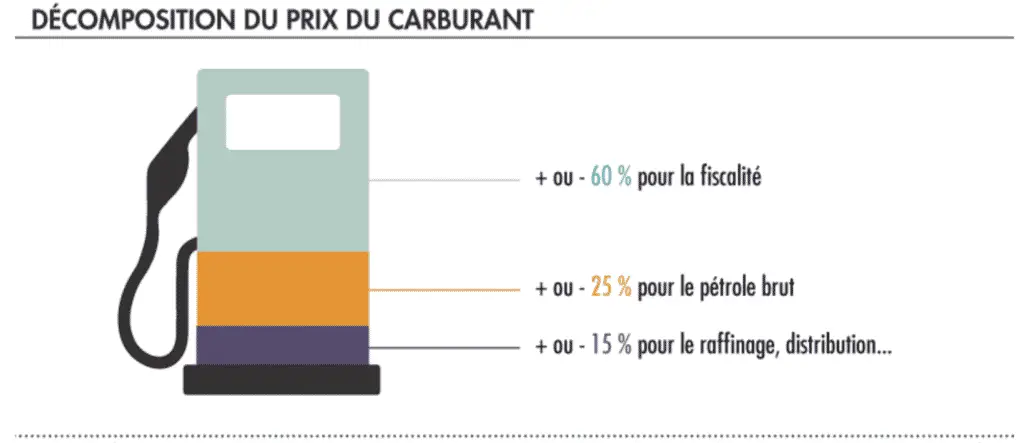

Petrol prices are rising... and so are taxes

Many users have been quick to point out the impact of oil price rises on the taxes levied by the government. In France, as in many other European countries, taxes account for almost half the cost of fuel. The taxation of petroleum products is made up of two parts. The domestic consumption tax on energy products (TICPE) is an excise duty. It is calculated on a pro rata basis according to volume. VAT, on the other hand, is proportional to the market price. Any increase therefore has a direct impact on the amount collected by the State. In this context, it's hard to forget the mobilisation of the "yellow waistcoats" provoked by the increase in carbon tax in 2019!

Source : lafinancepourtous.com

For some, all the government needs to do is reduce VAT on fuel. However, this measure would not help businesses and professionals who are already exempt from tax. Not to mention that it would result in an estimated loss of revenue of €500 million, which would weigh heavily on the government's budget.

Rising prices a source of concern for users

The fact remains that the increase in the price of petrol and diesel has many consequences, both economically and socially. The difficulties that emerge first and foremost concern mobility. According to a survey published by the magazine LSA, 35 % of the French plan to limit or modify their travel for work or leisure.

Another concern is purchasing power, which has already been undermined by inflation and Covid-19. Some households are spending 15 % of their budget on fuel purchases. But that's not all: in the long term, the rise in prices at the pump is likely to have collateral effects, the impact of which has yet to be measured. Many companies will be forced to pass on the extra cost of fuel to their products and services. Ultimately, it is the consumer who will have to absorb these additional costs.

The transport sectors, already weakened by successive confinements, are already severely affected. Fuel is a major item of expenditure for airlines. Many of them have chosen to reduce their margins in order to maintain competitive offers. But there is every chance that the impact of this new increase will be passed on to the price of airline tickets.

The situation is also critical for road hauliers, since fuel accounts for almost a third of their costs. For these professionals, it's tricky to increase rates at the drop of a hat, especially as invoicing has to be deferred when contracts are annual.

Regardless of their field of activity, companies with a vehicle fleet are forced to deal with the additional costs involved. Fleet managers are going to find it increasingly difficult to rationalise costs... unless they rely on alternative and sustainable energies.

Lastly, the conflict between Ukraine and Russia is likely to accelerate the transformation of the automotive sector, which has already been affected by the crisis in Europe. shortage of semiconductors. In the absence of sufficient supplies, production stoppages are multiplying. Some manufacturers - including France's Renault - have already closed their Moscow plants. This new crisis highlights the need to rethink fragile economic models by focusing innovation on sustainable mobility.

Government measures: targeted and temporary aid

To alleviate the consequences of the rise in fuel prices, Prime Minister Jean Castex announced on Friday 11 March a resilience plan which will come into effect next April.

Drivers will benefit from a reduction of 15 centimes per litre for four months from 1 April. All petroleum-based and petroleum-derived fuels are affected. Prices displayed at service station entrances will remain unchanged. The discount will be applied directly by the distributors at the time of payment. Distributors will then be reimbursed by the government.

This massive reduction plan represents a shortfall of €2 billion for the State. It is designed to supplement the increase inmileage allowance in force since 25 January 2022. As a reminder, the scale was raised by 10 % at the end of January for professionals who have to travel by road in the course of their duties. To take advantage of this, all you have to do is fill in the field for deductible actual expenses on your tax return.

Although they have been greeted with relief by drivers, the government's financial efforts will only temporarily alleviate a major energy crisis, which highlights a heavy dependence on fuels produced beyond Europe's borders.

It therefore seems urgent to step up investment to offset the volatility of fossil fuels. The local production of renewable energies, vectors of green growth, fits perfectly into this approach.

The electric car: between autonomy and savings

Against the backdrop of a new oil crisis, the electric drive appears to be the big winner. Over and above the savings made on an individual scale, it can offer a degree of independence, since it is based on "greener", locally produced energy.

Compared with conventional 100 % vehicles, there are many benefits for users.

On average, drivers of electric cars can cut your fuel budget by a factor of three. The average cost of a full tank of fuel is no more than 10 euros, compared with almost 40 euros for a full tank of fuel. thermal vehicle. Of course, you have to add the cost of a subscription to an electricity supplier, but this only has a small impact on the total amount of the bill.

La electric car is also cheaper to run, because maintenance costs are reduced. In particular, drivers can save on the cost of oil changes and fuel filter replacements.

Taxation of electricity is much more advantageous. The CSPE (contribution to the public electricity service) does not exceed 25 % of expenditure (excluding VAT), whereas taxes on oil amount to almost 60 % of the final price for the user.

However, to recharge an electric vehicle or a "green" fleet, it is necessary to deploy one or more charging stations.

From tax credits have been implemented to facilitate the deployment of this equipment. The MaPrimeRénov' covers the purchase and installation of an electric charging point in a single-family home, up to 75 % of the cost. The work must be carried out between 1 January 2021 and 31 December 2023. Assistance is capped at 300 euros per household, with no means-testing. It is open to all French tax residents, whether they own their home, rent it or live in it free of charge.

Le ADVENIR system allows you to benefit from financial assistance for the installation of charging points in shared-ownership accommodation. Any homeowner can apply for an individual grant, in the form of a contribution towards the cost of the work of up to 20 % (capped at 600 euros per charging point, with no bonus) and VAT at 5.5 %. The only condition is that you must have a private parking space or garage.

For businesses, the scale is between 20 % and 50 %, depending on the use of the car parks (private or public). The maximum aid ceiling for the installation of charging points in a car park will depend on the power of the charging point.

As the culmination of new tensions between Russia and the West, the war in Ukraine raises many questions about energy dependency and the volatility of oil markets. But this large-scale conflict also reveals an opportunity to accelerate a energy transition The need for this is no longer in doubt.