Discover several models of electric vehicles that can be delivered quickly!

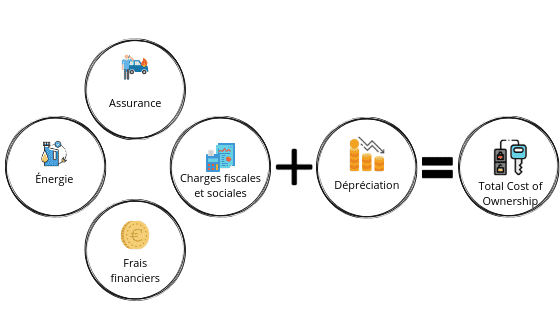

TCO (Total cost of ownership): definition

Le TCO (Total cost of ownership) represents the total cost of an asset.

The TCO (Total cost of ownership) has beeninvented in 1987 by the American consulting firm Gartner Groupwith the aim of reducing their customers' IT bills. The aim was to put a figure on the cost of IT equipment and try to reduce it.

In the case of fleets Total cost of ownership (TCO) is an estimate of the total cost of owning a car over a five-year period. It includes all expenditure on fuel, insurance, maintenance, repairs, services and interest on the payment, as well as the losses incurred in depreciating the vehicle at the end of the same period.

How do you calculate your TCO (Total cost of ownership)?

Accurately calculating the total cost of ownership can help a company determine when it needs to replace the vehicles in its fleet or consider the transition to leased vehicles. It is important to measure TCO carefully, as a misleading calculation can give a false picture of the cost of your assets and lead to biased financial decisions.

In this article, we will calculate the TCO (Total Cost of Ownership), taking into account the following parameters:

- Capital

- Fuel costs

- Maintenance, assistance and insurance

- Administrative costs and taxes

- Impairment

Depreciation: Approximately 40% of TCO (Total cost of ownership)

The value of your asset decreases over time as it wears and deteriorates. Companies often calculate depreciation on the assumption that it will be valued at 0 $ at the end of its expected useful life. As a general rule, however, assets can be valued at 20 % of their purchase price after five to six years of useful life and 10 % of their purchase price after ten years.

When buying new assets, consider buying those with a lower depreciation rate so that they retain a higher residual value in the future once you're ready to sell.

Don't forget incorporate the registration and administration costs of your vehicle into your TCO (Total Cost of Ownership) calculation. These costs can vary from fleet to fleet. Take careful account of all associated costs in your calculations.

Fuel: Approximately 20% of TCO (Total cost of ownership)

The cost of fuel is generally the second biggest expense in the operation of a company. vehicle fleet. How to limit your fuel costs is a subject in itself. This cost depends on a number of environmental and human factors:

- Petrol and diesel prices

- The condition of cars and vans

- How drivers drive them.

The choice of engine - diesel, petrol, electric or hybrid - is fundamental to optimising your costs. Commercial vehicles, for example, are largely dominated by diesel, because they often make long journeys. Smaller cars that do less driving will run on petrol.

Good to know: under-inflated tyres can consume up to 15 % more fuel. Make sure you keep a constant eye on them.

You can better control fuel costs by choosing to refuel at pre-selected service stations, or track the fuel expenditure of each vehicle over time to optimise these costs.

Beev's advice

- Choose vehicles with low CO2 emissions and low fuel consumption

- Measure your fuel consumption and look for solutions that have an impact on costs.

- Think about driver training

- Keep tyres inflated and vehicles in good running order

Insurance: Approximately 10%-15% of TCO (Total cost of ownership)

Obviously, cars and vans with a good insurance rating will cost less to insure overall.

So if you take out comprehensive insurance for your entire fleet vs. specific insurance for each vehicle helps you save money.

Insurers have specific insurance policies for car fleets. But before you choose an insurance policy, you need to know what the risks are: for example, if you choose an electric vehicle, you will need comprehensive insurance rather than traditional insurance.

