An overall decline in the long-term leasing market

The current economic climate is not conducive to investment, and the automotive sector is feeling the consequences. The full service leasing (FSL) market, usually the driving force behind corporate fleets, is also experiencing a marked slowdown.

According to the latest study published by SesamLLD (Syndicat des Entreprises des Services Automobiles en LLD et des Mobilités), the automotive market in 2025 is showing signs of running out of steam after several months of fragile growth.

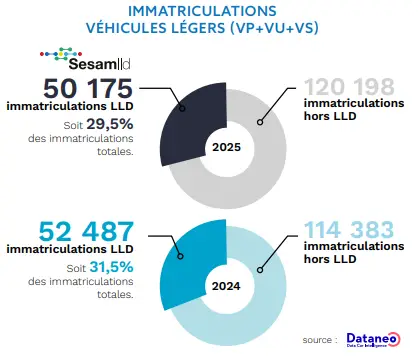

In September 2025, total registrations reached 170,373 vehicles, a moderate increase on September 2024 (166,870). However, this apparent increase conceals a less favourable reality: the share of leased vehicles in total registrations fell from 31.5 % to 29.5 % in one year.

https://www.sesamlld.com/wp-content/uploads/2025/10/Flash-092025.pdf

This market contraction can be explained by several factors:

- Rising interest rates, which increase the cost of financing vehicles and slow down fleet renewal;

- Rising prices for new vehicles, particularly internal combustion vehicles, impacting total cost of ownership (TCO);

- Internal budgetary trade-offs, which lead companies to extend the duration of their contracts or defer the renewal of their vehicles.

Despite this slowdown, full service leasing remains an essential pillar of corporate mobility policies. This form of financing continues to offer fleet managers valuable financial and operational flexibility.

Key figure: 59.6% of company vehicles are registered under full service leasing. (1)

(1) excluding short-term leases, demonstration vehicles and vehicles built for company use

Electricity, the driving force behind a new cycle

The rise of electric vehicles is a real opportunity to revitalise leasing and rethink the mobility strategies of business fleets.

Fleets switch to electric leasing

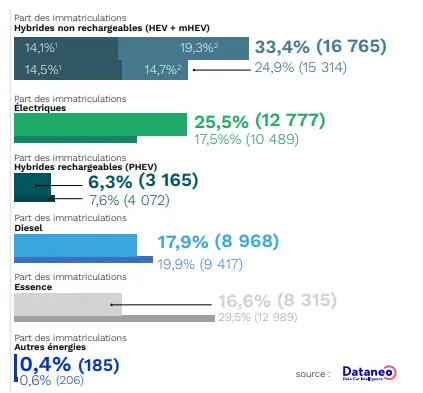

While the overall leasing market is experiencing a slowdown, electric vehicles (EVs) are continuing to make inroads into business fleets. According to the latest figures for the third quarter of 2025 Electric leasing registrations represent 25.5 % of the market, or 12,777 vehicles, compared with 17.5 % (10,489 vehicles) during the same period last year. This rapid growth confirms the driving role played by EVs in the renewal and modernisation of company car fleets.

At the same time, the proportion of internal combustion vehicles (petrol and diesel) continues to fall, reinforcing the central role of EVs in mobility strategies.

LTL figures for the third quarter of 2025 compared with the same period N-1: breakdown by engine/fuel type

Lower TCO, more favourable taxation and a CSR image

It's no coincidence that electric leasing is attracting more and more companies, regardless of their sector of activity. There are many advantages for business fleets:

- Controlling operating costs: EV leasing makes it possible to forecast and stabilise expenditure, thanks to reduced maintenance costs, lower energy costs and all-inclusive contracts that simplify management. fleet management.

- Tax and financial optimisation: Government grants and tax benefits make electric leasing particularly profitable, while limiting the impact on cash flow.

- Enhanced responsible image: Going electric contributes to the company's CSR strategy, highlights its commitment to sustainable development and meets the expectations of customers and partners.

- Flexibility and fleet modernisation: Leasing offers the possibility of rapidly updating vehicles and adapting the fleet to real needs, without tying up capital.

Growth of EVs in fleets and the regulatory framework

The adoption of EVs is also supported by the LOM Act and environmental regulations, which encourage the reduction of emissions and the transition to clean engines. For companies, electric leasing is becoming an effective strategy for modernising their fleet, while controlling costs and complying with regulatory obligations.

Why are companies choosing to lease electric vehicles?

Access to the latest innovations without massive investment

With the Electric vehicle leasings, your company can have access to the latest models without having to invest a lot of capital. You benefit from the latest technological innovations and EV performance, while avoiding the constraints associated with direct purchase. This formula allows you to modernise your fleet gradually and flexibly, according to your needs and the development of your business.

Controlling expenditure and cash flow

Leasing is simple and predictable: at the end of the contract, you simply return the vehicle. There's no resale to worry about, and no residual value to calculate.

This formula is ideal for companies that want to renew their fleet regularly. You control your costs over the chosen period and leave with a new model without worrying about the discount.

Unlike leasing or traditional acquisition, long-term leasing does not include the vehicle as an asset on the balance sheet. The lease payments are booked as operating expenses, which helps to lighten the balance sheet and improve certain expenditure items, potentially facilitating access to other essential investments for the growth of your company.

