What is recoverable vehicle VAT and how will it work in 2025?

MasteringRecoverable VATon your company cars is a strategic financial lever for your company.

In practical terms, this means recover VAT paid on your business expenses - purchases, provision of services or reimbursement of your employees' expenses (travel, accommodation) - so that you only pay the State the net VAT, i.e. the difference between the VAT collected and the deductible VAT.

Applied to vehicles, this mechanism can seem labyrinthine, as it does not apply in the same way to all categories and uses.

To simplify the rule, which we will explain in more detail below :

- For the passenger carsVAT is not recoverable, except in the case of certain professions such as taxis, driving schools or ambulances.

- For the commercial vehiclesIf a company purchases, rents or maintains a vehicle, it can reclaim VAT on the purchase, rental or maintenance, provided that the vehicle is included in the company's assets and is used exclusively for business purposes.

This distinction has a major impact on the profitability of your fleet. A commercial vehicle eligible for the scheme purchased for €27,600 including VAT, for example, can reclaim €4,600 in VAT, reducing the real cost to €23,000. Multiply this mechanism by several dozen or hundreds of vehicles, and the cumulative savings can quickly add up to several hundred thousand euros!

It is therefore a real asset for optimise your costs and the ROI of your fleet, while boosting your competitiveness and offering your employees mobility solutions that are better adapted to your company's needs.

When is recoverable vehicle VAT possible for businesses?

Company eligibility

Only companies subject to VAT are eligible. Companies or entities not subject to VAT (certain associations, non-taxable professions, private individuals) are not eligible.

Professional use of the vehicle

The vehicle must be used primarily for business purposes.

Exclusion of personal vehicles

VAT is not recoverable on employees' personal vehicles or on vehicles that are not registered as company assets.

Does recoverable vehicle VAT apply differently to commercial vehicles and passenger cars?

The distinction between passenger cars and commercial vehicles is decisive in determining whether or not VAT is recoverable. This classification is based on precise tax criteria linked to the design and use of the vehicle.

| Category | Key features | Recoverable VAT | Tax consequences |

|---|---|---|---|

| Passenger car (PC) | Designed to carry people (several seats, mixed use possible) | Not recoverable, with some exceptions (taxis, driving schools, ambulances) | Less advantageous from a tax point of view, as there is no clawback on purchase, rental or maintenance. |

| Commercial vehicle (CV) | Separate load area, few or no rear seats, mainly for professional use | 100 % recoverable (purchase, hire, maintenance, fuel) | More business-friendly, encourages professional investment |

Worth remembering: For a commercial vehicle to be eligible for VAT recovery, four criteria must be met.

- The vehicle is used exclusively for business purposes

- The company is subject to VAT

- The invoice clearly shows VAT

- The vehicle is classified as "commercial" for tax purposes

Practical tip: converting a passenger car into a commercial vehicle

La converting a passenger car into a commercial vehicle is a strategy used by certain companies to optimise VAT recovery. This involves structural modifications to the vehicle, such as removing the rear seats and installing a compliant load area.

As far as administrative formalities are concerned, remember to update the vehicle registration certificate (carte grise) to obtain official classification as a commercial vehicle. Once the conversion has been validated, the company can potentially reclaim 100 % of VAT.

Before taking this step, it is advisable to consult a tax expert or an approved body to ensure that the work is compliant and has been approved by the authorities.

What are the advantages of recoverable VAT on electric vehicles in 2025?

You wish to optimise your fleet management and improve the ROI of your vehicle fleet? Electric vehicles are an interesting lever, even if their VAT treatment is not exempt from the general rule.

Non-deductible VAT on purchases

As with all passenger cars, the VAT paid on the purchase or long-term hire of an electric car is as followsis not recoverable by a companyThere are exceptions for certain professions (taxis, driving schools, ambulances). This rule therefore limits the direct tax benefits linked to the initial investment. VAT can be reclaimed in full on the electric commercial vehicles included in the scheme.

Lower taxes and other incentives

Electric vehicles also benefit from a taxation more flexible :

- Total exemption from TVS (Company Vehicle Tax)

- Separate deductibility of battery as part of depreciation, which reduces the accounting burden.

What conditions need to be met to qualify for recoverable VAT on company vehicles?

