The emergence of French electric battery industries

At the heart of the Hauts-de-France region, a veritable "valley of the battery"is taking shape, ushering in a new era for the French automotive industry.

4 major players set to transform the electromobility landscape in France. The latter are counting on propel the country to the forefront of the innovation race in the field of electric vehicles. With huge investments and cutting-edge technologiesThese companies promise not only to reduce dependence on Asian importsbut also create thousands of jobs and position France as a European leader.

ACC: the French pioneer in electric batteries

Automotive Cells Company (ACC), a joint venture founded in 2020is the result of a strategic collaboration between 3 industrial giants :

- Stellantis,

- Mercedes-Benz,

- and TotalEnergies (via its subsidiary Saft).

See also our article :

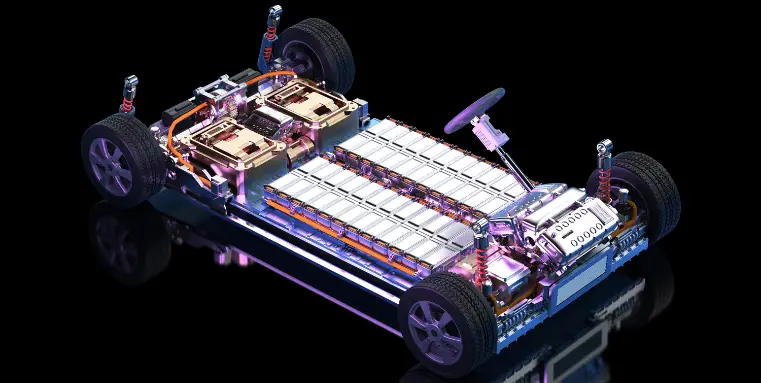

This initiative aims to strengthening the competitiveness of the French automotive industry in the face of competition from Asia, particularly in the field of electric vehiclesbut also to be aligned with EU vote to ban the sale of internal combustion vehicles in 2035. The first NMC batteries (nickel-manganese-cobalt) produced will equip models such as the Peugeot e-3008which until now has been powered by Chinese batteries from BYDThis is just one example of French carmakers' commitment to the energy transition.

The idea is to become very competitive, because today the battery represents 40% of the price of a vehicle.

Matthieu Hubert, General Secretary of ACC

Having said that, ACC has begun marketing its first batteries produced in France, marking a crucial step in its quest for industrial sovereignty. Although the beginnings are modest, with a planned production of 2,000 battery packs by 2024ACC's ambitions are colossal:

- 150,000 equivalent units by 2025,

- A generating capacity of 120 GWh (gigawatt-hour) by 2030,

- Up to 2.5 million units by 2030or approximately 20% of the European market.

This meteoric rise is a testament to ACC's determination to establish itself as a "leader in the field".champion of European sovereignty"In a sector largely dominated by Asian players.

We aspire to become a European leader in the face of intense Asian competition.

Matthieu Hubert, General Secretary of ACC

What's more, ACC doesn't just produce standard batteries. The company is committed to innovation, combining :

- the Cutting-edge R&D from Mercedes-Benz,

- the automotive expertise of Stellantis,

- and theSaft's centenary expertise in the batteries.

This synergy will enable ACC to develop new-generation batteries that are more efficient and long-lasting.

What's more, in May 2023, ACC inaugurates its first gigafactory in Billy-Berclau/Douvrinin Pas-de-Calais, in the heart of the famous Battery valley. This plant, with currently 800 employeesis the first in a series of four planned in the Hauts-de-France regionsymbolises France's commitment to the transition to electromobility.

💡Did you know ? Since 2018, France has initiated a first "Batteries plan"to accelerate the development of a national production sector. It is this plan that has enabled gigafactories to be set up across the country and supported research and development projects in the field of batteries.

ACC's presence in the Hauts-de-France region has been described as a "major step forward".3rd industrial revolution"by the regional authorities. This initiative promises to :

- boost the local and national economy,

- create thousands of direct and indirect jobs,

- and strengthen France's position in the electromobility value chain.

But that's not all! As previously stated, ACC's ambitions are not limited to France. 2 other gigafactories are planned à Kaiserslautern in Germany (2025) and Termoli in Italy (2026)

Envision AESC x Renault Group : The Douai Gigafactory

Envision Automotive Energy Supply Corporation (AESC)a subsidiary of the Envision group, is a a major player in the development and the manufacture of high-performance batteries for electric vehicles. Founded in 2007, the company has established itself as a global leader in providing batteries that are both reliable and long-lasting.

As part of its expansion strategy, Envision AESC has chosen to Douaiin the Hauts-de-Franceto set up a gigafactory dedicated to the production of batteries for electric vehicles. This colossal project represents a initial investment of 1.3 billion euros and promises to revolutionise the French car industry.

