PLF 2026: what MEPs have really changed about the malus CO₂

Le FMP 2026 initially envisaged a sharp acceleration in the CO₂ malus, leading to massive increases on internal combustion vehicles, from the first grams of CO₂.

This trajectory was in line with the steady tightening observed since 2018: lower thresholds, higher tax rates, higher taxation.

However, the suddenness of the proposed increase has triggered a wave of opposition from individuals, businesses, long-term hire companies and trade associations.

Why the initial increase in the 2026 malus was explosive for businesses

When the first version of the PLF was unveiled, market players immediately warned of the direct consequences that a too rapid increase in the malus would have for companies. The initial scale provided for’lower the tax threshold by several grams, making virtually all internal combustion models taxable, including engines that are considered “reasonable”.

Hire companies were quick to point out that such a tougher stance would have a domino effect: higher rents from the moment the contract was signed, higher rents in the course of the contract as a result of revisions, falling residual values, greater volatility in return schedules and, contractually, a massive impact on the total cost of ownership of combustion-powered fleets.

For their part, trade associations feared a contraction in the market, particularly for light commercial vehicles and company cars, which are still largely combustion-powered. Companies would then have been forced to reduce their purchasing volumes or extend existing contracts, exacerbating the obsolescence of the fleet, which was already causing problems in terms of maintenance and fuel consumption.

Faced with this combination of economic and operational risks, MEPs were forced to adjust the text.

The rollback voted through the House: temporary relief or real correction?

This adjustment voted by the House mitigates the increase initially planned, This does not call into question the general trend towards a tougher stance.

However, the MEPs have neither frozen the trajectory, nor suspended the logic of gradually lowering the thresholds, nor questioned the very principle of an annual tightening.

The adjustment voted for is therefore not a change of course, but rather a shock absorber designed to prevent the car market from rising too sharply. The malus continues to rise: just less quickly than expected.

The political and economic reasons for this partial U-turn

This partial reversal can be explained by a complex political context. After several successive increases since 2018, the CO₂ malus has reached a very high level, now affecting the majority of internal combustion vehicles, including those intended for fleets. Further acceleration would have risked fuelling a tense social climate.

MEPs were also sensitive to the economic arguments: a still-fragile car market, manufacturers forced to manage a costly transition, leasing companies faced with the risk of accelerated depreciation of combustion models, and companies already under pressure to adapt.

In a nutshell This step backwards was motivated by the urgent need to avoid a rupture, not by a renunciation of the climate trajectory set for 2030 and 2035.

Why the announced reduction in the CO₂ penalty is only a respite for fleets

On the face of it, the softening seems positive. But for fleets, what some interpret as good news is really just a technical pause.

The carbon trajectory (SNBC) remains unchanged and imposes an automatic tightening of the rules

France is committed to the National Low-Carbon Strategy (SNBC), which requires a drastic reduction in transport-related emissions. The CO₂ penalty remains one of the instruments of this strategy: its increases are programmed to achieve the European objectives.

As manufacturers will have to reduce the average emissions of their sales, the government cannot afford to relax taxation for long. In practice, this means that even with a one-off :

- the thresholds will continue to be lowered each year; ;

- bearings will continue to be more and more expensive; ;

- the proportion of internal combustion vehicles eligible for the malus will automatically increase.

What the MEPs have offered is not a U-turn, but simply a temporary softening.

Future thermal tax increases already scheduled for 2026-2030

The 2026 to 2030 will see the arrival of other increases already written into the legislation. Emissions standards for light commercial vehicles will be tightened, the SVAT will continue to rise for internal combustion engines, and the weight-based penalty will affect more models. At the same time, the advantages granted to non-rechargeable hybrids will disappear, the EPZs will be tightened up and fuel will become more expensive as a result of the ETS2 carbon market.

Anticipated impact on the internal combustion engine fleet: VR, LLD, TVS, weight-based malus, etc.

