Outline of the amendments to Article 13 of the PLF 2026

Article 13 of the Finance Bill 2026 concentrates the measures that will directly affect company car taxation.

The government's objective is clear: accelerate the energy transition of the vehicle fleet, while guaranteeing a long-term tax return.

These amendments continue the trend that has been underway since 2020: making internal combustion vehicles more expensive to run and buy, while maintaining benefits for zero-emission vehicles.

CO₂ and weight penalties: towards stricter thresholds

Le malus CO₂ will be one of the most closely watched tax levers. In 2026, it will apply from 118 g/km, compared with 123 g/km today. Above 150 g/km, the increments will be raised from 10 to 20 %, significantly increasing the cost of registration for combustion-powered fleets.

Le weight penaltyThe number of vehicles subject to the test will be extended to include vehicles weighing more than 1,600 kg (compared with 1,800 kg previously). This means that internal combustion SUVs and non-rechargeable hybrids will be the first to fall victim to the tougher rules.

By 2028, according to PLF projections, the CO₂ penalty could start as low as 98g/km, and the maximum penalty could reach up to €100,000 for the most polluting models.

This drastic change will make it economically impossible for fleets to buy certain top-of-the-range combustion models.

TVS and new exemptions for clean vehicles

Second axis: company car tax (TVS). This is a recurring tax paid by companies for the vehicles they make available (company cars, etc.).

The PLF 2026 confirms a clear line:

- 100 % electric vehicles remain exempt from VAT.

- Plug-in hybrids with very low emissions (≤ 50 g CO₂/km) remain temporarily exempt (12 quarters).

- Thermal vehicles, on the other hand, will see their tax burden tightened, through a review of the upper brackets of VAT.

In other words, as long as your fleet is electrified, TVS is not a budgetary issue. If it is not, it becomes a structural cost item to be included in the TCO.

Warning point : From 2028, the government plans to include more parameters in the calculation, in particular the mass of the vehicle, and not just its official emissions. We are moving towards an "overall impact" reading, which affects both CO₂ and the weight of the vehicle on the road. Large combustion SUVs will therefore be taxed twice: because they pollute, and because they weigh a lot.

Suramortissement and incentives for electricity investment

The tax deferral scheme for electric, low-emission hybrid and hydrogen vehicles has been extended to 2027.

It allows companies to deduct up to 140 % of the purchase price of the vehicle from their taxable income.

This mechanism remains a cornerstone for amortising investment in zero-emission fleets, particularly in a context of rising acquisition costs.

| Tax measure Type of device | Vehicles concerned Thresholds / criteria | Main effect Predicted impact | Planned application Entry into force |

|---|---|---|---|

| Enhanced malus CO₂ | Thermal > 118 g/km | Increase in thresholds (+10-20 %) | 1st January 2026 |

| Lower weight penalty | Vehicles > 1 600 kg | Extension of the perimeter | 2026 |

| TVS exemption | EVs / hybrids < 50 g/km | Maintenance / extension | 2026 |

| EV bonus | < 2.4 t / < 20 g CO₂/km | Extended to 2027 | 2026 |

| Ecological bonus | Vehicles < €47,000 / zero emission | Conditionally maintained EU | 2026 |

| Projection 2028 | All vehicles | Malus CO₂ from 98 g/km, max €100,000 | 1st January 2028 |

To remember: The PLF 2026 reinforces the "polluter pays" principle while preparing for a historic tax hike in 2028.

Direct impact on company fleets

Changes to the FMP 2026 are not just about taxation in the short term: they are redefining the way in which companies will have to manage their vehicle fleets between now and the end of the decade.

Rising costs for internal combustion and conventional hybrid fleets

The first impact is thehe rise in total cost of ownership (TCO) thermal vehicles. Between the CO₂ malus on registration, the weight malus for heavy vehicles, and then the TVS each year, these vehicles are becoming more expensive to buy and more expensive to keep.

For a company SUV, we're potentially talking about several thousand euros in additional taxation over the vehicle's life cycle. This is no longer negligible. For a fleet of 50, 100 or 300 vehicles, it quite simply becomes a strategic issue for financial management.

