Higher taxes on Chinese cars: a good or bad decision for the EU?

The European Union's decision to impose higher taxes on Chinese electric cars is a controversial issue. The measure is intended to support the European automotive industry in the face of growing competition, by enabling local manufacturers to strengthen their market position.

However, it does raise concerns about its impact on European consumers, who could be faced with higher prices and a reduced supply of electric vehicles. This policy raises the question of the balance between protecting the local market and offering affordable options to buyers.

Why is the European Union imposing a tax increase of up to 35 % on Chinese electric cars?

The European Union justifies the imposition of a tax of up to 35 % on electric cars imported from China by the need to counter trade practices deemed unfair. Chinese manufacturers benefit from substantial subsidies from their government, enabling them to offer very competitive prices on the European market. By increasing these taxes, the EU is seeking to re-establish fairer competition, enabling European companies to defend themselves against these practices, while promoting a transition towards a sustainable automotive industry within Europe.

How is Chinese competition threatening the European car market?

The expansion of Chinese brands in the electric vehicle sector represents a considerable challenge for the European automotive market. Thanks to significant government support, these companies are able to offer models at very competitive prices, appealing to many European consumers.

This trend could reduce the market share of European manufacturers, with negative impacts on employment and innovation in the sector. At the same time, it poses a challenge to EU initiatives aimed at maintaining a competitive and sustainable automotive industry.

What impact will this tax have on the price of electric cars in Europe?

Higher taxes on Chinese electric cars will have a direct impact on market prices in Europe. By making these vehicles more expensive, the tax could reduce the attractiveness of Chinese models, which could lead to a reduction in their market share. However, this situation could also encourage European manufacturers to step up their production and innovation efforts to offer competitive alternatives.

So while consumers may face higher prices in the short term, this could also lead to an improvement in supply in the long term, encouraging a transition to more accessible, quality electric vehicles.

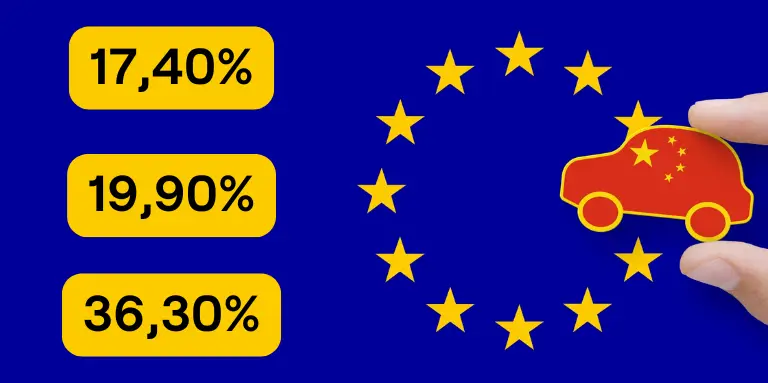

What new tax rates will be applied to Chinese electric cars?

Comparison with taxes applied to cars produced in Europe

| Manufacturer / Brand | New surcharge | Total tax (including basic 10%) |

|---|---|---|

| BYD | 17,40% | 27,40% |

| Geely | 19,30% | 29,30% |

| SAIC (MG) | 35,30% | 45,30% |

| Tesla | 9% | 19% |

| BMW, Volvo, Polestar | 20-21% | 30-31% |

| Other cooperating brands | 20,70% | 30,70% |

| Non-cooperating brands | 35,30% | 45,30% |

For further information: Tax on Chinese electric cars: 30 models affected

Will the tax apply to all electric cars or just certain categories?

The new EU tax will apply to all electric cars assembled in China, regardless of brand or model type, whether they are made by Chinese manufacturers (such as BYD, Geely or SAIC) or by non-Chinese brands that produce certain models in China.

Tesla and Dacia, for example, are also concerned, since their models, such as the Tesla Model 3 and the Dacia Springare assembled in China. This increases the cost of these vehicles for European consumers.

Surcharges vary according to the brand and its cooperation with the EU investigation. For example, manufacturers that have cooperated are charged a lower fee, while those that have not may be hit with a higher surcharge. For example, Tesla has negotiated a tax of 19 %while SAIC (owner of MG Motor) is facing a tax of up to 36.3 %.

This measure is designed to protect the European car market from competition from subsidised Chinese vehicles, by making these imported models more expensive and therefore less competitive in Europe. The surcharge could become permanent by the end of 2024 if no agreement is reached with China.

List of Chinese electric cars affected by the tax increase in Europe

| Brand | Model | Applied surcharge | Remarks |

|---|---|---|---|

| BYD | Dolphin, Seal | 17,0 % | BYD models affected by Chinese subsidies |

| Geely | Lynk & Co 01, Zeekr 001 | 19,9 % | Geely also produces Volvo in China, impacting certain models |

| SAIC (MG) | MG4, MG Marvel R | Up to 36.3 % | SAIC (MG holder) affected by the highest rate |

| Tesla | Model 3 (assembled in China) | 19,0 % | Tesla Model benefits from reduced cooperation surcharge |

| Dacia | Spring | 36,3 % | Very popular model produced in China, high surcharge |

| XPeng | P7, G9 | 21,0 % | Affected by average tax due to moderate cooperation |

| Nio | ET7, ES8 | Approx. 20 % | Variable surcharge depending on cooperation with the investigation |

Conclusion

In summary, the European Union's increase in taxes on electric cars imported from China is a move designed to protect local industry and promote fair competition. While this measure may strengthen the position of European manufacturers, it raises concerns about the impact on prices and access to a varied range of electric vehicles.

If you're thinking of buying an electric or hybrid vehicle, we can help.The installation of a recharging pointTo find out more, contact Beev, the electric mobility expert, to help you get started.

Use the TCO simulator to calculate the total cost of ownership of your car and compare it with its internal combustion equivalent.