Understanding the European automotive package: what's changing for businesses?

Before analysing the direct impact on fleets, it is essential to understand the overall logic of the European automotive package. It is not a single law, but a set of proposals, guidelines and regulatory adjustments designed to adapt the automotive sector to current economic, industrial and environmental realities.

The stated objective is now more nuanced than before: Keeping decarbonisation on course while preserving the competitiveness of European industry. This search for balance marks a significant shift in European thinking, without calling into question the fundamental trajectory towards electrification.

European objectives for decarbonisation and electric mobility

The European trajectory remains clear: drastically reduce CO₂ emissions from road transport and make electric the standard for new vehicles in the medium term. The objective of gradually phasing out sales of new combustion-powered vehicles by 2035 remains a structuring point for the entire market.

However, the latest developments in the automotive package reflect a more pragmatic approach. The European Union is introducing greater flexibility in the implementation of these objectives, recognising the diversity of industrial situations and the need to avoid sudden disruptions in the market.

For businesses, the message is twofold: the electrification of fleets is still unavoidable, but it is now part of a more gradual transition, better aligned with economic and industrial realities.

Technological neutrality and flexibility: a change in strategic tone

One of the major changes in the automotive package is the introduction of a form of technological neutrality. Without calling into question the priority given to electric vehicles, Europe recognises that other levers can temporarily contribute to reducing emissions: low-carbon materials, industrial optimisation, advanced hybrid solutions or compensation mechanisms.

This change of tone is intended to give manufacturers some room for manoeuvre, while maintaining a downward trajectory for emissions. For corporate fleets, this means a potentially more stable market, less exposed to sudden regulatory shocks.

European production, local content and industrial sovereignty

Another key aspect of the package is the local production of vehicles and key components, particularly batteries. The European Union is seeking to strengthen its industrial sovereignty by reducing its dependence on imports from outside Europe, particularly from Asia.

This desire to favour greater local content meets several objectives: securing supply chains, stabilising industrial capacities and limiting exposure to geopolitical tensions. For fleet managers, this is a positive signal in terms of supply reliability and medium-term visibility.

A regulatory framework that is still evolving: what companies need to anticipate

It should be remembered, however, that the European automotive package is still partly a work in progress. Some of the precise details, such as local content and industrial support mechanisms, are still under discussion.

For companies, this situation calls for active monitoring and the ability to anticipate. Waiting for a totally fixed framework before taking action would be tantamount to accepting change rather than proactively incorporating it into fleet strategy.

What impact will this have on the availability and cost of professional electric vehicles?

One of the primary concerns of fleet managers is the availability of electric vehicles. Recent years have been marked by extended delivery times, production arbitrage and high price volatility. The aim of the European automotive package is precisely to provide greater stability in these areas.

Towards greater security of supply

By encouraging European production of vehicles and batteries, the European Union is seeking to reduce dependence on long and fragile supply chains. For businesses, this means more predictable delivery times and a better ability to plan fleet renewals.

Although these effects will not be immediate, they are a positive signal for fleet managers, who often have to build their electrification plans over several budget cycles.

European batteries: what impact on costs and lead times?

La battery represents a major part of the cost of an electric vehicle. The development of production capacity in Europe, supported by EU policies, could contribute to greater price stability in the medium term.

For companies, this means a clearer TCO, reduced exposure to fluctuations in international markets and greater consistency between ESG commitments and the choice of vehicles included in the fleet.

What fleet managers need to incorporate into their purchasing strategies

In this new context, purchasing strategies must evolve. Fleet managers are having to integrate more criteria relating to the origin of vehicles, the strength of supply chains and compatibility with European regulatory trajectories.

The automotive package thus reinforces the importance of a comprehensive, forward-looking approach to purchasing decisions, going beyond the simple logic of list prices.

Electric fleets: what impact on TCO and running costs?

Beyond the purchase price, the key issue for companies remains the total cost of ownership. The European automotive package, by influencing supply, production and regulation, has an indirect but real impact on the TCO of electric fleets.

If European industrial policies succeed in stabilising production and strengthening local competition, companies could benefit from better control over acquisition prices in the medium term. This stability is a key factor in ensuring the reliability of financial projections linked to the electrification of fleets.

Impact varies according to fleet profile

The effects of the automotive package will not be uniform. Urban fleets, characterised by short, repetitive journeys, will quickly benefit from the stability of electric models. Conversely, inter-site or commercial fleets will have to take greater account of changes in the range of vehicles on offer, the number of vehicles on the road and the type of vehicle used.’autonomy and recharging.

This differentiation reinforces the need for intelligent fleet segmentation, to optimise TCO according to actual usage.

Energy costs and recharging: a greater challenge

The operating cost of an electric vehicle depends largely on the recharging strategy in place. By speeding up electrification across the board, the European automotive package will automatically increase the pressure on recharging infrastructure, particularly in businesses.

To maintain a competitive TCO, organisations need to optimise their energy consumption, intelligently manage their recharging and anticipate the future needs of their fleets.