Important information: Non-rechargeable hybrids (traditional "full hybrids") will no longer be considered an attractive tax compromise by 2027-2028. These models duplicate some of the constraints of the internal combustion engine without benefiting from the full advantages of the electric 100 % or plug-in used correctly.

Enhanced benefits for electric and low-emission vehicles

Faced with this fiscal pressure, electric or very low-emission 100 % vehicles are becoming a financial necessity, not just an environmental one.

Why is this?

- No VAT for electric vehicles.

- There is no CO₂ or weight penalty (in the vast majority of cases, as the weight of electric cars is still monitored, but still outside the core tax target).

- Energy cost 3 to 4 times less than fossil fuel (pro recharge vs diesel/petrol).

- Reduced maintenance (no oil change, fewer engine wear parts).

- Extended capital cost allowance, which further reduces the overall bill.

The bottom line: over a 4 to 5 year lifecycle, a professional electric vehicle can have a TCO 20 to 25 % lower than an electric vehicle. thermal vehicle equivalent in comfort/category.

It's no longer a green image. It's about saving money.

A compulsory transition for large fleets

La Mobility Orientation Act (LOM) requires companies with more than 100 vehicles to ensure that 50 % of their renewals are low-emission by 2027.

The measures in the PLF 2026 reinforce this obligation by making the electricity transition economically unavoidable.

Use the TCO simulator to calculate the total cost of ownership of your car and compare it with its internal combustion equivalent.

How can you anticipate the tax changes of 2026?

Until now, many companies have managed their fleets in an operational way: replace when it's old.

From 2026 onwards, this is no longer enough. We need a managed approach: diagnosis, simulation, implementation plan. This is exactly what purchasing departments, finance directors and CSR managers are looking at today.

1) Carry out a fiscal and energy audit of the current fleet

This audit must answer simple, quantified questions:

- Which vehicles will become "too expensive for tax purposes" in 2026-2027?

- Which ones already exceed the future CO₂ or mass thresholds?

- What is the average age of the fleet?

- What is the annual mileage per usage profile (management, field sales, logistics, internal pool, etc.)?

The purpose of this audit is not just accounting. It allows us to build an internal argument with management: "If we do nothing, this is how much the fleet will cost us in 24 months' time".

2) Simulating the post-PLF 2026 TCO

With a TCO (total cost of ownership) simulator tailored to fleets, you can compare several scenarios:

- continue to buy an internal combustion engine and pay the malus plus the TVS,

- switch part of the fleet to plug-in hybrids that are actually used in electric mode,

- Immediately electrify certain uses, giving priority to the most predictable (regional sales staff, managers, in-house VTC, etc.).

This simulation highlights the most profitable transition scenarios for the company.

3) Implement a two-year transition plan

Going electric for a fleet doesn't mean buying cars at random. It's about :

- prioritise vehicle replacements the most costly fiscally by 2026-2028 ;

- deploy on-site charging stations (and possibly negotiate access to off-site fast charging for certain highly mobile profiles);

- monitoring tools (mileage, fuel consumption, availability) ;

- supporting drivers in adoption : autonomy management, good driving practices.

Key point Success is not just technical. It's cultural. An employee who understands why they are being given an electric vehicle and how to use it becomes an ally, not a hindrance.

The role of taxation in a sustainable mobility strategy

Car taxation is becoming a real lever for ecological steering.

It influences not only costs, but also image, CSR compliance and the company's overall performance.

Tax incentives: a lever for performance and competitiveness

It's important to understand what's at stake here.

Companies that act early simultaneously tick :

- the cost box (Optimised TCO thanks to tax benefits for electric cars),

- the image box (CSR communication, compliance with climate commitments),

- the market access box (more and more public and private tenders require proof of a genuine low-carbon strategy).

In other words, the low-carbon fleet is no longer a question of logistics operations. It's a business issue.

