A major step forward for’autonomy French industry

Before we look at the practical effects on companies and professional vehicle fleets, it is essential to understand what this plant is changing on a macro-industrial scale. The issue of battery autonomy is not just a technical debate: it affects the competitiveness of entire industries, from automotive to logistics, including energy and stationary storage.

For years, Europe has been heavily dependent on cells produced in Asia, both for electric vehicles and for some industrial applications. This means long supply chains, sometimes unpredictable lead times, exposure to price fluctuations and increased vulnerability to geopolitical tensions. In response, France is pursuing a strategy of reindustrialisation, based in particular on the creation of a dedicated cluster: the “Vallée de la battery”For example, in the Hauts-de-France region, where several gigafactory projects are concentrated in the same area, close to major automotive sites and well connected to port and rail infrastructures.

Verkor's Gigafactory is not an isolated element in this scheme, but an essential building block. It aims to anchor the production of low-carbon lithium-ion cells, the technological heart of electric vehicles, in France. This move also responds to another priority: keeping part of the added value in France, rather than letting it go to battery-producing countries.

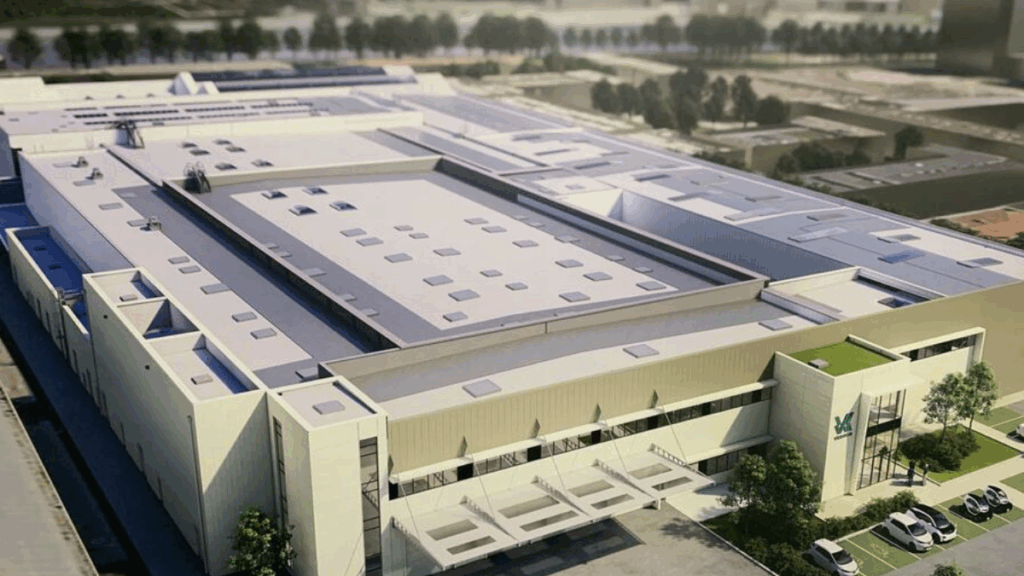

The Verkor gigafactory: a new-generation industrial site

To fully appreciate the potential of this project, we need to look at what the Bourbourg Gigafactory represents in concrete terms: its capacity, its timetable, its technologies, but also its local spin-offs. It is this combination that makes it both an industrial and a local transformation tool.

The official commissioning of the site in mid-December 2025 marks the transition from a construction and installation phase to a gradual industrialisation phase. The aim is not to produce at full capacity overnight, but to ramp up in a controlled manner, validating processes, training teams and stabilising quality.

Commissioning: a decisive step for the French industry

The Gigafactory's start-up represents a decisive step for the French battery industry. Until now, Verkor has had pilot capacities via its innovation centre, but the Bourbourg plant will enable us to move on to industrial scale. The first batteries to come out of this site are intended primarily for the automotive market, with a major partner for the first few years of production, but the medium-term prospects go well beyond this segment alone.

For the industry, this commissioning proves that a project of this scale can succeed in France, despite a demanding competitive environment. It sends out a positive signal to other manufacturers planning to invest in the battery ecosystem, whether in materials, recycling or downstream applications such as stationary storage.

Capacity, timetable and industrial ambition

The Gigafactory is starting out with an initial capacity target of around 16 GWh per year, once the site is fully operational. That's enough to power several hundred thousand electric vehicles every year, depending on the battery pack configurations. A significant proportion of this capacity has already been reserved for a major car manufacturer to power its future electric models, guaranteeing a solid base of demand for the first few years of operation.

But Verkor's ambition does not stop there. The project plans to increase capacity to 50 GWh by 2030, depending on demand and additional investment. At this level, the site would become one of the largest battery production centres in Europe, making a decisive contribution to the continent's energy and industrial sovereignty.

