Monday to Friday 9am - 12.30pm - 2pm - 7pm

What is the Greater Paris Metropolis?

The Greater Paris Metropolis is an exception in the Paris region. It is made up of several municipalities: the city of Paris and 130 communes. Created on 1 January 2016, the metropolis aims to address all issues relating to urban planning, housing, emergency accommodation, the fight against climate change and economic development.

Greater Paris is also a way of competing with the world's largest cities, such as New York and Greater London. With the union of all the communes, the Greater Paris Metropolis is no longer a city but a global entity with over 7 million inhabitants.

Help from Greater Paris to buy an electric vehicle

One of the priorities of the Greater Paris metropolitan area is to implement innovative solutions to improve the lives of its residents. In this context, it is developing ambitious environmental policies. The Greater Paris grant for the purchase of an electric vehicle is one of these. It is also known as "Métropole Roule Propre!

Good to know: Greater Paris assistance for the purchase of an electric vehicle only applies to individuals and not to legal entities.

The aid can be combined with the conversion premium

The Greater Paris grant for the purchase of an electric vehicle is designed to speed up the replacement of the Paris region's car fleet with clean vehicles. It complements the conversion bonus introduced by the French government.

Read also : Everything you need to know about the conversion premium in 2023

The aim of this measure is to create a Low Emission Zone (LEZ) by giving priority to helping the most modest households.

Who is eligible for Greater Paris assistance for the purchase of an electric vehicle?

All individual (does not apply to professionals) living in one of the 131 communes of the Greater Paris metropolitan area can benefit from Greater Paris assistance for the purchase of a clean vehicle.

The scheme works in the same way as the conversion premium, in that a vehicle must be destroyed in order to qualify. The owner must already own a car or van that is to be destroyed to replace a clean vehicle.

The vehicle to be destroyed must have been owned for at least one year prior to its destruction. Vehicles eligible for assistance are :

- diesel vehicles first registered before 1 January 2006

- petrol vehicles first registered before 1 January 1997

The vehicle must be destroyed in an end-of-life vehicle (ELV) processing centre approved by the Prefect. In addition, the vehicle must not be pledged or damaged.

The vehicle must be covered by an insurance policy that is valid on the date it is handed in for destruction or on the invoice date of the purchased or leased vehicle. You can find here the list of approved ELV centres in France.

Which vehicles are eligible for Grand Paris assistance?

Vehicles eligible for aid from Greater Paris must meet specific conditions in order to be validated by Greater Paris.

- Vehicle classification : private car (PC) or van (CTV)

- Energy : electric, hydrogen, rechargeable and non-rechargeable hybrid, or running on CNG (Crit'Air 0 and 1), emitting less than 122 grams of CO2 per kilometre.

- Buy : the vehicle may be new or used

- Financing : The vehicle can be purchased with cash or leased for at least two years

- Registration : The vehicle must be registered in France

- Price : the price may not exceed €50,000 including tax and excluding options.

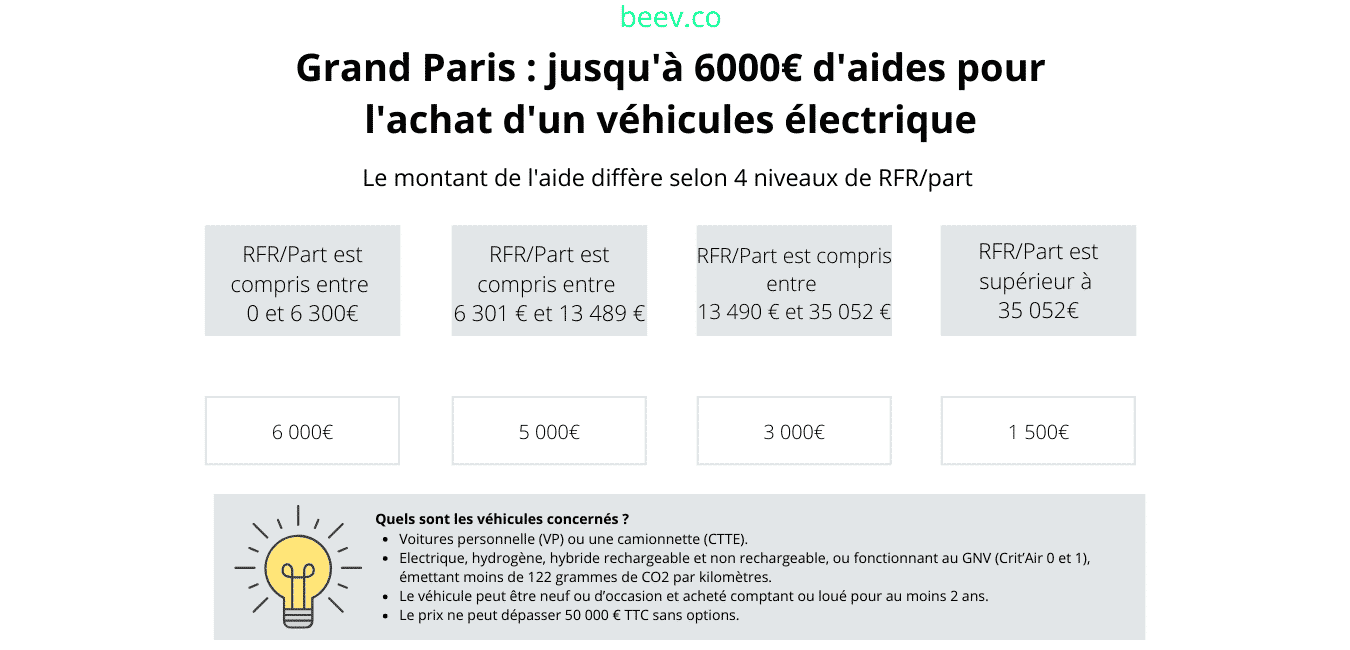

What is the amount of aid from Greater Paris?