Electric vehicles: a pragmatic response to regulatory pressure

With the rise of low-emission zones (ZFEs), higher tax rates for internal combustion vehicles, pressure on vehicle mass and CSR regulatory deadlines, the electric vehicle now seems the most rational option.

The PLF 2026 merely makes visible something that was already there:

- Thermal becomes financially defensive;

- electrics become financially attractive.

For general management, this changes the story told internally. They no longer say "we're going electric because it's green".

We're saying: "We're going electric because it will protect our margins and our competitiveness by 2028".

| Key stage Priority action | Concrete objective Expected results |

|---|---|

| Identifying vehicles exposed to the CO₂ / weight malus 2026-2028 | Prioritising urgent replacements |

| Calculate the comparative TCO for heat and power | Obtaining a budget argument for the finance department |

| Planning renewals before thresholds rise | Avoiding the additional costs associated with tax cuts |

| Take advantage of the additional depreciation extended until 2027 | Reduce the company's tax base |

| Deploying or securing recharging solutions (on-site + roaming) | Guaranteeing the operational use of electric vehicles |

| Updating the internal car policy | Integrate tax, CO₂ and vehicle weight criteria |

| Training drivers | Maximising genuine autonomy, limiting internal complaints, encouraging acceptance of change |

Conclusion - Anticipating today for more advantageous taxation tomorrow

The PLF 2026 confirms a reality: car taxation is no longer neutral. It is clearly pushing companies towards electric and low-emission vehicles, and is preparing to become even tougher by 2028 (lower CO₂ thresholds, taking weight into account, potentially massive malus ceilings).

For finance, CSR and mobility departments, waiting is no longer an option.

Not moving today means accepting tomorrow:

- a sharp rise in thermal TCO,

- an increase in VAT,

- increasingly punitive penalties on the purchase of internal combustion vehicles,

- and increasing difficulty in driving in low-emission zones.

Conversely, planning the transition now, even partially, even by segment of use, makes it possible :

- immediate tax optimisation,

- stabilise costs over the medium term,

- demonstrate the company's CSR alignment,

- and remain attractive in calls for tender.

In practical terms, the fleet is no longer a fixed cost centre. It is a strategic lever.

Anticipating the PLF 2026 today means protecting your 2028 margin.