Regulatory stability as a financial lever

Better regulatory visibility will enable companies to secure their investments. By clarifying the trajectory of electrification and supporting European industry, the automotive package helps to reduce the risk of rapid obsolescence of the choices made today.

Use the TCO simulator to calculate the total cost of ownership of your car and compare it with its internal combustion equivalent.

Recharging and infrastructure: a challenge strengthened by the European automotive package

The electrification of fleets cannot be dissociated from the issue of recharging infrastructure. The European automotive package, by speeding up the spread of electric vehicles, reinforces the importance of a well-sized IRVE that can be managed over the long term.

Anticipating the rise of electric fleets in companies

As the number of electric vehicles increases, recharging requirements are evolving rapidly. Companies need to anticipate this surge in demand to avoid hasty investment or operational constraints.

A multi-year vision of the IRVE enables costs to be optimised, operations to be secured and the growth of electric fleets to be supported with confidence.

Sizing and managing charging infrastructure over the long term

The sizing of charging points, the management of subscribed power and the integration of intelligent control solutions have become key issues. A poorly designed infrastructure can quickly generate additional energy costs or limit the use of vehicles.

The European context reinforces the need for a structured approach, aligned with both actual usage and regulatory developments.

The key role of experts in securing IRVE investments

In this context, support from specialists like Beev enables companies to secure their IRVE investments. Analysis of usage, sizing, energy optimisation and recharging management are all levers for transforming regulatory constraints into operational advantages.

What are the regulatory requirements for company fleets?

The European automotive package is part of a wider set of regulations that directly affect corporate fleets. These obligations reinforce the importance of proactive and structured management.

Greening fleets: what companies need to do

In France, the Climate and Resilience Act requires companies with large fleets to make increasing use of low-emission vehicles when renewing their fleets. This obligation automatically accelerates the electrification of fleets.

Car parks, charging points and IRVE compliance

The Mobility Orientation Law and the IRVE decree impose obligations for pre-equipment and compliance of company car parks. A well-designed, compliant IRVE becomes a tool for controlling costs and securing operations.

ESG reporting and the CSRD directive

With the CSRD directive, the energy and environmental performance of fleets is becoming a key element in extra-financial reporting. Controlling consumption, recharging and the use of energy are key factors in this respect.’carbon footprint is now a strategic issue for companies.

How companies can turn these changes into opportunities

Rather than being subjected to these developments, companies can take advantage of the European automotive package to boost the performance of their electric fleets.

Structuring a fleet strategy aligned with Europe

Aligning fleet strategy with European guidelines helps to anticipate market trends, secure investments and strengthen the coherence between financial, operational and CSR objectives.

Securing TCO through a global approach

The winning approach is based on an integrated vision: choice of vehicles, recharging strategy, energy management and driver support. This coherent approach enables us to maintain a competitive TCO despite the growing complexity of the sector.

Why specialised support becomes a competitive advantage

In an increasingly complex regulatory, technological and energy environment, the support of an expert in electric mobility is becoming a real competitive lever for companies. In addition to strategic advice, the ability to manage vehicle usage and recharging data in fine detail is becoming crucial.