The amount of aid from Greater Paris for the purchase of a clean vehicle is determined according to income criteria.

The lower the reference tax income, the greater the assistance from Greater Paris.

| Foyer fiscal | RFR/Part est compris entre 0 et 6 300 € | RFR/Part est comrpis entre 6 301 € et 13 489 € | RFR/Part est compris entre 13 490 € et 35 052 € | RFR/Part est supérieur à 35 052 € |

|---|---|---|---|---|

|

Amount of aid

|

6 000 €

|

5 000 €

|

3 000 €

|

1 500 €

|

Good to know: the reference tax income (RFR) must be divided by the number of reference tax units (PFR) in your household, which gives the RFR/Part.

What are the commitments of the beneficiary of Grand Paris aid?

In exchange for this grant, the beneficiary undertakes to :

- Do not make more than one application: assistance from the Metropolitan Council is only valid once per person

- Not to resell the vehicle within 6 months of its acquisition or to have driven 6,000 km with the new vehicle

- Scrap your old vehicle at an end-of-life vehicle (ELV) processing centre approved by the Prefect.

- Potentially be available to help the Metropole in its communication efforts by agreeing to the Metropole taking photos or videos of its vehicle for testimonials.

How do I apply for Greater Paris assistance?

If you are eligible for this new aid, you can start putting together the application step by step so that you can benefit from it.

If you don't like red tape, good news! You can apply on the same principle as for the "conversion allowance" on the same website. platform.

Documents for applicants for Greater Paris assistance

- Proof of the applicant's identity (national identity card or residence permit)

- Proof that the applicant's main residence is in one of the 131 communes of the Greater Paris metropolitan area

- A sworn undertaking by the applicant not to have received any aid from the Greater Paris metropolitan area

- An undertaking on the applicant's honour to have read these rules and to comply with them

- Proof of a zero income tax assessment for the year preceding the acquisition or leasing of the vehicle, or identification details of the income tax notice for the year preceding the acquisition or leasing of the vehicle, within the meaning of Article 6 of the Order of 8 October 2013 on the creation by the Directorate General of Public Finance of an automated personal data processing system known as the "income tax notice verification service" ;

- The reference tax income shown on the income tax notice for the year preceding the purchase or lease of the vehicle

- The number of tax units shown on the income tax notice for the year preceding the purchase or lease of the vehicle

- If you are attached to your parents' tax household, theundertaking of honour that the applicant is attached to the tax household of his/her parent(s), in accordance with the model certificate provided by the Agence de services et de paiement (Services and Payment Agency)

- The applicant's payment details (RIB)

Documents relating to the vehicle purchased or leased

- Proof of ownership

- Proof of purchase and date of purchase (in the case of a leased vehicle, the date of payment of the 1st lease instalment) In the case of a new vehicle, the date of order if different from the date of purchase or, in the case of a leased vehicle, the date of the lease contract.

- Proof of registration, the date of registration and the date of first use.

- registration

- The acquisition cost and market value of the battery if applicable

- Vehicle registration document showing national type, energy source, carbon dioxide emissions per kilometre, classification according to the level of emissions of atmospheric pollutants, vehicle characteristics including full commercial name and serial number.

- If you are buying the vehicle, an undertaking on your honour not to resell the vehicle and to provide proof, at any request from the Agence de services et de paiement, that you will be in possession of the vehicle for a period of six months following its purchase, or before it has travelled 6,000 kilometres in the case of a passenger car or van.

- If you are leasing the vehicle, an undertaking on your honour not to amend the contract and to provide proof, at the request of the Agence de services et paiement, of possession of the vehicle for a period of two years following the conclusion of the contract.

Documents relating to the vehicle to be destroyed

- Proof of ownership

- The acquisition date

- Proof of registration and date of first registration;

- The national genre

- The energy source ;

- The date of acceptance for destruction

- Proof that the vehicle is not pledged

- Proof that the vehicle is undamaged within the meaning of Articles L. 327-1 to L. 327-6 of the Highway Code

- Proof that the vehicle is covered by an insurance policy that is valid on the date it is handed in for destruction or on the invoice date of the purchased or leased vehicle.

Where to send your application

The application is processed by the "Conversion grant" department. As soon as this part has been validated, the application is processed again so that it may be eligible for "Métropole Roule Propre" aid.

The applicant is then informed of the committee's decision at the end of the review of their application. The decision will be made by the President of the Greater Paris metropolitan area.

The sum is then transferred to the beneficiary if the response is positive.

Now you know all the details of the Greater Paris scheme to help you buy an electric vehicle.

Beev offers multi-brand 100% electric vehicles at the best prices, as well as recharging solutions.