When should I file my 2022 tax return?

The online tax return service will be available from Thursday 7 April 2022 on the impots.gouv website for 2021 income. The tax return deadlines vary depending on the taxpayer's département of residence:

- Tuesday 24 May 2022 at midnight for departments 01 (Ain) to 19 (Corrèze) and for non-residents who received taxable income from French sources in France in 2021;

- Tuesday 31 May 2022 for departments from 20 (Corse-du-Sud) to 54 (Meurthe-et-Moselle);

- Wednesday 8 June 2022 in departments from 55 (Meuse) to 976 (Mayotte).

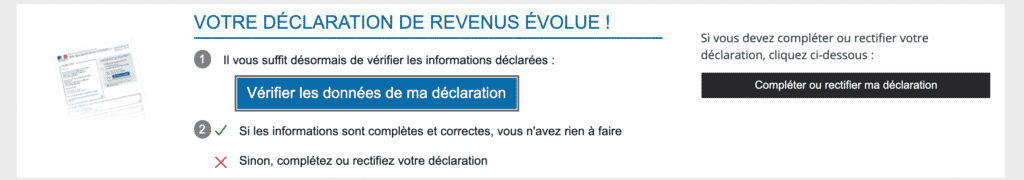

Good to know: for the third year running, automatic tax returns have been introduced to simplify tax returns for most households. Once the tax authorities have all the information they need to tax your income, all you have to do is validate the return.

How do I file my tax return?

- Connect to the site impots.gouv.fr

- All you have to do now is check the information declared:

- If the information is correct, the declaration is validated and you have nothing further to do.

- If the information is incomplete, you must rectify your declaration.

A 20% increase in the expenses that can be deducted from income for drivers with electric cars

The government has introduced a 20% surcharge on the expenses that can be deducted from income for drivers of electric cars.

The measure already applies to 2022 tax, to be paid on the basis of 2021 income to be declared from April 2022.

All the more reason to buy an electric vehicle! It's one of a list of grants that have been put in place to speed up the transition to cleaner vehicles in France.

- Ecological bonus of €6,000 for an electric vehicle

- La conversion premium for the most modest households

The new decree published in the Journal officiel provides for an increase of 20% on the amount of travel expenses that can be deducted from income. These new scales (see below) are always calculated on the basis of the power of the vehicle and the number of kilometres travelled.

New mileage rates for electric vehicles

In principle, the mileage scale changes every year. The scale to be used in 2023 for thetax returnto be sent in the spring will be published by decree in the Journal Officiel in February 2023. There are in fact several scales: the mileage scale for cars must be distinguished from the mileage scales for motorbikes and scooters. These different scales are published by the tax authorities in the same decree.

The 2023 kilometric scale should be significantly higher than the scale applied last year.The 2022 mileage scale for car journeys was as follows. The letterdis the distance travelled in km during the year. The coefficient applicable to this distance increases according to the power of your vehicle (in taxable horsepower, abbreviated to "HP"), up to a limit of 7 HP.

The 2022 grid for motorists is attached:

| Fiscal power | Distance (d) up to 5,000 km | Distance (d) from 5,001 to 20,000 km | Distance (d) over 20,000 km |

| 3 CV and less | d x 0.502 | (d x 0.3) + 1007 | d x 0.35 |

| 4 CV | d x 0.575 | (d x 0.323) + 1262 | d x 0.387 |

| 5 CV | d x 0.603 | (d x 0.339) + 1320 | d x 0.405 |

| 6 CV | d x 0.631 | (d x 0.355) + 1382 | d x 0.425 |

| 7 CV and more | d x 0.661 | (d x 0.374) + 1435 | d x 0.446 |

The 20% increase (compared with conventional grids) also applies to electric two-wheelers (where available).

| Type of two-wheeler | Distance (d) up to 3,000 km | Distance (d) from 3,001 to 6,000 km | Distance (d) over 6,000 km |

| 1 or 2 CV | d x 0.375 | (d x 0.094) + 845 | d x 0.234 |

| 3, 4, 5 HP | d x 0.444 | (d x 0.078) + 1099 | d x 0.261 |

| More than 5 hp | d x 0.575 | (d x 0.075) + 1502 | d x 0.325 |

* 2 wheels over 50 cc

| Rates applicable to electric mopeds* (in euros) for the 2021 tax return | ||

| Distance (d) up to 3,000 km | Distance (d) from 3,001 to 6,000 km | Distance (d) over 6,000 km |

| d x 0.299 | (d x 0.070) + 458 | d x 0.162 |

* 2 wheels under 50 cc

An advantageous scale

This scale is based on the power of the car and the distance travelled, in order to assess the costs associated with using a private car. So if you drove an electric car 7,000 km in 2022, you could deduct €3,728 from your income.

This new benefit is available where the taxpayer has opted to deduct actual expenses. This option may be more advantageous than the deduction of 10 % automatically applied by the tax authorities to employees' remuneration.