For a company to be able to deduct VAT on a company car, a number of administrative rules must be strictly adhered to:

1. Supporting documents

You must complete the Cerfa n°3310-CA3 and accompanied by documentary evidence of the purchase or expenditure relating to the vehicle. The supporting documents must clearly state :

- the amount including VAT,

- the amount of VAT,

- the identity of the supplier

In practice, this is usually an invoice, but a purchase order or other equivalent document can also be used as proof.

2. Compliance with invoicing rules

Invoices used as supporting documents must comply with the statutory requirements and be kept for the statutory periods.

In the event of an audit, an error or omission may result in a tax adjustment and the obligation to repay unduly deducted VAT.

3. Notion of payability

VAT can only be deducted when it becomes due. In other words, the company can only reclaim it during the reporting period corresponding to the issue of the invoice or the payment, depending on the applicable system. This concept is essential, as it determines the timetable for recovering the tax.

How do I know if a vehicle is eligible for recoverable vehicle VAT?

Eligibility for VAT recovery depends on the category of vehicle and its professional use.

Here are the eligibility rules for 2025:

| Vehicle category | Conditions for reclaiming VAT | Remarks / Exceptions |

|---|---|---|

| Light commercial vehicles (LCVs) and industrial vehicles (IVs) | VAT fully recoverable if used professionally | VAT directly recoverable, no additional conditions |

| Passenger cars | VAT recoverable under certain conditions only | Conventional vehicles (saloons, city cars, SUVs) not used exclusively for business purposes → VAT not recoverable |

| Exempt professions (taxis, ambulances, driving schools) | VAT recoverable in full, professional use compulsory | For professional use only |

| Mixed-use company vehicles | VAT recoverable in part or in full, depending on use | If mixed non-professional use → VAT not recoverable |

| Demonstration vehicles | Non-recoverable VAT | Even if used professionally |

If in doubt, consult the vehicle registration document (carte grise) to identify the vehicle's European category (e.g. M1 for passenger cars, N1 for light commercial vehicles). For commercial vehicles, the words "CTTE" or "VU" generally appear on the vehicle registration document.

Our advisors can help you determine whether your electric commercial vehicles are eligible for VAT recovery.

What is the list of electric vehicles with recoverable VAT in 2025?

Here is a non-exhaustive list of vehicle models with recoverable VAT:

| Model | Autonomy (WLTP) | List price (excluding bonuses) |

|---|---|---|

| Mercedes eSprinter Van 47 kWh | 158 km | 84 582 € |

| Citroën ë-Jumpy 75 kWh | 330 km | 45 500 € |

| Peugeot e-Partner 50 kWh | 200 km | 40 440 € |

Can VAT be reclaimed on a used electric or hybrid vehicle?

VAT can be reclaimed on used electric or hybrid vehicles eligible for the scheme, subject to certain conditions:

- Professional vendor subject to VAT: the purchase must be made from a professional. VAT cannot be reclaimed when purchased from a private individual.

- Invoice showing VAT : the invoice must show the amount of VAT separately. If the vehicle is sold under the margin VAT scheme, recovery is not possible.

- Exclusive professional use: the vehicle must be used for business purposes. VAT cannot be reclaimed for purely personal use.

Our advice: Before finalising the purchase, check that the invoice clearly states "VAT deductible". This guarantees that the vehicle falls within the legal framework giving entitlement to the deduction.

Recoverable VAT on vehicles and tax depreciation: what limits should you be aware of?

When a business buys a vehicle eligible for the recoverable VAT scheme, it can deduct the depreciation of the purchase price from its profits, but only up to specific limits, which depend on the CO₂ emissions (WLTP) of the vehicle.

Ceilings applicable to passenger cars :

| Year of acquisition | CO₂ emissions (g/km) | Deductibility ceiling (€) |

|---|---|---|

| Before 1 January 2021 | > 165 | 9 900 € |

| 50 - 165 | 18 300 € | |

| 20 - 49 | 20 300 € | |

| 0 - 19 | 30 000 € | |

| From 1 January 2021 | > 160 | 9 900 € |

| 50 - 160 | 18 300 € |

Ceilings for other vehicles (excluding cars) :

| Year of acquisition | CO₂ emissions (g/km) | Ceiling (€) |

|---|---|---|

| 2018 | ≥ 151 | 9 900 € |

| 60 - 150 | 18 300 € | |

| 20 - 59 | 20 300 € | |

| 0 - 19 | 30 000 € | |

| 2019 | ≥ 141 | 9 900 € |

| 60 - 140 | 18 300 € | |

| 2020 | ≥ 136 | 9 900 € |

| 60 - 135 | 18 300 € | |

| From 2021 | ≥ 131 | 9 900 € |

| 60 - 130 | 18 300 € |

The more CO₂ the vehicle emits, the lower the deduction limit.