This project, carried out in partnership with Renault Groupaims to strengthen the local supply chain and support the production of electric vehicles in Europe. The first phase of the plant will have a production capacity of 9 GWh per year from 2024with a ambition to reach 30 GWh/year by 2030.

In addition, the Envision AESC gigafactory is strategically located near the Renault Georges Besse plant. The aim of this collaboration is to equip Renault's iconic electric models, namely :

- the electric Renault 4,

- and the Renault 5 E-Tech electric.

See also our article :

See also our article :

Despite the ambition of the project, Envision AESC faces a number of challengessuch as construction delaysThis will inevitably have an impact on the production plans of Renaultbut also the the need for massive recruitmentbecause 770 positions to be filled before production starts in March 2025.

Worth noting The Gigafactory is also expected to generate around 2,500 jobs by 2030.

Verkor: the new French champion of electric batteries

Founded in Grenoble in 2020Verkor has rapidly established itself as a major player in the production of lithium-ion batteries for electric vehicles in France. This ambitious start-up embodies France's determination to become a European leader in low-carbon batteries for a number of reasons:

- Low-cost batteries carbon footprint 4 to 5 times lower emissions than Asian production.

- Low-carbon energy mix A combination of nuclear, wind and low-carbon heating networks.

- Dark Green" rating from Standard & Poor's The project's environmental excellence.

The cornerstone of Verkor's strategy is the construction of a gigafactory in Dunkirkin the north of France, like the other 2 mentioned above. This site, covering 80 hectaresis designed to produce battery cells for Equip around 300,000 electric vehicles per year.

The worksstarted in November 2023 in the presence of Elisabeth Borne (former Prime Minister) and a number of members of the government. progressed at an impressive rate. According to Sylvain Paineau, Verkor's Infrastructure Director and one of the start-up's 6 co-founders, this makes the plant theone of the largest buildings in France with a 18 times the length of Notre-Dame de Paris.

But that's not all: in September 2023, Verkor completed a exceptional fundraising from more than 2 billion eurosmarking a record for French Tech. Investors include Renaultinfrastructure funds such as Meridiam and Macquarieand the support from the French government 650 million.

Naturally, the project promises to revolutionise the French car industry:

- Long-term objective 50 GWh by 2030

- Initial production capacity 16 GWh per year from 2025

- Job creation 1200 direct jobs and 3000 indirect jobs

Production is due to start in summer 2025, with the first batteries destined mainly for Renaults future electric crossover.Alpineand the electric commercial vehicles FlexEVan.

See also our article :

ProLogium: Taiwanese innovation at the heart of the French battery revolution

ProLogium, a Taiwanese battery company founded in 2006 by Vincent Yang, which plans to set up its first gigafactory outside Taiwan, also in Dunkirk, representing a colossal investment of 5.2 billion euros.

For added context, the batteries developed by ProLogium use an innovative architecture with a ceramic separatoroffering a superior energy density and fast charging capabilities. This filmless design facilitates scalable mass production and promises autonomy increased for electric vehicles. Here are just a few examples of the exceptional performance offered by these solid lithium-ceramic (LCB) batteries:

- Service life extended,

- Increased security thanks to the solid electrolyte,

- Range of around 500 km for a small car,

- Ultra-fast recharging up to 60% in 5 minutes, 80% in 9 minutes.

La Construction of the plant is scheduled to begin in late 2024 or early 2025.with production scheduled for 2027. Initially, the capacity will be 2 to 4 GWhwith a potential increase to 8-16 GWh by 2030based on market demand. Ultimately, the capacity of final production should be 48 GWh.

💡Did you know ? To optimise production, ProLogium works with Schneider Electrica world leader in automation solutions.

In other words, this gradual expansion is designed to adapt to market demand for electric vehicles, while taking into account the challenges of competitiveness and production costs.

Nevertheless, it is important to note that despite the technological advantages, the ProLogium batteries are more expensive than conventional batteries lithium-iron-phosphate (LFP), with a price of around 170 $ per kWh compared with 100-115 $ for LFPs.

In addition to its gigafactory, ProLogium is strengthening its presence in France with the opening of a R&D centre on the Paris-Saclay plateau :

- Total surface area of 1,805 m².

- 2 laboratories: "L'Odyssée" (late 2024) and "L'Iliade" (early 2025)

- Collaboration with the University of Paris-Saclay, CEA, CNRS and Arkema

Summary table of the main electric battery gigafactories planned in France

| Company | Location | Planned capacity | Start date | Partners/Customers |

|---|---|---|---|---|

| ACC | Billy-Berclau/Douvrin (62) | 40 GWh by 2030 | End 2023 | Stellantis, Mercedes |

| Envision AESC | Douai (59) | 24 GWh by 2030 | End 2024 | Renault |

| Verkor | Dunkerque (59) | 16-20 GWh, 50 GWh in 2030 | Summer 2025 | Renault |

| ProLogium | Dunkerque (59) | Not specified | 2027 | Not specified |

Chinese domination: a major challenge for French batteries

The arrival of French batteries on the electric vehicle market marks a crucial turning point for the European industry. However, in the face of China's overwhelming dominance, the road to industrial sovereignty promises to be fraught with pitfalls.