Combustion-powered fleets will be the first to be exposed:

- The value of internal combustion vehicles will continue to depreciate, which will have an automatic impact on leasing and return costs; ;

- Thermal TVS will automatically increase according to emissions; ;

- heavy models will suffer a double impact: CO₂ plus weight; ;

- EPZ restrictions will progressively exclude entire activity zones; ;

- fuel costs will remain volatile, and even increase with ETS2.

The internal combustion engine fleet is therefore becoming an increasingly exposed asset. Even with a temporary reduction in the malus, the tax trajectory remains clearly upwards.

Impact 2026: the immediate consequences for companies and their fleets

Beyond political communication, Fleet managers must anticipate the tangible effects from 2026.

Delaying renewals: a major financial risk

Some companies are considering extending the life of their internal combustion vehicles in the hope of “saving time”. But precisely the opposite is happening:

- thermal residual values are falling faster than expected; ;

- future long-term leasing rentals include scheduled increases; ;

- maintenance costs soar after 4 years; ;

- The EPZs make certain areas inaccessible, forcing people to make costly bypasses; ;

- and insurance costs are rising on older vehicles.

Postponement creates a scissors effect: rising costs plus increased restrictions.

Gradual explosion in thermal TCO from 2026

From 2026, several components of the TCO of internal combustion vehicles will increase simultaneously, creating a cumulative effect that will be difficult for companies to absorb. The cost of fuel will remain particularly unstable, under the combined effect of the ETS2 carbon market and persistent volatility in oil prices. This structural rise will come on top of the gradual increase in the TVS, which automatically follows the tightening of emissions thresholds planned for the coming years.

Maintenance will also be more onerous. Vehicles that are kept for too long age less well, require more servicing and use parts whose cost increases every year. Leasing companies are also anticipating the impact of new tax rules on residual values. Lease payments under long-term leasing will gradually include a proportion of the malus, even though the 2026 scale has been reduced, which will lead to a mechanical increase in lease payments for internal combustion models.

Added to this is the accelerating deterioration in the residual values of combustion models. The tighter the regulatory thresholds, the more petrol and diesel versions lose value at the end of their contract. For finance departments and fleet managers alike, the diagnosis is clear: the CO₂ malus is just the tip of the thermal tax iceberg. All the indicators point to a structural increase in the cost of use from 2026 and even more so by 2027-2030.

Increased pressure on car policies and mobility budgets

The adjustment to the PLF 2026 will force many companies to review their car policy sooner than expected. Emissions thresholds will have to be tightened, certain categories, particularly combustion-powered SUVs, will become more difficult to maintain, and staff envelopes will have to be readjusted because of rising acquisition and running costs.

To stay within budget, some organisations will have to reduce the variety of models, increase the use of pool vehicles or encourage alternative forms of mobility.

In this context, the transition to electric vehicles is no longer just an environmental choice: it is becoming an economic imperative. The costs of combustion-powered vehicles are rising rapidly, while electric vehicles offer more stable taxation and better compliance with future regulations. For fleets, switching to electric vehicles is therefore becoming the safest strategy for protecting mobility budgets.

The real signal to fleet managers: prepare for the post-thermal era

Behind the voted relief lies a very clear message: thermal energy is fiscally condemned, and companies need to reduce their exposure.

Securing costs before future tax increases

Companies that are rapidly electrifying their fleets :

- stabilise their TCO over 36 to 60 months; ;

- avoid the cumulative effect of these increases on thermals; ;

- secure RVs on EVs (which are much more stable);

- improve their CSR scores at no extra cost.

The 2025-2026 window is an opportunity.

Reducing exposure to heavy internal combustion engines and hybrids

Thermal models, but also non-rechargeable hybrids and heavy-duty hybrids, will see their taxation tightened.

It is becoming strategic to gradually reduce :

- the petrol component,

- the diesel share,

- the single hybrid share.

The aim is not to electrify everything overnight, but to avoid increasing the financial risk.

Focus on stable electric models that are available and have a good eco-score.

By 2025, the electric vehicle market will have matured: prices will have stabilised, residual values will have increased, performance will have improved and the number of electric vehicles will have fallen.’autonomy covers the majority of professional uses. The widespread use of the CCS standard simplifies recharging, further improving operational continuity for teams in the field.