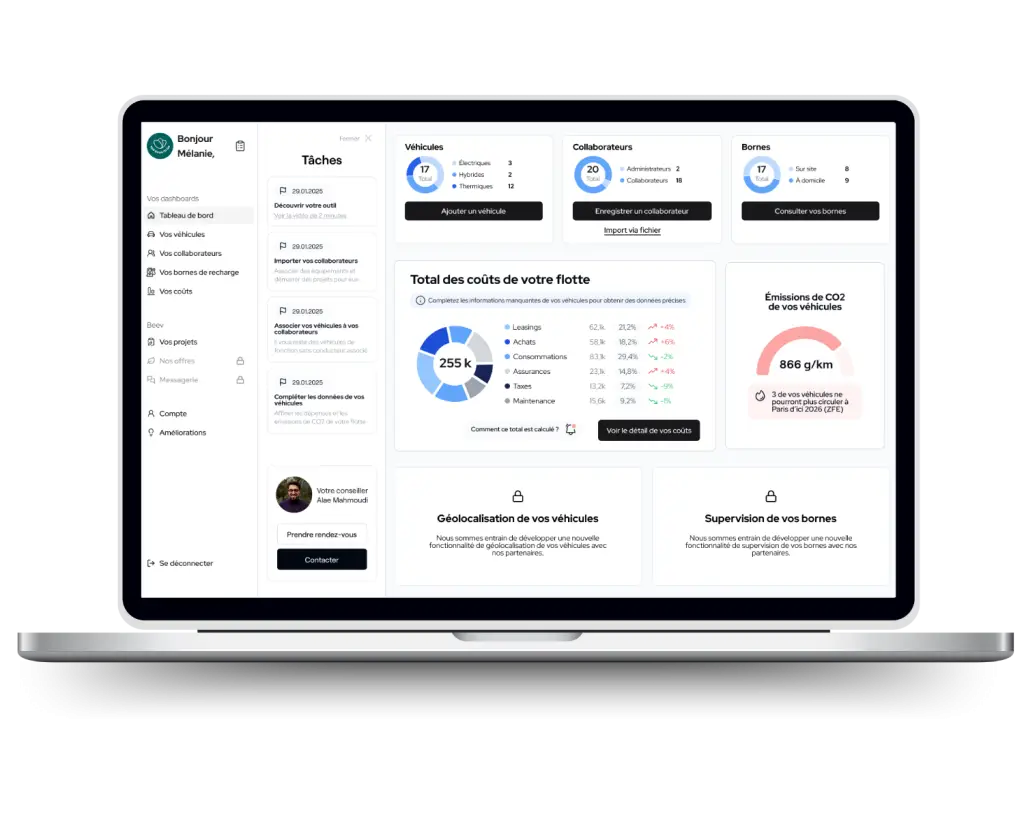

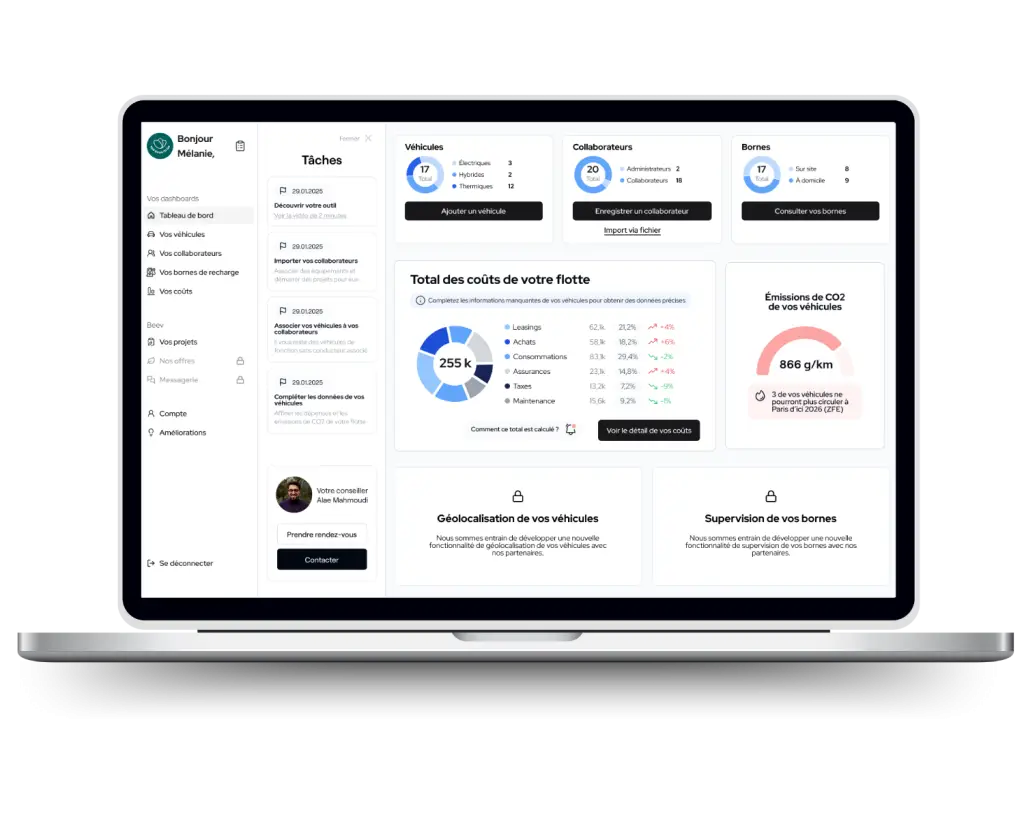

In this context, fleet management and energy management tools, such as Beev's Fleet Manager tool, enable companies to centrally track vehicles, consumption, recharging cycles and associated costs. This consolidated view makes it easier to anticipate needs, optimise TCO and comply with regulatory and reporting requirements.

By combining operational support and management tools, Beev helps companies to structure their electric transition in a sustainable way, from the choice of vehicles to the sizing and operation of recharging infrastructures, while turning regulatory complexity into an operational advantage.

Key points for managers of electric vehicle fleets

The European automotive package confirms that the electrification of fleets is no longer a one-off trend, but a lasting and structuring transformation of the automotive sector. For fleet managers, this is more than just a piece of institutional news; it's a strong strategic signal that redefines the operating conditions for corporate fleets.

Vehicle availability, cost control, recharging infrastructure and regulatory obligations are now closely linked. In this new context, anticipation becomes a decisive lever. Companies that integrate these changes into their fleet strategy today can not only comply with European requirements, but also secure their costs, improve their operational performance and strengthen their environmental credentials.

In the long term, structured, proactive and supported management of electric mobility, from the choice of vehicles to the management of recharging infrastructures, is a real competitive factor for businesses. Companies that see the European automotive package as a strategic opportunity, rather than a regulatory constraint, will be best placed to take advantage of this new situation.

Manage your fleet easily with our dedicated tool

A fleet management tool from A to Z

- Add your fleet and employees in just a few clicks

- Plan your transition to electric vehicles and monitor your CSR objectives in real time

- Centralise your expenses