Chinese hegemony in the electric battery market

At present, the China dominates the world battery marketconcentrating nearly 70 % production capacity. This predominance is currently exposing France and Europe as a whole to risks of technological and economic dependence.

Indeed, the China currently dominates the global market for electric vehicles and batterieswith a considerable lead over other countries. Visit 2022the China accounted for 59% of global sales of electric vehicleswith over 6 million units sold.

To give you more recent figures, China accounted for 69% of global sales of electric and plug-in hybrid vehiclesor 9.7 million units out of a total of 14.1 million on the January-October 2024.

What's more, the Middle Kingdom dominates global battery production for electric vehicles, with a generating capacity of 1,500 gigawatt hours by 2023double the demand at that time.

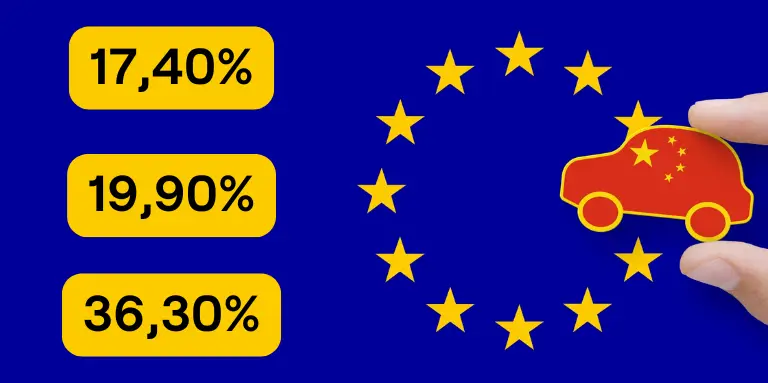

It should be noted that Chinese companies CATL and BYD alone represent more than 50% of world production batteries for electric cars.

But that's not all: the batteries offered are 40% less expensive that competition and cost per kWh is around 56-66 $compared with 95 $ for competitors, not to mention massive government support via subsidies and incentive policies and their estimated technological lead of 10 years.

China's leading manufacturers of batteries for electric cars: CATL and BYD

As briefly mentioned above, French production of batteries for electric vehicles is facing the following challenges 2 Chinese giants almost impossible to ignoreliterally dominating the world market.

First up, we have none other than leader No. 1 CATL, offering batteries for electric cars with cutting-edge technology. For more details, here's what the manufacturer is promising:

- From high energy density batteries :

- Development of solid electrolyte cells with a density of 500 Wh/kg, double that of current batteries

- Promising greater autonomy and reduced vehicle weight

- A CIIC platform (Intelligent Integrated Chassis) :

- Ready-to-use chassis integrating batteries, electric motors and essential components

- Exceptional range of 1000 km

- Fuel efficiency of 10.5 kWh per 100 km

- Fast charge: 300 km range in 5 minutes, 80% battery in 10 minutes

- A fast-charging network :

- Plan to deploy 10,000 fast chargers in 100 Chinese cities by the end of 2025

- Working with Star Charge to develop an all-in-one recharging solution

- From battery innovations :

- Fast charging technology enables 80% to be recharged in 5 minutes

- 8-year or 800,000 km warranty on certain batteries

- From Shenxing Plus" battery :

- LFP technology offering over 1000 km of range

See also our article :

Secondly, we have the challenger BYDholding a market share of 36.8 % in 2023is positioning itself not only as a manufacturer of batteries and electric vehicles, but also as a major player in the field of energy efficiency. an innovator in the entire electromobility ecosystemthe battery production to therecharging infrastructure.

If you didn't know, BYD recently developed the Blade Batteryfor a scheduled for launch in 2025being a LFP battery bidder :

- A improved safety :

- Passed the nail penetration test without emitting smoke or fire

- The surface temperature only reaches 30 to 60°C during this rigorous test.

- A optimised resistance :

- Aluminium honeycomb structure with high-strength panels

- Each cell acts as a structural beam to withstand the forces of the sun.

