Monday to Friday 9am - 12.30pm - 2pm - 7pm

What is the WLTP cycle?

The WLTP (Worldwide Harmonized Light Vehicle Test Procedure) is a new protocol for measuring fuel consumption and emissions of CO2 and other pollutants by vehicles.

From 2020, it will replace the NEDC (New European Driving Cycle). The differences are linked to the test conditions. Under the WLTP cycle (Worldwide harmonized Light vehicule Test Procedure) :

- The test will last longer - the tests will last 30 minutes, compared with the current 20 minutes.

- The distance covered will be greater + reduced stopping time - Approximately 25 km will be covered and the vehicle will only be able to stop for 13% of the test time.

- Average speed will be higher - around 47 km/h over the 25 km to better reflect the real-life conditions of motorists.

- The weather conditions will be more realistic - tests will be carried out at more realistic temperatures (14° at start-up, then 23°)

- Weight and equipment will be taken into account. whereas the NEDC cycle did not take them into account, the new cycle does. WTLP will take them into account.

Also read - WLTP cycle: How does it differ from the NEDC cycle?

What are the key upcoming dates?

The cycle WLTP has already been applied to LCVs since September 2021. The standard will be extended to passenger cars from June 2022.

To sum up:

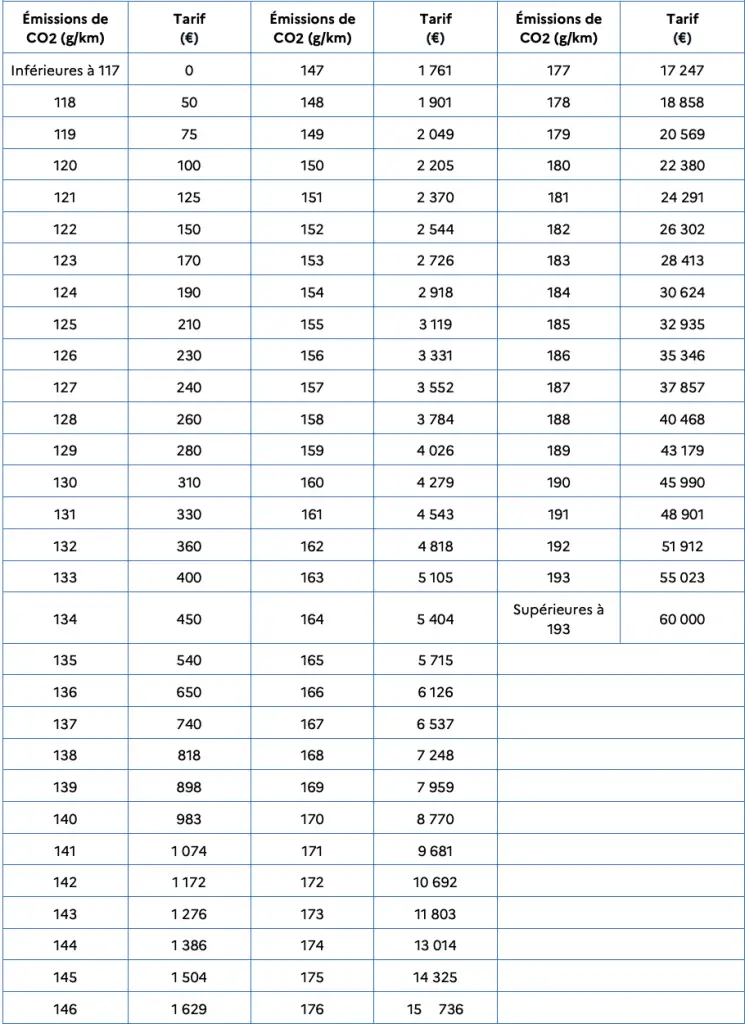

In January 2024, a new scale of ecologic malus comes into force.

What does this mean for the 2024 environmental penalty?

With all these changes, it turns out that the results for CO2 emissions from vehicles are increasing. In other words, vehicles are polluting more than they appear to be. The CO2 emissions used to calculate the ecological bonus and penalty will change, with the amount of the penalty revised upwards from next year.

In 2024, it will now apply to vehicles with CO2 emissions starting at 118g/km. That's 5g less than in 2023.

What is the WLTP standard What does this mean for individuals?

The new standard WLTP will have two major consequences:

- The CO2 emission rate will be higher, which will change the classification of the vehicle. Vehicles will move up a bracket, which will have an impact on the wallet.

- The scale has been revised upwards. The price of the environmental penalty will increase in 2023.

What does the WLTP standard mean in practical terms for companies?

The new WLTP standard will have three major consequences:

- The CO2 emission rate will be higher, which will change the classification of the vehicle. The vehicles will change bracket.

- The scale has been revised upwards. The price of the environmental penalty increases in 2024.