Verkor's approach is also based on a technological positioning focused on low-carbon batteries. The plant is designed to take advantage of highly decarbonised electricity, thanks in particular to the local energy mix and links with the major energy operators, in order to reduce the carbon footprint.’carbon footprint per kWh of battery produced. At a time when product carbon footprints are becoming increasingly important in corporate purchasing decisions, this argument is far from trivial.

A structuring project for the economy and skills

In local terms, the Gigafactory represents an investment of around €1.5 billion and is expected to generate around 1,200 direct jobs, plus several thousand indirect jobs in logistics, subcontracting, industrial services and maintenance.

What sets Verkor apart is that it has anticipated the skills issue from the outset, via its innovation and training centre in Grenoble, a veritable “battery school”, where the technicians, engineers and operators of tomorrow are trained. As a result, Bourbourg's ramp-up is based on a base of expertise that is already in place, limiting the risk of skills shortages - a major challenge for all European gigafactories.

What contribution will this make to French industry and businesses?

How will the Gigafactory change the situation for companies, manufacturers and fleet managers? The main effects are threefold: secure supplies, stable costs and improved global competitiveness.

At a time when global supply chains have been weakened, having local battery production capacity is a strategic advantage. It reduces our dependence on intercontinental flows, gives us greater control over lead times and limits our exposure to disruptions or logistical bottlenecks.

More secure battery supplies

For manufacturers, integrators and, ultimately, professional customers, the presence of a local cell producer means a shorter and better controlled supply chain. Batteries no longer systematically travel thousands of kilometres before being incorporated into vehicles or equipment. This reduction in distance not only helps to reduce lead times, but also improves resilience in the event of an international crisis.

This means that fleet managers and purchasing departments can look at their renewal plans with greater visibility, in the knowledge that part of the production is carried out locally. This does not eliminate all the risks, but it considerably reduces some of them, particularly those linked to maritime logistics or customs tensions.

Towards greater cost predictability

Batteries account for a very large proportion of the price of electric vehicles, and therefore of the overall TCO. When cells are imported, costs are subject to exchange rate fluctuations, customs tariffs, additional transport costs and the volatility of raw materials.

By localising production, France and Europe are seeking to cushion some of these uncertainties. Long-term contracts make it possible to smooth out variations and provide more stable reference points for budget planning. On the scale of a large fleet, this stability can make a significant difference to the trade-off between thermal and electric power.

A competitive advantage for battery-using industries

Companies that rely on electric solutions for their activities, commercial vehicles, handling equipment, robots and storage systems benefit from an overall improvement in their competitiveness. The combination of improved battery availability, a reduced carbon footprint and more predictable costs strengthens their ability to offer high-performance solutions.

For sectors that are highly exposed to ESG requirements, integrating batteries produced locally and using low-carbon energy is becoming a concrete argument in calls for tender and extra-financial reports.

Transformation of the professional vehicles and equipment market

The effects of the Verkor gigafactory do not stop at the major macroeconomic balances: they are being felt very directly in the professional vehicle and equipment market. For fleet managers, industrial directors and general services, the question is no longer whether the transition will take place, but how to support it in a smooth and controlled way.

Corporate fleets are at a turning point: regulations are tightening, low-emission zones are multiplying and end customers are expecting concrete commitments on decarbonisation. At the same time, companies need guarantees on vehicle availability, battery reliability and control of running costs.

Towards greater availability for business vehicle fleets

With an eventual capacity of 16 GWk and a possible extension to 50 GWh, Verkor is providing a structuring response to the growing demand for batteries for electric vehicles. A large proportion of these volumes are destined for models that will be used on a massive scale by businesses: commercial vehicles, company saloons and crossovers, and even specialised vehicles for certain professions.

This ramp-up is helping to reduce the delivery delays that many fleet managers have experienced in recent years. As production stabilises, the gap between the intention to go electric and the operational reality of orders should narrow, making it easier to plan renewal programmes.

A clearer and more convincing TCO

For an electric transition to be accepted by finance departments, the economic evidence must be solid. Lower running costs (energy, maintenance, tax) are already a strong argument in favour of electric vehicles, but uncertainty over the price of batteries and their availability has until now acted as a brake on certain large-scale projects.

Thanks to industrialisation in France, the TCO of electric vehicles is becoming more predictable. Companies can more accurately simulate the profitability of their electrification projects by incorporating more stable cost assumptions and better-documented lifespans. Against this backdrop, our comprehensive support solutions - including TCO studies, renewal scenarios, financing and recharging management - come into their own to help decision-makers move from the business case to practical implementation.