- A increased autonomy :

- Space utilisation is more than 50% better than traditional batteries

- Higher energy density and longer range

- A extended service life :

- Over 5000 charge and discharge cycles

What's more, we also have the new golden battery from ZeekrThis is a significant advance in battery technology for electric vehicles. Here are the key points:

- Ultra-fast recharging :

- Can add 500 km of range in just 15 minutes

- Uses an 800V electrical system to improve charging speed

- Charging infrastructure :

- Zeekr plans to install 1,000 fast chargers by 2024

- Target of 10,000 charging stations by 2026 in China

- Energy efficiency :

- Achieved a volumetric utilization of 83.7%, higher than that of many global competitors

- Careful design to maximise energy density in the battery pack

- Deployment :

- First use in the Zeekr 007 model, since deliveries in January 2024

- Several other models designed to use this battery

See also our article :

your charging point

The quest for French sovereignty in terms of electric batteries

Faced with the overwhelming dominance of Asian giants as we saw earlier, France is deploying a ambitious strategy to become a key player of this industrial revolution. Find out here how the country intends to turning the challenge of French batteries into an opportunity reindustrialisation and energy autonomy, thereby reshaping the future of its automotive industry.

The strategic challenge of "Made in France" batteries

By developing national production capacity, France is now seeking to secure its battery supply and reduce its vulnerability to international market fluctuationsin parallel with the recent European Commission measures against Chinese electric cars.

See also our article :

The projects presented above therefore represent a generating potential of 170 GWh by 2030mobilising more than 17 billion euros of investment. This concentration of major players makes it possible to build up a a complete and competitive ecosystem, covering the entire value chainfrom the extraction of raw materials to recycling.

This strategy is part of the France 2030 Planwhich aims to reindustrialise the country while meeting the requirements of the energy transition:

- the creation of around 10,000 direct jobs in the sector,

- l'equipping electric vehicles with French batteries,

- and the production of 2 million electric vehicles in France by 2030.

Despite these ambitions, the road to industrial sovereignty remains fraught with pitfalls, not least because French manufacturers are having to make up lost ground against Asian competitors with over 10 years' experience.

At the same time, according to the Reuters article, following Northvolt's setback, the Europe's hopes for batteries now rest largely with China. Swedish start-up Northvolt, considered a key player in reducing Europe's dependence on Chinese batteries, has decided to give priority to a plant in the United States rather than in Germany.

What's more, in France, Eramet has suspended plans for a battery recycling plant in DunkirkThis is a setback for the French "battery valley". The French mining group took this decision due to uncertainties over the supply of raw materials and outlets for recycled products. This suspension comes on top of other delays and cancellations of projects in the region, calling into question France's strategy of developing a local battery industry.

However, according to Transport & Environment (T&E), local battery production in Europe could reduce CO2 emissions by 37% compared with a supply chain controlled by China, and up to 60% using renewable electricity ! T&E also believes that local production of cells and battery components in Europe could save 133 Mt of CO2 between 2024 and 2030These are encouraging figures that could help to alleviate the many challenges facing the French, and Europe in general.

See also our article :

Innovation and performance: the promise of French industry in the face of Chinese competition, despite the challenges

As a reminder, the 4 main French players presented above are assert their expertise and develop innovative technologies for stand out from their Chinese counterparts as follows:

- ACC works on solid electrolyte batterieswhich promises higher energy density and greater safety.

- Envision AESC plans to equip 180,000 to 200,000 vehicles a year by 2026, in close collaboration with Renault.

- Verkor relies on high-performance lithium-ion batterieswith a planned production capacity of 300,000 electric vehicles a year by 2027.

- ProLogium is focusing on solid-state lithium-ceramic (LCB), offering a range of around 500 km for a small car and ultra-fast charging.

However, the challenges remain significant. Less than half (47%) of lithium-ion battery production planned in Europe up to 2030 is considered safe. The The remaining 53% are at risk from delayof downscaling orcancellation without stronger government action.

To strengthen its position, Europe needs to adopt a 3-pronged strategyAs T&E suggests: "Make Europe", "Buy Europe" and "Protect Europe". This approach implies reform State aid for the manufacture of clean technologiesof create demand for European productsand introduce protective trade measures.

Conclusion

France and Europe are at a major turning point. The success of their strategy will depend on their ability to support innovation effectively, à create a strong local marketand protect their fledgling industry in the face of international competition.

As a result, ACC, Verkor, Envision AESC and ProLogium not only represent a significant production potentialbut also a promise of innovation. Their efforts to develop cutting-edge technologies, such as solid electrolyte batteries and lithium-ceramic batteries, are a source of great satisfaction. key to closing the technology gap with Asian competitors.

Nevertheless, as T&E points out, Europe must act quickly to secure these investments. Julia Poliscanova, from T&E, stresses the importance of need for "laser focus and concerted thinking European leaders to capitalise on the climate and industrial benefits of batteries.

In short, the issue goes far beyond the industrial framework. It's about create jobsof reducing the automotive sector's carbon footprint and position France as a leader in innovation in sustainable mobility. The coming years will be crucial in determining whether these ambitions will be realised in the face of the Asian competition.

You would like toto electric?

Beev offers multi-brand 100% electric vehicles at the best prices, as well as recharging solutions.