Lower tax benefits for internal combustion company cars?

A recent study by T&E highlighted the need to reduce the tax benefits associated with internal combustion company carssuch as those powered by petrol and diesel, marks a A significant turning point in sustainable mobility policy. Indeed, these company cars account for a large proportion of the French car fleetThere will be more than 2.1 million company cars in circulation by the end of 2023, including around 1.1 million with combustion or hybrid engines.

💡As a reminder A company car is permanently provided to the employee, with no obligation to return it on leaving the workplace. This vehicle can be used both in the professional environment than for private transportoutside working hours.

That said, a proposal to revise the tax rules applicable to internal combustion-powered company cars is currently under consideration.

This would be a reform aimed at reducing the benefits in kind associated with these polluting vehicles. There is talk of a possible switch from increase the cost of the vehicle from the current 30% to 50%This would considerably increase the bill for companies and employees.

4 billion in lost revenue for the State and Social Security

In fact, the government has highlighted the considerable tax advantages that have enabled these vehicles to benefit from tax cuts anddepreciation. At present, theStatus (with reductions in income and corporation tax) and the Social Security (through the reduction in employee and employer contributions) will lose almost 4 billion euros every year (3.96 billion) as a result of these tax breaks, according to Transport & Environment.

The NGO takes the example of the BMW X3 thermal, which benefits from a estimated annual tax benefit of €23,600a 4 times the subsidy for a social lease which extends over 3 years.

By way of comparison, this is equivalent to almost 40 % of the savings targeted by the government with the pension reform (€10.3 billion in 2027) or the subsidising of half a million social leasing of electric cars.

Transport & Environment, NGOs

For the NGO, the tax regime applicable to internal combustion and hybrid company cars :

- alters the tax signal,

- and is not encouraging French companies to make a rapid transition to electric vehicles.

As a result, from 2025 onwards, the revision of the scales of benefits in kind for internal combustion vehicles should generate a significant increase in the taxable portionmaking these polluting vehicles less attractive to companies. According to estimates, this measure could bring in up to 4 billion euros for the Stateand encouraging companies to turn to more environmentally friendly alternatives, such as electric cars.

A decision focused on speeding up the greening of company fleets

This measure is part of a wider policy aimed at greening the car fleets of French companiesfor thea ban on the sale of new polluting vehicles from 2035 as well as requirements CAFE standards.

The objective is clear: to encourage companies to renew their car fleets by opting for cleaner vehicles.

What's more, company cars play a crucial role in the ecological transition of the national car fleet: rapidly integrated into the second-hand market, they offer French people in the middle and lower classes the chance to buy a new car. the possibility of acquiring more affordable electric models.

💡Did you know ? 85 % of French people prefer to buy second-hand vehicles rather than new models.

A financial impact for companies and employees

As previously stated, if this reform materialises, it will have an impact on both companies and employees receiving this benefit in kind.

In practice, combustion-powered company cars are subject to :

- to theincome tax,

- as well as employer and social security contributions.

However, only the portion corresponding to private use is subject to taxation. This personal use can be assessed either :

- via a package,

- or real way.

But that's not all! Another tax measure will have a direct impact on business costs: thenon-deductible depreciation of passenger vehicles in 2025. This change could considerably change companies' interest in internal combustion vehiclesby making their cost less advantageous from a tax point of view. To find out more about how this reform will affect your fleet choices, read our detailed article here.

See also our article :

As a result, it is this flat-rate valuation method that is attracting Matignon's attention.

As a reminder, employees who have a company car may use it for both business and personal travel. The private use of these vehicles is subject to a specific tax regimedescribed by Transport & Environment as "a genuinetax and social niche".

In other words, the State believes that the most company cars are used mainly for personal journeys. Indeed, 65 % of the kilometres travelled by these vehicles would be done privatelyThis is double the 30 % currently used for tax purposes, hence the aim of increasing this threshold to 50 % of rental income.

This could go a long way towards explaining the reluctance of French companies to make the transition to electric vehicles in their fleets and to comply with the European directive on electric vehicles. LOM Act.

To consult : Ecological transition: 60 % of the 3,447 French companies concerned do not comply with the LOM law

The accommodating tax regime for company cars and hybrids is tantamount to an indirect subsidy for fossil fuels.

T&E, NGOS

As it is difficult to establish precisely the proportion of private and professional use of the vehicle, a 2002 decree established a flat-rate tax scale:

- For a company-acquired vehicle 9 % if the fuel is not paid for by the company, and 12 % if the fuel is paid for by the company.

- For a vehicle leased by the company (in professional leasing) 30 % when fuel is not included, and 40 % if it is.