Very clean vehicles (0 to 19 g/km) can benefit from a maximum of 30 000 €.

Recoverable VAT on vehicles: what about maintenance, hire and electricity costs?

Recoverable VAT on fuels

| Fuel type | Passenger car (PC) | Commercial vehicle (CV) |

|---|---|---|

| Petrol / Superfuels (E5, E10, ARS) | Deductible at 80 % | 100% deductible % |

| Diesel / Superethanol E85 | Deductible at 80 % | 100% deductible % |

| LPG, propane, butane, CNG | 100% deductible % | 100% deductible % |

VAT on electricity: an additional benefit

Electricity benefits from a particularly favourable regime: VAT is recoverable at 100 % for both passenger cars and commercial vehicles, provided they are used for professional purposes. This measure is designed to encourage the adoption of clean vehicles and reduce the financial burden associated with their acquisition.

Recoverable VAT on vehicle leasing

The tax regime applicable to the leasing of company vehicles is identical to that for the purchase of vehicles:

- Passenger car : for rentals of more than three months, the rent is deductible up to a limit of €9,900 or €18,300, depending on the CO₂ emission rate. VAT on these rents is not recoverable.

- Commercial vehicle : the rent is fully deductible, and VAT is also recoverable at 100 %.

For maintenance costs

100 % of VAT on the maintenance of commercial vehicles is recoverable.

It is advisable to keep all the detailed invoices (service, repairs, parts). These documents, together with the mileage record, are essential in the event of a tax audit to demonstrate that the vehicle is being used for business purposes.

Ecological bonus and recoverable VAT on electric vehicles: can the benefits be combined?

Businesses that buy or lease an electric commercial vehicle can benefit from a number of schemes in addition to recoverable VAT:

- The ecological bonus : It applies to the purchase or long-term leasing of a new electric vehicle, subject to compliance with the price ceilings and conditions set by the government.

- The conversion premium : if the purchase or lease is accompanied by the scrapping of an old polluting vehicle, the company can also benefit.

Reclaiming VAT on company vehicles is a strategic tool for optimising your costs and securing your mobility budget.

By combining this measure with existing schemes, you can significantly reduce the overall cost of your fleet, while actively participating in the energy transition.

Properly implemented, this tax opportunity boosts the profitability of your car fleet and can even enhance your commitment to sustainable mobility when you choose electric cars!

