Monday to Friday 9am - 12.30pm - 2pm - 7pm

What is a self-employed person?

The self-employed are distinguished from employees by the absence of an employment contract. In effect, a self-employed person is both an entrepreneur and his or her own employee. In France, the self-employed are strongly represented by the paramedical and medical sector, VTC drivers and agriculture. However, the digitalisation of the working environment has led to the emergence of professions such as consultants, developers, graphic designers, etc.

These independent professions have car taxation very advantageous, thanks to their legal status.

As a self-employed person, you can choose from a number of legal forms:

- Sole proprietorship

- The EIRL Limited Liability Sole Proprietorship

- The EURL limited liability company (Entreprise Unipersonnelle à Responsabilité Limitée)

- SASU Société par Actions Simplifiée Unipersonnelle (simplified joint stock company with one shareholder)

These different types of status will allow you to deduct interest on loans and charges related to the use of your property, and will not be subject to tax. tax on the use of passenger vehicles for economic purposes when buying and using an electric vehicle.

Car taxation for the self-employed

When you are self-employed, theautonomy is a redundant but very real word that also applies to travel. That's why buying a car can quickly become essential. in particular to develop your business as a self-employed entrepreneur.

Buying a car is an investment that is potentially an important step in your growth. It's up to you to plan the purchase in a sensible way. Being an entrepreneur does not prevent you from buying a vehicle for your business, but certain tax and legal limits do apply.

The tax treatment of an electric car depends on the company's status:

- If you have a micro-business, you cannot deduct your charges from your turnover.

- If you have a legal structure other than micro-enterprise :

Expenses relating to the operation of vehicles are deductible from taxable profits. Depreciation takes account of the depreciation in value of your vehicle over time: it can therefore be considered as an asset. burden for your company. Depreciation applies only to private cars and is subject to a ceiling.

Law no. 2016-1917 of 29 December 2016 introduced new ceilings: the depreciation base is calculated according to the year the vehicle was acquired and its CO2/km emission rate. So the more polluting and older your vehicle, the lower the depreciation base. This table summarises the ceiling on depreciation for passenger cars under the new calculation scale in the General Tax Code.

➡️ ALSO WORTH READING - The 2022 white paper on the taxation of electric vehicles

How can I finance my electric car if I'm self-employed?

Buying a car is an important step in the lives of many French people. But how do you make the right choice? Buying a vehicle is seen as an investment. By buying an electric vehicle, a self-employed person is investing in a sustainable consumer good. Depending on your budget, your profile and the vehicle to be financed, there are a number of ways to go about it.

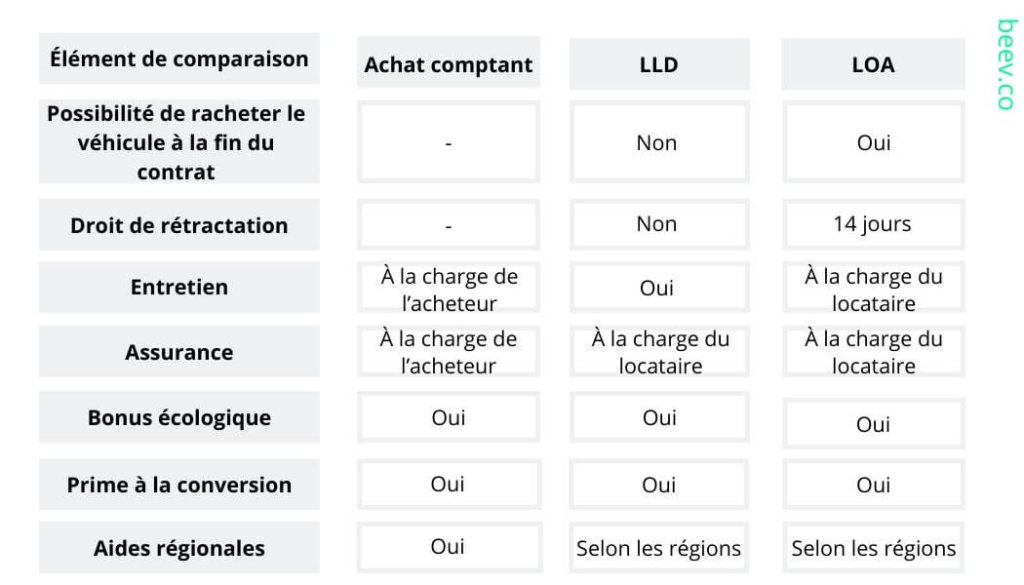

As well as buying a vehicle outright, there are two other popular methods of financing in France. Leasing with an option to buy (LOA) and long-term rental (LLD).