- The price of tax on the use of passenger vehicles for economic purposes is also increasing.

Good to know: you can estimate the price of theannual tax on the use of passenger cars for economic purposes here.

Maximum ecological penalty to be increased in 2024

From 1ᵉʳ January 2024, the maximum amount of the ecological malus initially set at €50,000 will see an increase of €10,000 for vehicles emitting 194 g/km of CO2 or more. This increase demonstrates France's efforts to discourage the purchase of the most polluting vehicles and encourage the ecological transition. The aim is to reduce greenhouse gas emissions to meet the country's environmental targets.

Weight tax continues, but will be lowered in 2024

La taxe sur le poids des véhicules se prolonge pour l’année à venir. Elle sera néanmoins abaissée de 1800 kg à 1600 kg à partir du 1ᵉʳ janvier 2024. La taxe sur le poids est appliquée à un taux de 10 € par kilo supplémentaire au-dessus du seuil de déclenchement. Les voitures électriques ne sont pas concernées par cette taxe.

The scale for the 2023 environmental penalty revised upwards

The 2022 scale was already higher than expected. In 2019, the threshold for triggering the ecological penalty was 117 g/km of CO2. Experts had estimated that this threshold would be lowered by 3g in 2020, but this is not the case. In 2022, the threshold for triggering the ecological penalty was 110 g/km of CO2..

Here is the new scale for the ecological penalty for 2024.

Source : Finance Bill for 2024

The scale of tax on the use of private cars

The 2023 tax on the use of passenger cars for economic purposes is expected to remain at the same level as in 2022.

- Exemption for vehicles emitting less than 20 g/km of CO2

- Vehicles emitting between 21g/km and 60 g/km of CO2 will be subject to a tax of €1/g.

| Puissance fiscale en chevaux | Tarif applicable en euros |

|---|---|

Less than or equal to 3 | 750 |

From 4 to 6 | 1 400 |

From 7 to 10 | 3 000 |

From 11 to 15 | 3 600 |

More than 15 | 4 500 |

Source: impots.gouv.fr |

| Taux d'émission de CO2 ( en grammes par kilomètre) | Tarif applicable par gramme de Co2 (en euros) aux véhicules ne relevant pas du nouveau dispositif d'immatriculation (NEDC) | Tarif applicable par gramme de Co2 (en euros) aux véhicules relevant du nouveau dispositif d'immatriculation (WLTP) |

|---|---|---|

Up to 20 g/km | 0 € | 0 € |

From 21 to 50 g/km | 1 € | 17 à 40 € |

From 51 to 60 g/km | 1 € | 41 à 48 € |

From 61 to 100 g/km | 2 € | 49 à 150 € |

From 101 to 120 g/km | 4,5 € | 162 à 192 € |

From 121 to 140 g/km | 6,5 € | 194 à 392 € |

From 141 to 150 g/km | 13 € | 109 à 600 € |

From 151 to 160 g/km | 13 € | 664 à 1 168 € |

From 161 to 170 g/km | 19,5 € | 1 124 à 1751 € |

From 171 to 190 g/km | 19,5 € | 1 813 à 3 116 € |

From 191 to 200 g/km | 19,5 € | 3 190 à 3 580 € |

From 201 to 230 g/km | 23,5 € | 3 618 à 4 968 € |

From 231 to 250 g/km | 23,5 € | 5 036 à 6 250 € |

From 251 to 270 g/km | 29 € | 6 325 à 7 747 € |

More than 270 g/km | 29 € | 29 € |

Revenues to finance the ecological bonus

It is estimated that 800 million euros revenue generated in 2020by the ecological malus with the deployment of this new calculation method.

What will this revenue be used for? To finance the environmental bonus and the conversion premium.

The environmental bonus will remain unchanged. However, its budget will be increased. In 2019, the projected budget for the eco-bonus is €260 million. In 2022, it has been increased by 50%, i.e. 390 million allocated to the 2022 environmental bonus. The remainder will be used to finance the conversion premium, which will be tougher in 2019 to benefit the least polluting vehicles.

Good to know, the conversion premium was modified in August 2019 to encourage the least polluting vehicles, particularly electric vehicles.

What about plug-in hybrids?

Previously exempt from the environmental penalty in the same way as electric cars, the Finance Bill for 2024 intends to suspend this exemption and the annual CO2 tax from 2025.

These vehicles, which emit carbon dioxide, will also be affected by the mass penalty. They will benefit from an allowance that reflects the mass of the car on a flat-rate basis. battery for the annual CO2 tax, vehicles that use E85 superethanol will benefit from an allowance, as is already the case for the CO2 penalty on registration. The extra kilo will be charged :

- 10 € from 1600 to 1799 kg

- 15 € from 1800 to 1899 kg

- 20 € from 1900 to 1999 kg

- 25 € from 2000 to 2100 kg

- then €30