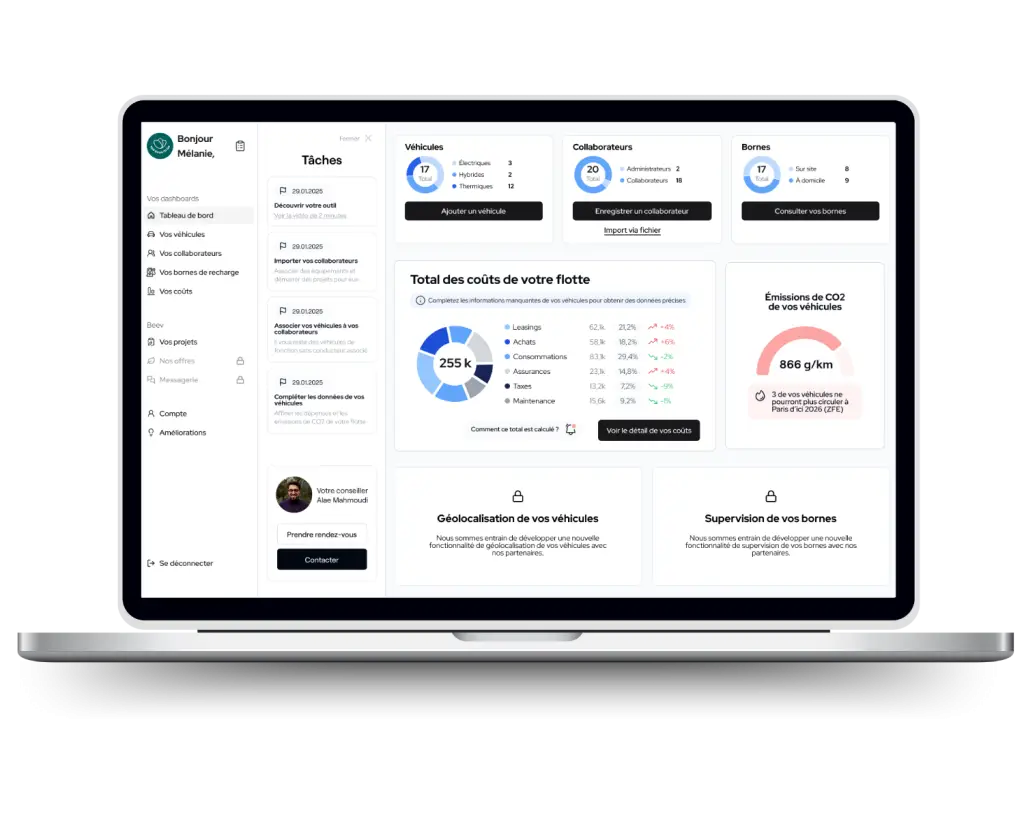

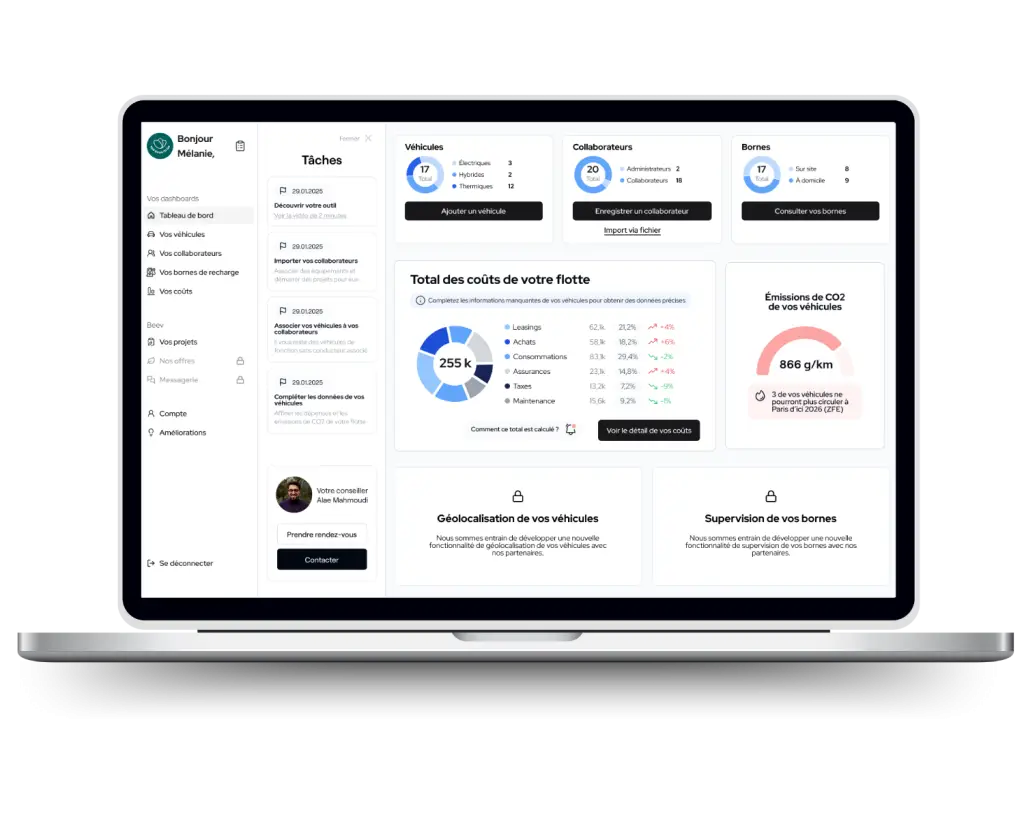

Manage your fleet easily with our dedicated tool

A fleet management tool from A to Z

- Add your fleet and employees in just a few clicks

- Plan your transition to electric vehicles and monitor your CSR objectives in real time

- Centralise your expenses