- The LOA : is a lease with an option to buy, which allows you to lease a vehicle with the option of buying it at the end of the lease. This method has a number of advantages, such as the possibility of buying back or terminating the lease before the end of the contract, or the possibility of getting a good deal if the vehicle is in demand at the end of the contract.

- Long-term leasing : is a long-term leasing scheme for professionals that allows them to hire a vehicle for a period of 1 to 5 years. During this period, the hirer pays a fixed rent and benefits from maintenance and assistance services included in the price. Full service leasing is beginning to develop, but remains marginal for the time being. However, this method is very popular with companies, thanks to advantages such as better budget management with fixed rental payments and the possibility of changing vehicles frequently.

Discover Mansa

Now that you know the different types of contract, let me introduce you to Mansa!

Mansa is a young French fintech co-founded in 2019 by Ali Rami, Benjamin Cambier and Rémy Tinco. The fintech is attacking the credit sector by adapting scoring to new ways of working. The observation is as follows: the banks' risk assessment model is still based on salaried employment, the dominant working method. To put together a loan application, banks therefore require recurring income from a single source, or pay slips. This is precisely what self-employed people do not have.

To achieve this, Mansa offers a platform whose credit offer is dedicated to self-employed workers and freelancers, with an immediate response in 10 minutes and funds available within 24 hours. Perfect, isn't it?

Tips for successful financing

Why do you think banks are so reluctant to lend to self-employed people?

Banks have developed along the lines of permanent contracts rather than freelance work.

To obtain credit, you need a payslip, a single income from a single source, a single employer and, above all, a stable income.

As a result, freelancers and self-employed people don't fit into the traditional banking boxes.

The "risk" calculated by the bank is therefore very high, or worse, the self-employed person is automatically rejected by the banks' software, which is not adapted to these profiles.

How can you maximise your chances of obtaining credit?

This is common sense advice.

Save systematically to build up a deposit or a safety cushion.

Avoid going overdrawn at all costs and don't spend more than you earn.

Banks generally respect the one-third rule. This means that the monthly instalments of your loan must correspond to no more than ⅓ of what you have in your account at the beginning of the month at the time of collection.

What documents do I need to provide?

You can apply for a loan online in just 10 minutes. Our algorithm analyses bank statements, taking into account the characteristics of self-employed people.

The documents you need to provide then depend on your legal status.

Legally, we need to have the self-employed person's identity document, the "identity document" of the self-employed person's organisation (siren or kbis status notice), a document showing the organisation's turnover (urssaf turnover certificate, tax notice or balance sheet) and the bank account number on which to receive the funds.

My income fell during covid-19. Can I still apply for a loan?

Of course we do! And that justifies our mission even more.

The raison d'être of Mansa is to help the self-employed to finance themselves. It is in these times of crisis that the self-employed need us most.

However, we are also careful not to put the self-employed at risk, as a loan must be repayable.

It can be difficult for freelancers obtain a loan from a traditional bank to finance a need, such as the purchase of an electric vehicle for example, which remains an important step in the lives of many French people. Today, there are a multitude of ways to finance your electric car, including cash purchase, leasing or long-term leasing, offered in particular by Mansa, a young French fintech offering dedicated to self-employed workers and freelancers, with an immediate response in 10 minutes and funds available within 24 hours.

Now that you know how to finance your electric car as a self-employed or freelance worker: it's up to you!

Beev offers multi-brand 100% electric vehicles at the best prices, as well as recharging solutions.