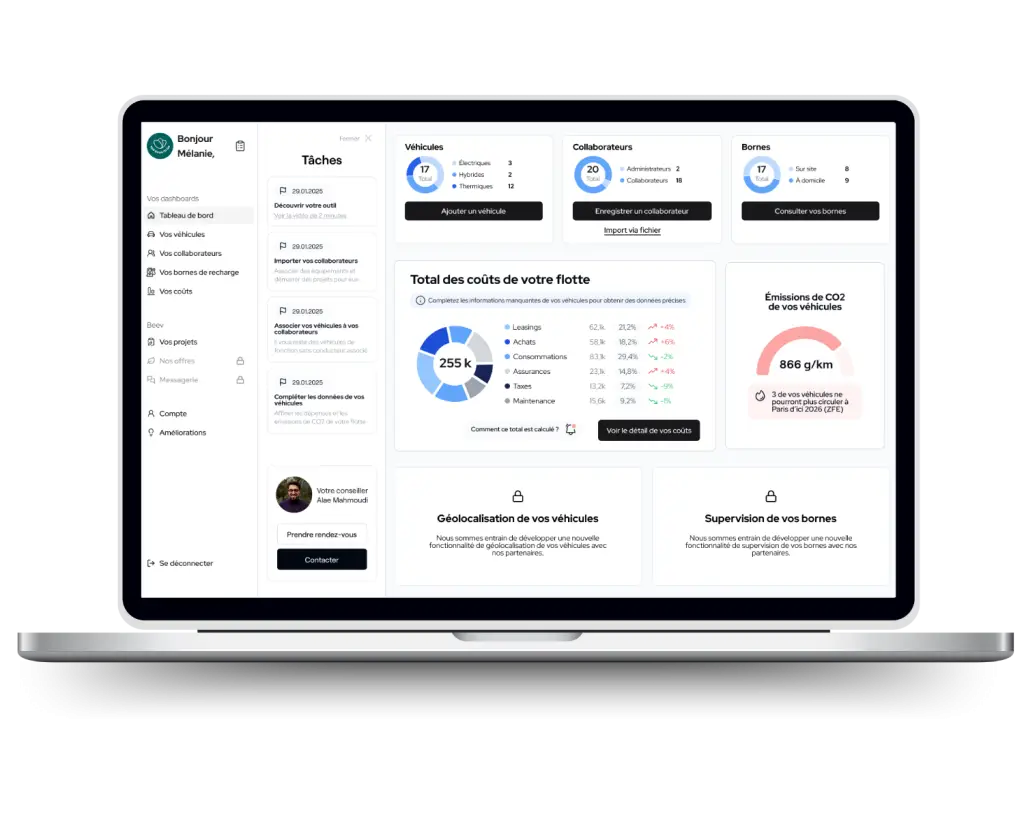

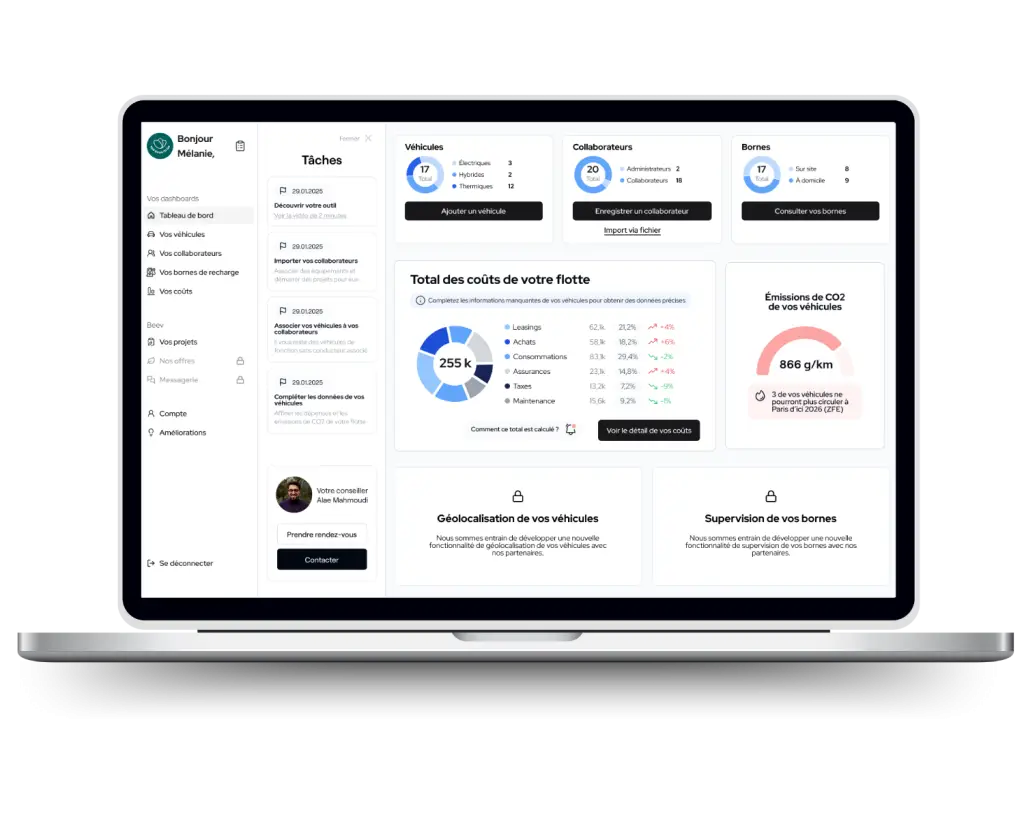

Manage your fleet easily with our dedicated tool

A fleet management tool from A to Z

- Add your fleet and employees in just a few clicks

- Plan your transition to electric vehicles and monitor your CSR objectives in real time

- Centralise your expenses