Monday to Friday 9am - 12.30pm - 2pm - 7pm

Electric car registration document: everything you need to know

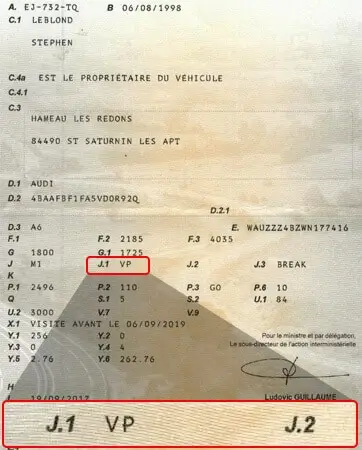

What is a vehicle registration document?

The "carte grise", or registration certificate, is a document that identifies your vehicle. Without it, you are not allowed to drive your vehicle and you could be fined.

The vehicle registration document contains a large amount of useful information, concerning both the owner of the vehicle and the vehicle itself. It includes technical details such as :

- The number of tax horses

- The type of fuel the vehicle accepts if it is a thermal vehicle

- Boot volume

- Total weight of the car

- Etc...

The data displayed on the vehicle itself includes :

- The make of the vehicle

- The model

- The date of registration

- The registration number

- Etc...

Finally, it contains information about the owner of the vehicle:

- Surname/First name

- Address

- If you are an owner or co-owner

- Etc.

Electric car registration document: Where and how to obtain it?

Since 6 November 2017, the creation or renewal of a card can only be done online as part of the New Generation Prefecture Plan ( PPNG ). The aim of this plan is to digitise procedures for secure documents such as passports, identity cards, driving licences, etc.

All the necessary procedures can be carried out on the official website of theNational agency for secure documents.

If you need to register a car, here are the steps to follow:

- Log on to the website of the Agence nationale des titres sécurisés (French secure documents agency)

- Register or log in

- Pay the various taxes and fees (regional tax, transmission tax, ecological tax, management tax, etc.)

- Provide the various documents requested

Once your application has been submitted, you will receive your provisional registration certificate by e-mail. If you wish to drive your vehicle while waiting to receive your vehicle registration document, you must download the receipt which will be sent to you by e-mail.

Once you have registered your application, here are the documents you will need:

- A photocopy of the Proof of address less than 6 months old

- A photocopy of the driving licence of the holder

- A photocopy of insurance certificate of the vehicle

- The original application for a vehicle registration certificate

- The original registration mandate

Now you have all the information you need to purchase your card grey.

How long will it take?

Once you have completed the registration process, your electric vehicle registration document will be sent to you by post.

In general, you will receive your vehicle registration document within a relatively short time. In the meantime, you can drive your vehicle, but you will need to take with you the receipt for your vehicle registration document, which you will receive by e-mail.

You may be stopped, and if this happens you will have to show the officers your receipt.

The formalities for registering the vehicle and putting it on the road must be completed within one month of the date of purchase.

You do not need to renew your vehicle registration document, but only if it has been lost, stolen or damaged, including if any information on the document is illegible.

How much does a vehicle registration document cost?

The cost of registration may vary from region to region. You may be subject to several taxes;

- The regional tax, which corresponds to the number of tax horses (CV) multiplied by the amount of regional tax for a 1 CV.

- Management fee

- Vocational training tax

- Fixed fee (11 euros)

- Tax on polluting vehicles

- Royalty tax

You can also simulate the cost of your vehicle registration certificate right here → registration certificate cost simulator

| Région | Prix par CV | Exonération véhicule propre |

|---|---|---|

|

Ile-de-France

|

46,15 €

|

100 %

|

|

Burgundy-Franche-Comté

|

51,00 €

|

100 %

|

|

Corsica

|

27,00 €

|

100 %

|

|

New Aquitaine

|

41,00 €

|

100 %

|

|

Hauts-de-France

|

33,00 €

|

100 %

|

|

Auvergne-Rhône-Alpes

|

43,00 €

|

100 %

|

|

Normandy

|

35,00 €

|

100 %

|

|

Pays-de-la-Loire

|

48,00 €

|

100 %

|

|

PACA

|

51,20 €

|

100 %

|

|

Great East

|

42,00 €

|

100 %

|

|

Occitania

|

44,00 €

|

100 %

|

|

Brittany

|

51,00 €

|

50 %

|

|

Centre-Val de Loire

|

49,80 €

|

50 %

|

|

Guadeloupe

|

41,00 €

|

0 %

|

|

French Guiana

|

42,50 €

|

0 %

|

|

La Réunion

|

51,00 €

|

0 %

|

|

Martinique

|

30,00 €

|

0 %

|

|

Mayotte

|

30,00 €

|

0 %

|

Electric car registration document: changing the address on your registration document

If you are moving house, or if an event occurs that requires you to change your main address, you should know that it is essential to update your address, including on your vehicle registration document.