For fleets in this context, the transition to electric vehicles is no longer just an environmental choice: it is becoming an economic imperative. These vehicles have easier access to public subsidies, have a more controlled TCO and offer sustainable compliance with future regulations.

Use the TCO simulator to calculate the total cost of ownership of your car and compare it with its internal combustion equivalent.

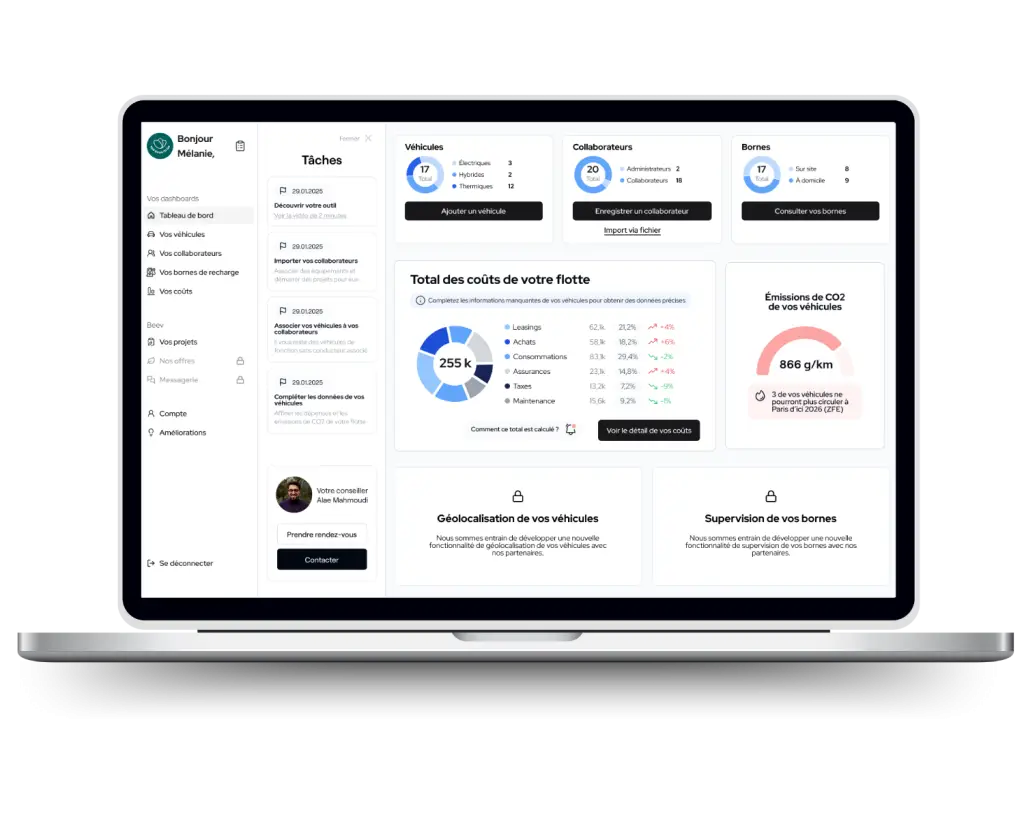

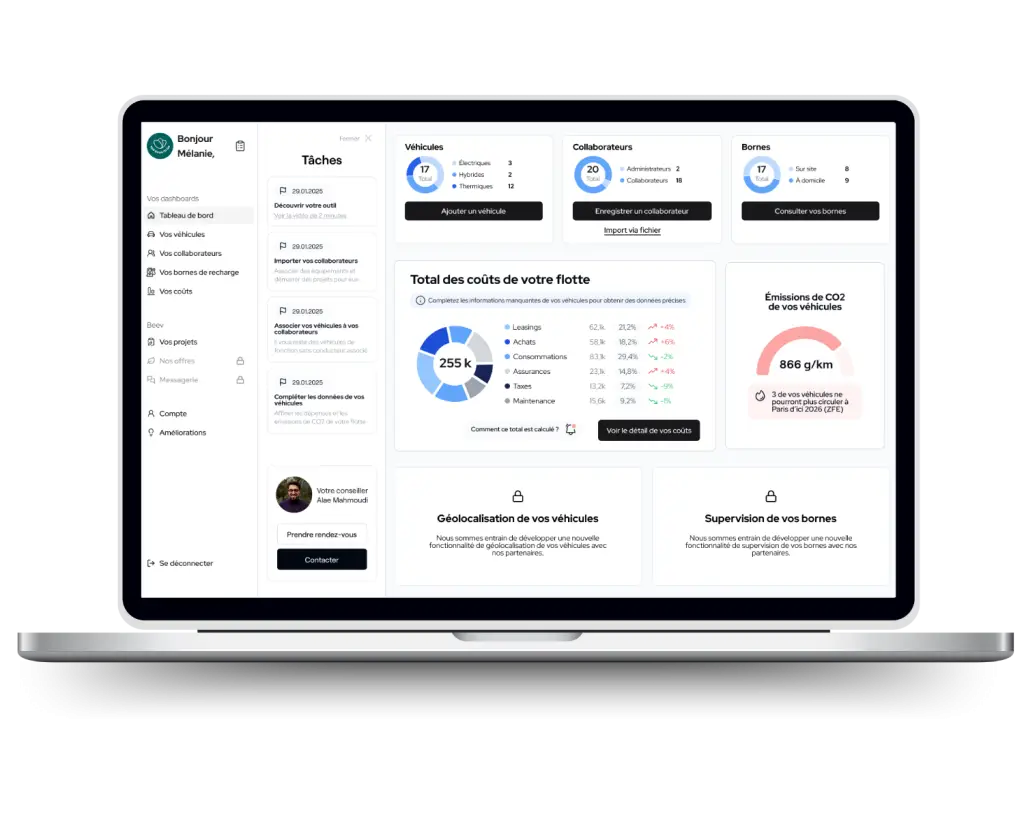

How Beev helps companies anticipate the malus and optimise their TCO

Beev provides comprehensive support to absorb future increases and optimise acquisition decisions.

Full TCO audit: thermal vs electric (2025-2030)

Beev analysis:

- the actual cost of the thermals over 6 years,

- the total cost of comparable electric models,

- the combined effects of malus, TVS, fuel, maintenance and VR,

- and budget forecasts based on several scenarios.

The aim: to determine the most profitable trajectory for the fleet.

Tax simulation (malus, TVS, bonus, AEV, ZFE)

Each company benefits from a precise tax projection:

- impact of the 2026-2030 malus,

- changes in TVS,

- company environmental bonus,

- EPZ constraints by city,

- impact of the weight penalty.

Decisions are taken on the basis of figures, not suppositions.

Support for car policy: rules, thresholds, environmental scoring

Beev helps to structure or update the car policy:

- CO₂ criteria and segment thresholds,

- real autonomy requirements,

- intensive use management,

- integration of the eco-score,

- optimised budget allocation.

A modern car policy reduces tax risk while improving employee satisfaction.

Selection of EVs adapted to business uses and optimisation of long-term leases

Beev offers a totally neutral multi-brand selection:

- regional trade,

- peri-urban technicians,

- delivery drivers,

- pool-cars,

- multi-agency.

Each vehicle is selected on the basis of actual use, availability and total cost.

Worth remembering: a softened malus, but thermal taxes still doomed

The reduction in the CO₂ malus in 2026 does not mark a change in strategy, but a one-off adjustment to avoid too sudden a shock.

The basic trajectory remains unchanged: thermal taxation will continue to increase over the next few years.

Companies should bear in mind three key points:

- The malus is being reduced slightly, but thermal taxes are set to increase.

- Delaying the transition is more expensive than speeding it up.

- Companies that take action in 2025-2026 secure their TCO and limit their risks.

The others will have to absorb the increases at each renewal, with a much heavier budgetary impact.

Manage your fleet easily with our dedicated tool

A fleet management tool from A to Z

- Add your fleet and employees in just a few clicks

- Plan your transition to electric vehicles and monitor your CSR objectives in real time

- Centralise your expenses