For electric vehicles, this accounting treatment is often accompanied byadditional tax benefits. Given their CO₂ emissions In addition to very low or zero emissions, they are generally more eligible for green tax schemes: total or partial exemption from TVS, optimised tax deductions and deductions on benefits in kind for your employees. These measures enable companies to reduce the real cost of their fleet while complying with environmental obligations.

However, it is important to remember that deductibility and tax treatment are subject to ceilings, which vary according to the type of vehicle and its technical characteristics. VAT can only be reclaimed on certain expenses, so you need to check the conditions carefully when setting up your contracts.

Maintenance and servicing included

Do your vehicles cover long distances every day? Leasing can help you control servicing and maintenance costs, even for journeys of more than 25,000 km a year. What's more, the maintenance of electric vehicles is simplified thanks to a reduced number of mechanical parts and servicing operations. All essential services are included in the rental price, giving you peace of mind and predictability in the management of your fleet.

Rationalise costs by developing on-site recharging

Finally, on-site recharging becomes a real competitive lever. By equipping your premises with recharging stations and supporting your employees, you can facilitate the daily use of EVs, improve operational efficiency and reinforce your responsible image with your partners and customers.

Lease an electric car

Would you like to lease an electric car? Beev offers you 100 % electric cars at negotiated prices, as well as recharging solutions.

What are the prospects for electric leasing?

A number of trends and regulatory factors indicate that electric vehicle leasing will be a strategic lever for companies, both in the short and long term.

Increase in the market share of electric vehicles

The proportion of EVs in business fleets continues to grow rapidly, driven by corporate demand for flexible, cost-effective solutions and growing awareness of environmental issues. Companies are anticipating the energy transition by gradually renewing their fleets with clean, modern vehicles suited to intensive use.

Favourable regulations and incentives

Environmental regulations play a major role in this dynamic. Low Emission Zones (ZFE) and tax depreciation schemes are encouraging companies to switch to EVs. These measures make electric leasing even more attractive, enabling companies to meet their legal obligations while optimising costs and fleet management.

Electric leasing: a winning model

The combination of controlled costs, simplified maintenance, tax benefits and contractual flexibility makes leasing electric vehicles a winning model in the long term.

How do you set up a leasing scheme for electric vehicles?

Switching to electric operational leasing is not something you can improvise: it has to be structured to meet your company's operational, financial and environmental needs. Here are the key stages in making your electric leasing project a success.

1. Define your fleet's needs

First and foremost, it is essential to clarify the uses and scope of your fleet:

- How many vehicles are needed?

- What are the user profiles (urban, interurban, delivery, sales, technical)?

- What journeys are made each day?

This analysis will enable you to size theautonomy This will enable you to choose the right vehicle models and anticipate your recharging needs. An accurate diagnosis guarantees a smooth transition and optimum use of your electric vehicles.

2. Choosing the right long-term leasing package

Once you've identified your needs, it's time to select the most appropriate package: length of contract (36, 48 or 60 months), annual mileage, rental charge and associated services (insurance, maintenance, assistance, top-up).

Beev provides you with a online simulator which allows you to adjust your leasing offer in real time according to your needs, your budget and the profile of your fleet:

3. Integrating recharging into the project

The success of an electric leasing project also depends on recharging infrastructure adapted.

Beev is with you every step of the way:

- Feasibility study: installation of terminals on site or at your employees' homes.

- Installation and supervision of equipment.

- Simplified access to public recharging thanks to multi-network cards.

The aim is to guarantee continuity of use and productivity for your teams, while reducing dependence on external stations.

4. Monitoring and developing the contract

The introduction of a full service lease is not the end of the project: on the contrary, it's the beginning of dynamic, progressive management of your fleet. Thanks to digital management tools, you can now monitor your entire fleet in real time and adjust your contracts according to your operational needs.

Integrated intelligent fleet management tools enable you to monitor :

- the energy consumption of each vehicle,

- mileage travelled and deviations from the planned package,

- driving behaviour (acceleration, braking, stopping times),

- maintenance planning to avoid unforeseen downtime.

This valuable data helps you to optimise TCO (Total Cost of Ownership), adjust contracts before they expire and better anticipate vehicle renewal. This gives you greater visibility and efficiency in the day-to-day management of your fleet.

Make your energy transition now, with a range of new 100 % electric vehicles available for leasing from Beev!

Contractual flexibility to match your growth

One of the great advantages of full service leasing, especially for electric vehicles, is its flexibility. Do your needs change? You can :

- extend or reduce the term of the contract ;

- replace an obsolete model with a more efficient vehicle;

- add new vehicles to support your company's growth.

Beev allows you to adjust your fleet without any major administrative constraints, thanks to flexible contracts and dedicated support. This flexibility is particularly valuable in a context of energy transition, where technologies and regulations are changing rapidly.

Faced with rising costs, regulatory pressure and environmental requirements, Operational Leasing of electric vehicles is the right solution for your company. It combines flexibility, performance and financial optimisation, while enhancing your CSR image.

Simulate your electric leasing offer now with Beev and find out how to combine economic performance and energy transition:

Discover our Beev electric leasing offers

Monday to Friday

9am - 12.30pm - 2pm - 7pm