Who is affected by the obligation to declare the level of greening in 2025?

Not all companies are in the same boat. The obligation to declare the greening rate of your fleet depends on a number of criteria linked to your organisation and the composition of your vehicles.

- Companies and public authorities with at least 100 vehicles This threshold automatically triggers the obligation to declare.

- Rental and leasing companies : also affected, as they manage large fleets and influence the secondary market.

- Local authorities and public bodies : subject to the same obligations in order to participate in the global decarbonisation effort.

In practical terms, if your fleet reaches this threshold, or if you are a major player in business mobility, you must declare each year the percentage of so-called 'clean' vehicles (electric, rechargeable hybrids, hydrogen, etc.) in your fleet.

What should I do if my declaration is late or forgotten?

Forgetting or delaying to declare can have serious consequences:

- Financial penaltiesdepending on the size of your fleet.

- Loss of eligibility for certain tax benefitsThese include partial exemptions from TVS (Taxe sur les Véhicules de Société).

- Tighter controls the administration may ask for detailed supporting documents, resulting in an additional administrative burden.

It is therefore crucial to establish a clear internal procedure, with a timetable and a designated person in charge, so as not to miss this annual deadline.

Deadline of 30 September 2025: what you need to know

The deadline is 30 September 2025. This is the maximum deadline for submitting your greening rate declaration to the authorities for renewals carried out in 2024.

Some key points:

- The declaration is made annually It will then have to be renewed every year at the same time.

- Dematerialised format Most procedures are now carried out via a dedicated online portal, which makes them easier to send, but requires your data to have already been consolidated.

Impact of the Annual Incentive Tax (TAI) on your reporting obligations

Since 2024, the Annual Incentive Tax (TAI) has strengthened the fleet monitoring system. It is based directly on the level of greening of your vehicles:

- The higher your green rating, the lower the tax burden.

- Conversely, a delay in the ecological transition of your fleet entails a increase in the amount due.

Declaring the level of greening is therefore more than just an administrative formality: it has a real impact on your tax situation.

For the fleet managersThis turns a constraint into a means of optimising your budget. Investing in the electrification of your vehicles not only reduces fuel and maintenance costs, but also limits your exposure to TAI.

How can you accurately calculate your fleet greening rate?

The calculation of the fleet greening rate is based on an official formula, specified by the Decree no. 2020-1726 of 29 December 2020. This text defines precisely what is considered to be a "clean" vehicle and sets out the legal framework for this monitoring.

The calculation takes into account :

- The total number of vehicles in your fleet.

- The number of clean vehicles, defined according to thresholds for CO₂ emissions and energy used.

Practical example:

If your fleet comprises 200 vehicles, including 60 electric and 20 rechargeable hybrids, your greening rate is :

(60 + 20) / 200 x 100 = 40 %

Worth noting Some hybrid vehicles that cannot be recharged or have excessively high emissions are not counted as "clean", in accordance with the criteria set out in the decree.