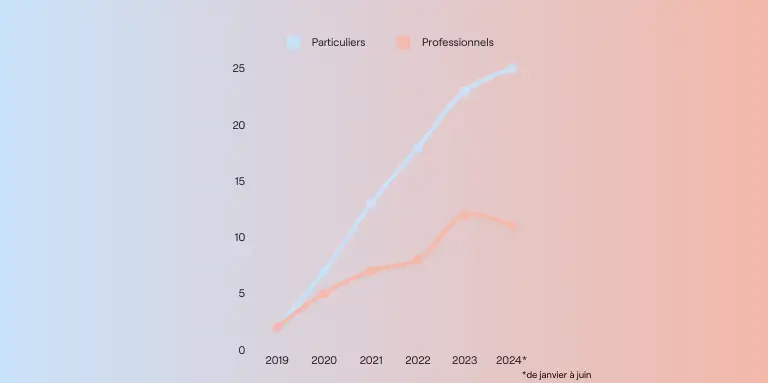

By way of example, 11 % of new company vehicles were electric in the first half of 2024, while 25 % of new cars registered by households were, thanks in part to social leasing.

Read more : An electric car for €100 a month?

For greater clarity, here is a graph showing the annual growth in registrations of electric cars (expressed as a percentage) by professional and private customers.

It should also be noted that the The rate of electrification of company vehicles in France remains well below that of its European neighbours. In the first half of 2024, it stood at 11 %, while it reached 35 % in Belgium and Denmarkand up to 75 % in Norway.

How is it done? In Belgium, the government has abolished the tax deductibility of company cars. In other words, their costs are no longer deductible from corporation tax. Similarly, in the United Kingdom, the benefit in kind has been modulated by the government. the most polluting vehicles are now subject to increased taxation.

To encourage the ecological transition of fleets, the NGO recommends a tax reform affecting both companies and employees:

- "Double the fixed rates used to assess the benefit in kind for the private use of company cars, while retaining the reduction currently available for electric models.".

- "Reduce the opportunities for employers to deduct part of the cost of acquiring fossil-fuelled company cars from their corporation tax, until this option is completely abolished in 2029.".

This initiative will therefore increase the pressure to speed up the ecological transition of business parks.

What are the benefits in kind for company electric vehicles?

Faced with increasing tax restrictions, electric vehicles are becoming an increasingly attractive alternative. What exactly are the benefits in kind available to employees in terms of company cars? The time has come to go electric and take advantage of its many financial and ecological benefits!

For a 360° view of the subject, see : Taxation of electric cars in the workplace: the essential guide

A specific calculation of the benefit in kind

To encourage companies to electrify their fleets, a special scheme now applies to electric vehicles when calculating benefits in kind.

From 1 January 2020 to 31 December 2024, when an employer makes a fully electric vehicle available to an employee :

- The electricity costs borne by the employer for recharging the vehicle are excluded from the calculation of the benefit in kind.

- A allowance of 50 % is applied to the benefit in kind, with a ceiling set at €1,800 per year.

Employer to pay for purchase and installation of recharging point

Until 31 December 2024, if you provide your employees at their place of work with a charging point, lbenefit in kind resulting from its use for personal purposes is valued at €0 (including electricity costs). Please note that this benefit will not be renewable for 2025.

If the terminal is installed outside the workplace, employers can cover all or part of the costs associated with :

- its purchase,

- its rental,

- its installation,

- and its use.

For example, if the employer covers all or part of the cost of acquiring and installing the terminal, the benefit in kind is :

- 0 € if the provision of the terminal ends with the contract.

- 50 % the actual expenses that the employee would have incurred in acquiring and installing the equipment

- in the limit of €1,000.

- 75 % the actual expenses that the employee would have incurred in acquiring and installing the equipment

- in the limit of €1,500 if the recharging solution is more than 5 years old.

On the other hand, if the employer covers all or part of the other costs associated with the use of the recharging point or the hire contract, 50 % of the amount of actual expenses that the employee should have incurred (excluding electricity costs).

Attractive mileage allowances

When an employee uses his or her private vehicle for business purposes, he or she is entitled to mileage allowances. These are determined according to a scale established by the tax authorities.

From the beginning of 2021, when employees use a fully electric personal vehicle, these allowances are increased by 20 % in relation to this scale.

As a reminder, the calculation of the amount of allowances and the deduction of transport costs are based on 2 main parameters:

- The administrative or fiscal power of the vehicle

- The more powerful the vehicle, the higher the employee's mileage expenses.

- The distance travelled during the year

- The government's scale offers a sliding scale of charges per kilometre for heavy drivers.

Conclusion

By reducing these benefits in kind, theState encourages companies to re-evaluate their fleets and opt for electric vehiclesThis is not only to meet regulatory requirements, but also to make substantial savings. This initiative goes beyond a simple tax change: it translates into a real commitment to decarbonising the transport sector.

Electric vehicles are not only an environmentally-friendly alternative, they also offer undeniable financial benefits for both companies and employees.

For those who want to learn more about the transition to electric vehicles, Beev is here to support you through this transition. As your specialist in electric mobilityWe offer tailor-made solutions to electrify your fleet:

- Choice of vehicle Our electric car experts will help you select the models best suited to your needs and budget.

- Installation of charging stations Our recharging point experts will install recharging points on your site, giving you a turnkey service.

- Monitoring and managing your fleet : Our Fleet manager allows you to monitor the use of your vehicles in real time and optimise their management.