A powerful lever for ESG strategies

Finally, the origin and method of production of batteries are playing an increasingly important role in ESG strategies. The fact that the cells produced at Bourboug come from a low-carbon factory, powered by a largely decarbonised energy mix, means that companies can improve their carbon footprint throughout the value chain.

CSR reports, the European directive on extra-financial reporting and investor requirements are giving increasing weight to these dimensions. By choosing vehicles or equipment incorporating locally produced batteries with a reduced footprint, companies can demonstrate their commitments in ways that go beyond mere rhetoric.

Use the TCO simulator to calculate the total cost of ownership of your car and compare it with its internal combustion equivalent.

A knock-on effect on the recharging and electrification ecosystem

The increase in battery production goes hand in hand with the development of recharging infrastructures. For professional fleets, batteries and IRVEs are now inseparable: electrification requires precise planning of recharging needs at each site. If they don't plan ahead, companies run the risk of incurring additional costs, operational constraints or limited use of their new electric vehicles.

With the rise of players such as Verkor, recharging is becoming a real infrastructure issue that needs to be considered over the long term. Companies need to size their installations, optimise their available power and, where necessary, integrate energy management solutions to guarantee business continuity. In this dynamic, the support of specialists like Beev becomes decisive: understand usage, assess the future growth of fleets, structure the IRVE strategy and securing investment are essential if we are to reap the full benefits of the electricity transition.

Professional electrification is therefore not just about the availability of batteries, but about the ability of organisations to deploy reliable, scalable recharging that is consistent with their industrial ambitions. Beev is at the heart of this new ecosystem, helping companies to move from a one-off equipment approach to a truly integrated energy strategy.

Outlook: a more competitive France in the battery sector

The Verkor gigafactory is just one stage, albeit a spectacular one, in a wider dynamic. Other gigafactory projects are underway or already operational in the Hauts-de-France region, and the “Battery Valley” continues to take shape, even if some competing projects have experienced delays or technological adjustments.

This situation illustrates both the scale of the ambition and the fragility of the industry: it is a capital-intensive sector, highly competitive and subject to rapid cycles of innovation. Against this backdrop, the actual commissioning of the Verkor gigafactory sends out a signal of credibility and stability: France is capable of bringing a project of this scale to fruition, mobilising the necessary funding and rallying an ecosystem of skills around it.

For companies and professionals, the challenge now is to position themselves proactively in this new value chain. This may involve working with industrial partners, investing in storage solutions, gradually integrating electric vehicles into their fleets, or upgrading the skills of their teams in the areas of batteries, recharging and energy management.

In the medium term, a France with several fully operational gigafactories, world-class innovation centres and players specialising in electric mobility and recharging will have a significant advantage on European markets. The combination of local industrial capacity, skills and structured professional demand will accelerate the transition to more sustainable mobility models... while boosting the competitiveness of businesses.

CONCLUSION

With the commissioning of its first battery gigafactory in Bourbourg, Verkor is turning an ambitious industrial project into a tangible reality. For France, it's a decisive step towards greater industrial sovereignty. For businesses, fleet managers and mobility players, it's an opportunity to rely on a local, low-carbon battery industry that's growing in strength.

The transition is no longer just about communication strategies or political announcements: it is taking shape in factories, jobs, logistics flows, supply contracts and deployment plans for electric fleets and recharging infrastructures. In this new landscape, those who anticipate, structure and plan their battery and charging strategy today will be best placed to take advantage of this new industrial situation.