In order to assess the risks associated with your vehicle fleet, you need to analyse your claims history and, based on the results, evaluate the areas for optimisation.

You can also integrate vehicle telematics into your fleet. What is telematics? It's a fleet management solution: drivers benefit from an intelligent, operational dashboard, and managers can exploit valuable data to help them make better management decisions.

Beev's advice

- Compare offers from all insurers to find the best deal

- Carry out an audit to find out which types of vehicle cost you the most

- Choose vehicles with low insurance rates

READ ALSO -Electric car insurance: a guide to making the right choice

Capital

It's the initial investment and it's the most neglected parameter, especially among SMEs that buy their vehicles in cash. Just because you buy the vehicle for cash without taking out a loan doesn't mean you shouldn't include it in your calculation. In fact, committing such large sums means losing out on investment opportunities and cash flow control.

A distinction must also be made between two cases:

- Large fleets

- Small fleets

The larger the company and the larger its fleet, the greater its negotiating power with the dealer. This gives them better economies of scale, and they can even negotiate for additional services to be included.

These à la carte contracts are less common for small businesses. fleets who have an interest in optimising their TCO (Total Cost of Ownership) and ensuring that the resale of their vehicle is commensurate with their investment.

Vehicle maintenance: Approximately 5%-10% of the TCO (Total cost of ownership)

The cost of maintaining a vehicle or asset increases over its lifetime. And these costs increase exponentially as the asset ages. The price of maintenance paid in year 7 is much higher than that paid in year 1.

Maintenance and repair costs can have a significant impact on the cost of ownership and monthly lease payments.

What you can do is compare the offers made by car hire companies. These companies have a great deal of expertise in the vehicles they hire, and looking at what they offer will give you an idea of the price you'll have to spend on a vehicle.

For example, if two vehicles that sell for the same cash price do not have the same leasing rate with a leasing company, you will know that the vehicle with the higher leasing rate costs more to maintain.

Beev's advice

- Consider all-inclusive packages from rental companies

- If you're buying the car yourself, choose a garage you can trust to get the best prices.

TCO calculations also include other costs, such as interest if you have chosen a bank loan, management fees or outsourcing costs. These costs vary from company to company and should be added to your calculation.

Use the TCO simulator to calculate the total cost of ownership of your car and compare it with its internal combustion equivalent.

How can the electric car impact your TCO (Total cost of ownership)?

Summing up what we have seen above and what we know about the electric car, we can draw a few conclusions.

Let's take the example of an SME that needs a light commercial vehicle. Most vans in France run on diesel, so let's compare the two engines.

Diesel van | Electric van | |

Initial investment | ➕ | ➕➕ |

Insurance | ➕ | ➕➕ |

Maintenance | ➕➕➕ | ➕ |

Administrative costs and taxes | ➕➕➕ | ➕ |

Impairment | ➖➖➖ | ➖ |

An electric commercial vehicle will cost you more than a diesel one, but given the current economic climate, you can save more by switching to a cleaner vehicle. It will be more cost-effective in terms of fuel and will be tax-efficient. Finally, a diesel commercial vehicle will no longer be able to sell on the second-hand market, whereas electric vehicles are selling much better than expected.

Another important aspect of the electric vehicle is its very advantageous tax treatment compared to a conventional car. thermal vehicleIf you would like to find out more about amortisation, the tax on the use of passenger vehicles for economic purposes (taxes on company vehicles) etc., read our article on the subject.

READ ALSO -Should you switch to an electric commercial vehicle?

In a nutshell

Choosing the right vehicles when running a company is vital. It's also a strategic issue when you consider the costs associated with vehicles. By optimising your TCO (Total Cost of Ownership) and choosing the right vehicles, you can free up significant sums for reinvestment in your company's growth.

For more information, we've put together a guide to this topic to explore the different aspects in depth:

Read our article about :

You would like toto electric?

Beev offers multi-brand 100% electric vehicles at the best prices, as well as recharging solutions.