It is perfectly possible to change the address on your vehicle registration document. You have one month in which to change the address on your vehicle registration document.

Changing your address is free of charge, and involves affixing a label containing your new address to your vehicle registration document.

If it is the 4th change, a new vehicle registration document is sent, but the cost is €2.76.

Only the holder of the vehicle registration document can make the request.

To change the address on your vehicle registration document, you will need :

- Your vehicle registration document

- Proof of address less than 6 months old (rent, gas bill, water bill, electricity bill, landline or mobile phone bill)

- A valid identity document

Company car registration document

A company car is a vehicle made available by the company to its employees on a permanent basis. It is owned by the employee both during and outside working hours.

For the service carIn the case of a taxi, for example, it is consumed by the professional only during working hours.

Note that even if the car is allocated to the employee, it still belongs to the company and it is the company's name that appears on the vehicle registration document.

A company or service vehicle has a PC or PC derivative vehicle registration document.

A passenger car is a vehicle that is defined as a private vehicle. It is the most commonly used type of vehicle.

The MPV is also a private vehicle, with the difference that it can be transformed into a commercial vehicle when used for business purposes.

It should also be noted that the vehicle must be the responsibility of the company, and all costs relating to its maintenance must be paid for by the company. However, there is an exception for cars leased under a long-term leasing contract.

With this type of contract, the leasing company is responsible for the registration costs.

If you are an employer, you should know that you benefit from financial 'relief' when buying a vehicle for your company.

To go further → Should you buy an electric car as an individual or as a company?

Discover several models of electric vehicles that can be delivered quickly!

The advantages of an electric car registration document

If you've bought a clean vehicle, you'll also benefit from advantages on your vehicle registration document! The registration document for an electric car is exempt from regional tax, or it can be subject to a rebate on this tax as well as on the fixed tax. In short, with an electric vehicle registration document, you pay only the licence fee and the management tax. That comes to just under €10.

Once again, this system has been introduced by the government to encourage the purchase of electric vehicles.

To go further → Taxation of electric vehicles

Existing aid

We often talk about this at Beev, and there are a number of grants available when you buy an electric vehicle.

In addition to this tax rebate or exemption, which applies to the registration document for your electric car, there are other existing forms of support, such as the ecological bonus and the conversion premium.

The ecological bonus

| Catégories | Depuis le 1er juillet 2021 | À partir du 1er janvier 2023 |

|---|---|---|

|

Electric vehicles (CO2 ⩽ 20g/km) costing less than €47,000

|

27 % of the price up to €6,000

|

27 % of the price up to €5,000

|

|

Electric vehicles (CO2 ⩽ 20g/km) costing less than €47,000 (legal entity)

|

27 % of the price up to €4,000

|

27 % of the price up to €3,000

|

|

Electric vehicles (CO2 ⩽ 20g/km) from €47,000 to €60,000

|

2 000 €

|

1 000 €

|

|

Electric vans or hydrogen-powered vehicles (CO2 content ⩽ 20g/km) over €60,000

|

2 000 €

|

1 000 €

|

|

Plug-in hybrid vehicle (CO2 levels between 21 and 50 g/km) of up to €50,000 and autonomy > 50 km

|

1 000 €

|

0 €

|

The conversion premium

| Prime à la conversion | Véhicule électrique neuf | Véhicule électrique d'occasion |

|---|---|---|

|

Companies (VP)

|

2 500 €

|

2 500 €

|

|

Reference tax income exceeds €18,000 per unit

|

2 500 €

|

2 500 €

|

|

Reference tax income is less than €18,000 per unit

|

5 000 €

|

5 000 €

|

To find out more: Ecological bonus 2023: everything you need to know

You can find all the information you need about government grants on the various government websites:

Ecological bonus for electric vehicles

Electric vehicle conversion bonus

If you have any further questions, please don't hesitate to contact us!