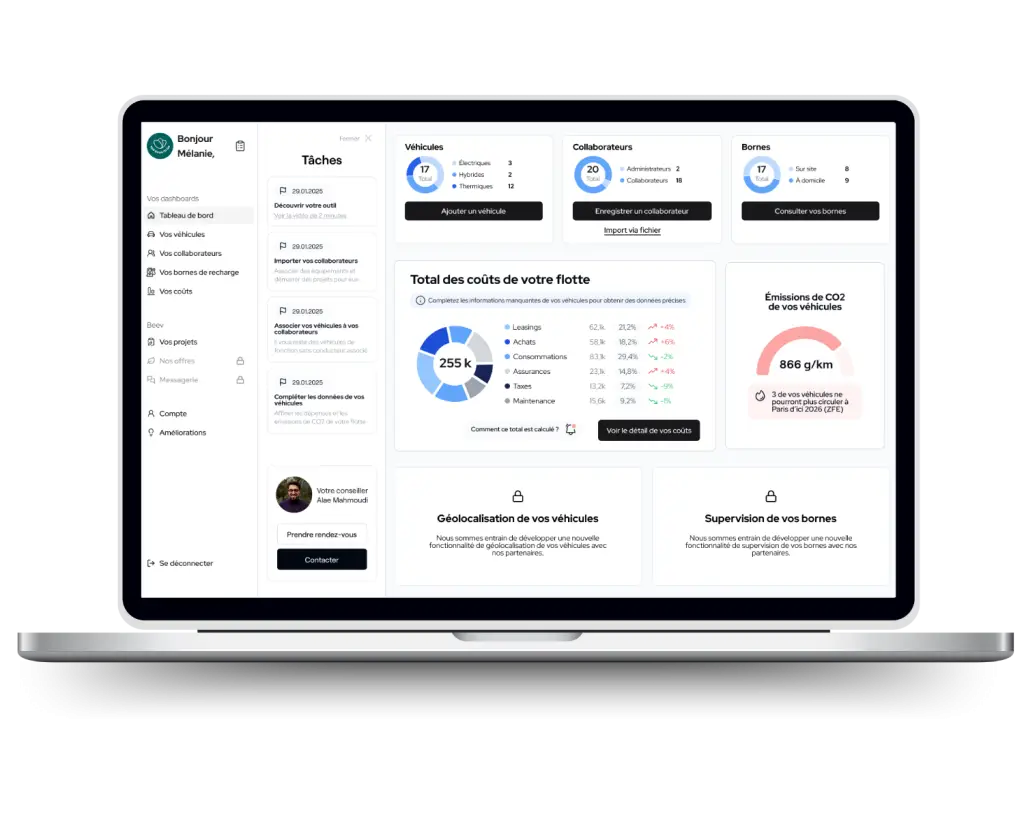

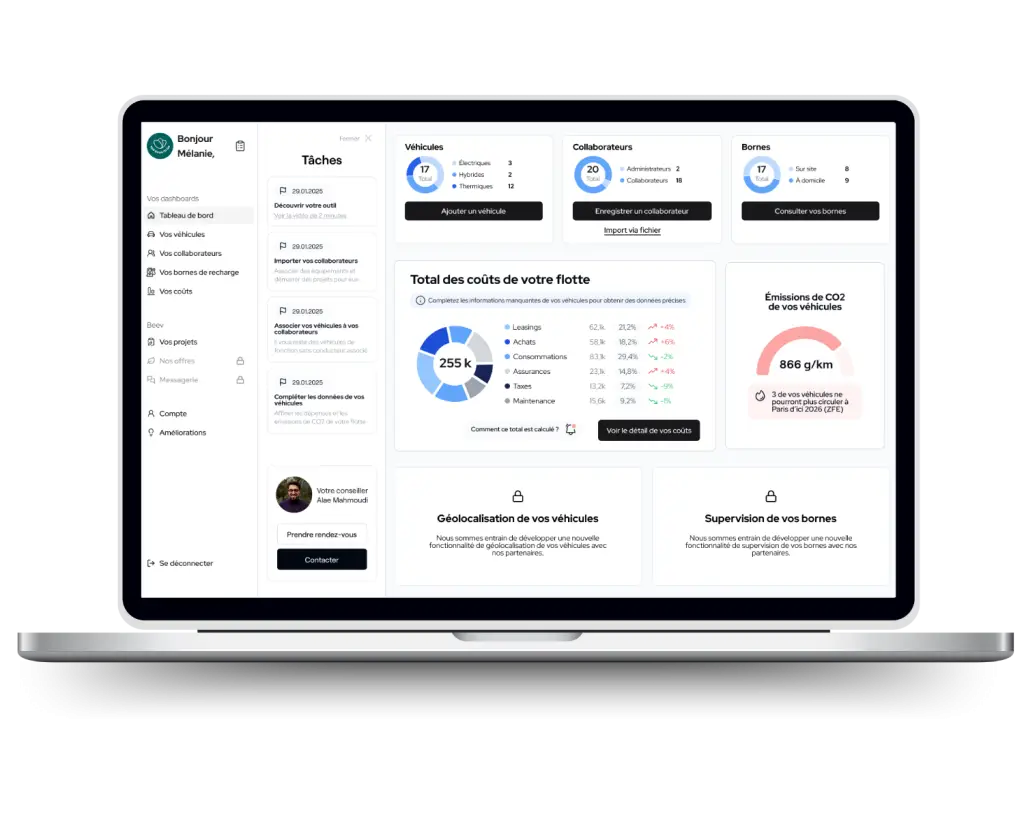

Council Beev: use our Beev fleet management software to ensure the reliability of your data and avoid any calculation errors.

Manage your fleet easily with our dedicated tool

A fleet management tool from A to Z

- Add your fleet and employees in just a few clicks

- Plan your transition to electric vehicles and monitor your CSR objectives in real time

- Centralise your expenses

Penalties and risks in the event of non-declaration or erroneous declaration

Not declaring or declaring the wrong rate exposes you to a number of risks:

- Administrative fines, proportional to the size of the fleet.

- Tax adjustment if the TAI is calculated on an incorrect basis.

- Damage to your brand imageThis is particularly sensitive at a time when CSR and the ecological transition are under scrutiny from your partners and customers.

Points to watch: the tax authorities may demand that the tax be adjusted retroactively over several years, with interest for late payment.

Strategies for optimising your green rating for 2025-2026

Here are some effective ways of optimising your greening rate:

- Accelerating electrification The following measures will be taken: give preference to the purchase or long-term leasing of electric vehicles.

- Gradually replacing internal combustion vehicles Target the oldest, most polluting models first.

- Implementing a global mobility policy encouraging car-sharing, car-pooling and the use of soft mobility solutions to reduce the total number of vehicles.

- Take advantage of available grants and subsidies: ecological bonuses, conversion bonuses, support from local authorities.

- Rely on a specialist partner to manage the transition and support you with administrative and tax issues.

By combining these levers, you can improve not only your greening rate, but also your company's competitiveness and responsible image.

By 2025, the mandatory declaration of the greening of the fleet will be a must for companies and local authorities. The 30 September deadline is not just an administrative formality: it affects your tax charges, reflects your organisation's commitment to the environment and can become a genuine strategic tool.

More than just a reporting tool, the greening rate becomes a key indicator of your energy transition and your attractiveness on the market.

You would like toto electric?

Beev offers multi-brand 100% electric vehicles at the best prices, as well as recharging solutions.