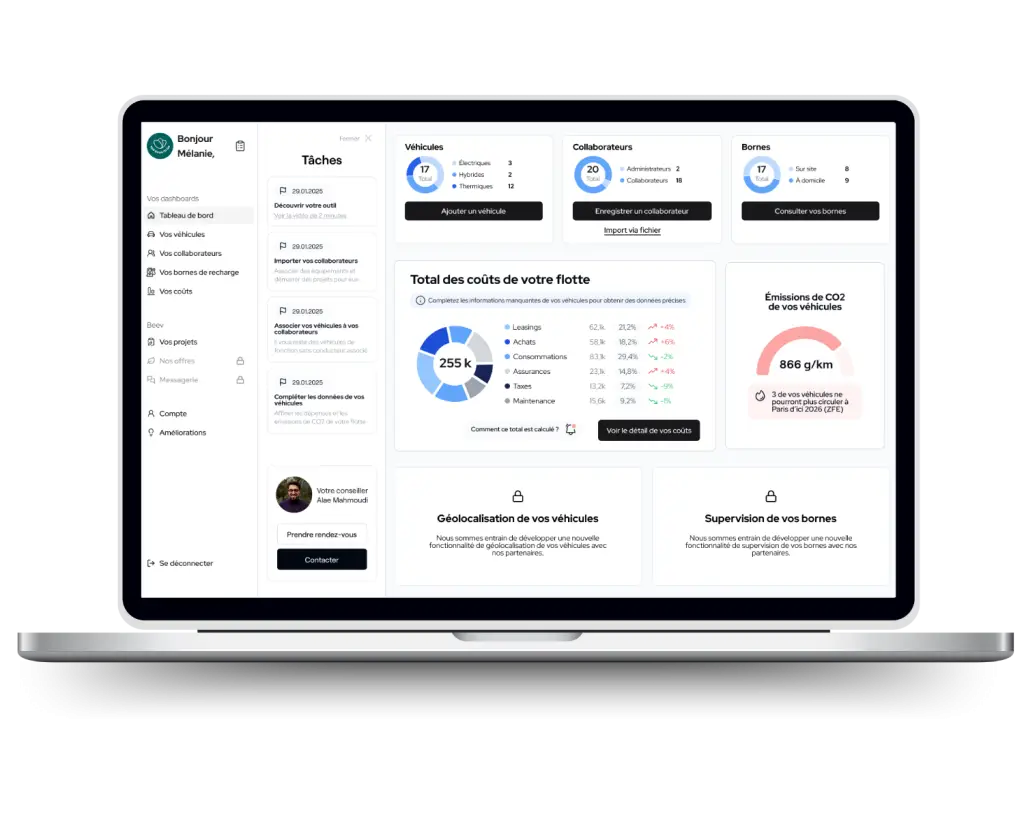

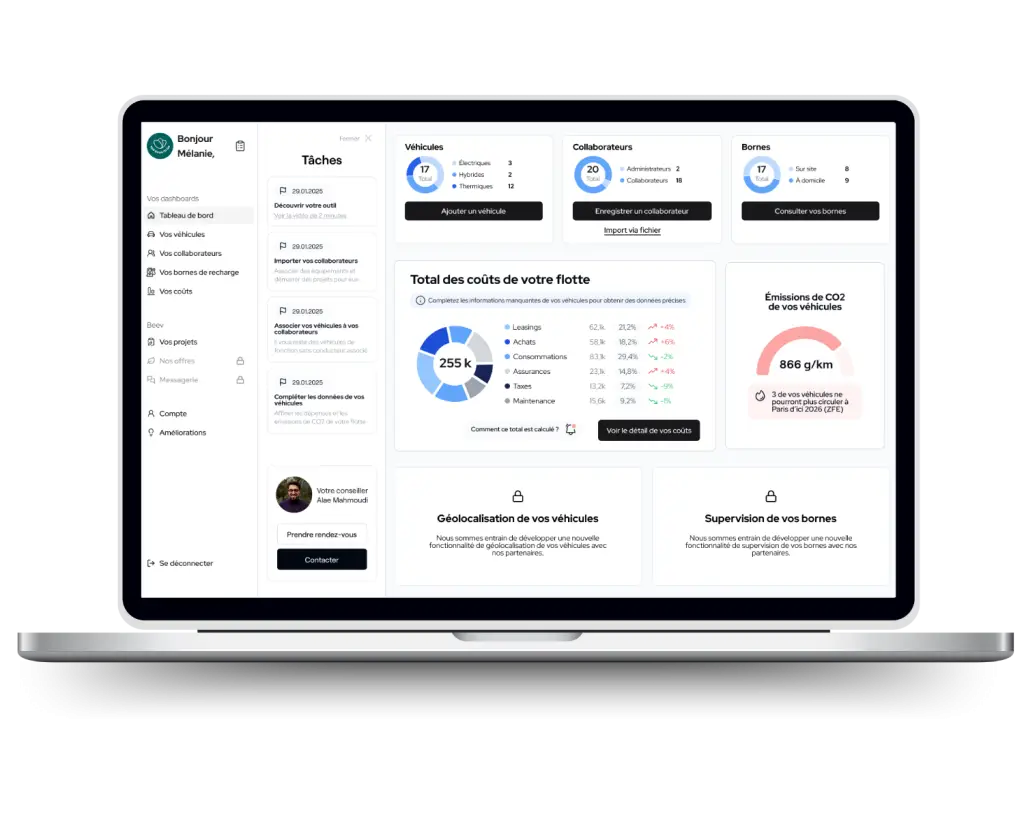

Manage your fleet easily with our dedicated tool

A fleet management tool from A to Z

- Add your fleet and employees in just a few clicks

- Plan your transition to electric vehicles and monitor your CSR objectives in real time

- Centralise your expenses