Home > Electrify your fleet with Beev > All about the electrification of company fleets

All about the electrification of company fleets

In 2025, managing a company car fleet can no longer be limited to operational considerations. Tougher taxation on internal combustion engines, the growing demands of the LOM law, the extension of the ZFEs (Low Emission Zones) and the gradual end of subsidies for hybrid models will require a strategic rethink.

In this context, the switch to 100 % electric vehicles is no longer an environmental choice, but a rational economic decision. At constant tax rates, combustion-powered fleets generate a growing net cost, while electric vehicles benefit from significant exemptions (TVS, malus, AEN), favourable depreciation ceilings and a much lower TCO.

Table of contents

The challenges of corporate fleet management

Managing a company car fleet involves tackling a number of major issues that are often underestimated.

The multiplicity of vehicles and users makes it more complex to monitor and optimise resources: assigning the right vehicle to the right person at the right time requires precise, scalable organisation.

In addition, the taxation of business vehicles is not only onerous, but also constantly changing, with rules that are difficult to anticipate and sometimes difficult to understand for managers who are not experts in the field.

Lastly, companies are facing increasing pressure in terms of corporate social responsibility (CSR): they have to adapt to strict environmental standards, while at the same time meeting strong internal expectations in terms of reducing their carbon footprint.

Monitoring contracts: leasing, maintenance, insurance, etc.

A fleet is made up of a multitude of separate contracts: leasing, insurance, maintenance, repairs, etc.

Each has its own deadlines, management procedures and alerts to comply with.

In the absence of a centralised tool, companies have to juggle several platforms, spreadsheets or manual reminders, which increases the risk of forgotten renewals or non-compliance.

Ultimately, the loss or dispersal of information can lead to hidden costs, or even service interruptions if a key contract is forgotten.

TCO: a key indicator, but difficult to manage

TCO (Total Cost of Ownership) has become the benchmark indicator for any decision concerning a fleet of vehicles.

It's not just a question of the purchase or lease price: TCO takes into account all the costs associated with the vehicle over its lifetime within the company: insurance, maintenance, energy (fuel or electricity), tax and any resale.

However, in practice, managing this TCO is a real challenge. The necessary data is often spread across several tools, service providers or departments. Calculating and accurately monitoring this cost requires specific skills and tools, which are difficult for a manager who is not specialised in management control or finance to master.

As a result, without digitalisation and centralisation of information, it becomes complicated to anticipate drift or take rational decisions.

Reduced TCO: energy, maintenance and taxation

The total cost of ownership (TCO) of an electric vehicle is now lower than that of an equivalent internal combustion vehicle thanks to :

- stable and competitive energy costs

- simplified maintenance (fewer wearing parts)

- tax exemptions accumulated over several years

Managing an electrification project

The electrification of a fleet is not just a question of image or ecology: it's a strategic opportunity for the company.

Firstly, there are real tax levers: electric vehicles benefit from purchase subsidies, reductions or even exemptions from specific taxes, and an increasingly favourable regulatory framework.

Secondly, the TCO of electric vehicles can be lower than that of internal combustion vehicles, thanks in particular to lower maintenance costs and stable energy costs.

However, not all models are created equal, and it is crucial to anticipate employees' needs in order to choose the right vehicles and put in place a relevant car policy.

Simulating the TCO of an electric vehicle makes it possible to take an objective decision and justify the investment to management.

Finally, managing this project also means being able to accurately monitor changes in the fleet's CO₂ emissions, to meet both regulatory requirements and internal CSR ambitions.

Managing employees and assignments

Allocating a vehicle to an employee is not something that can be improvised: it has to take into account the position, mobility needs, any acquired rights and the specific characteristics of electric vehicles (recharging, range, etc.).

Monitoring changes of user, returning vehicles, managing inventories and administrative follow-up are all key stages in guaranteeing the availability and conformity of the fleet, while ensuring employee satisfaction.

Monitoring and optimising terminals

The growing popularity of electric vehicles raises the question of recharging infrastructure.

Whether the charging points are installed on site or at employees' homes, it is essential to be able to monitor their technical status, actual usage and maintenance requirements, and to anticipate the upgrades needed to keep pace with fleet growth.

Company fleets: why go electric in 2025?

Increasingly unfavourable tax treatment for internal combustion engines

Increase in the ecological penalty and the weight-based penalty

Since 2025, the threshold for triggering the CO₂ malus has been lowered to 113 g/km, with a tax of up to €70,000 for the highest-emitting models. A weight-based penalty is added for vehicles exceeding 1,600 kg, with no cumulative ceiling of less than €70,000.

New tax on emissions (ex-TVS) and atmospheric pollutants

TAVT replaces TVS and now applies to all passenger vehicles. Only electric and hydrogen-powered vehicles are fully exempt. In 2025, a petrol or hybrid model could generate up to €600 in annual VAT.

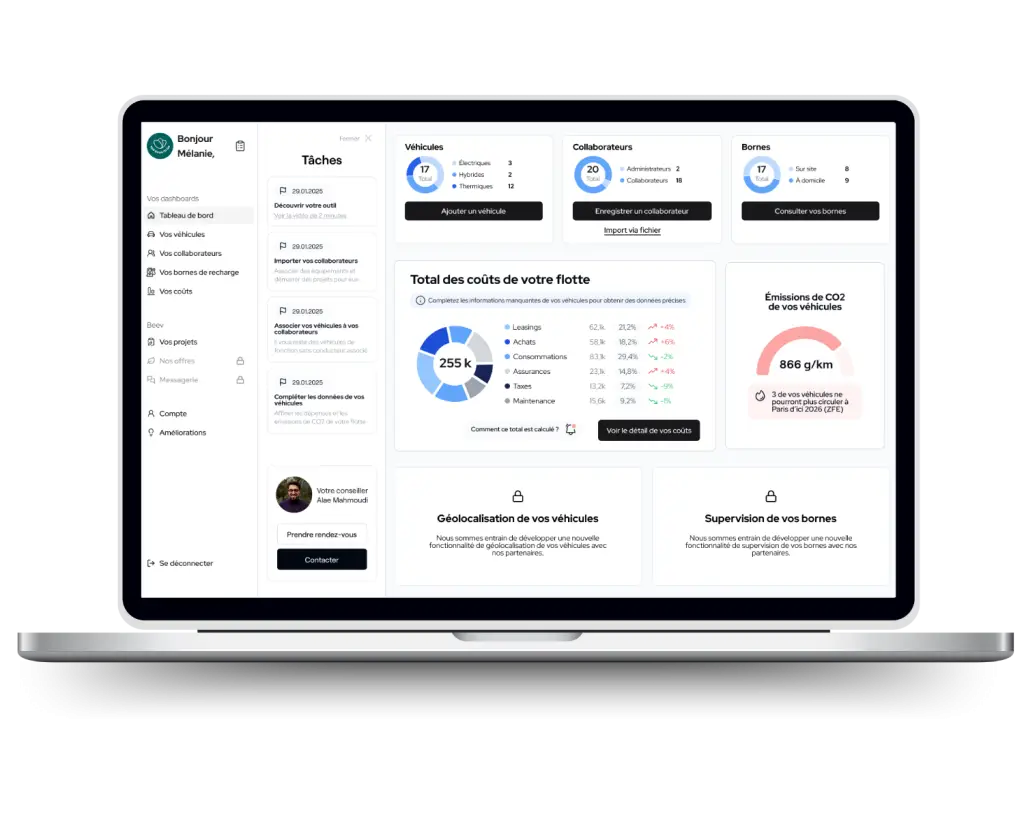

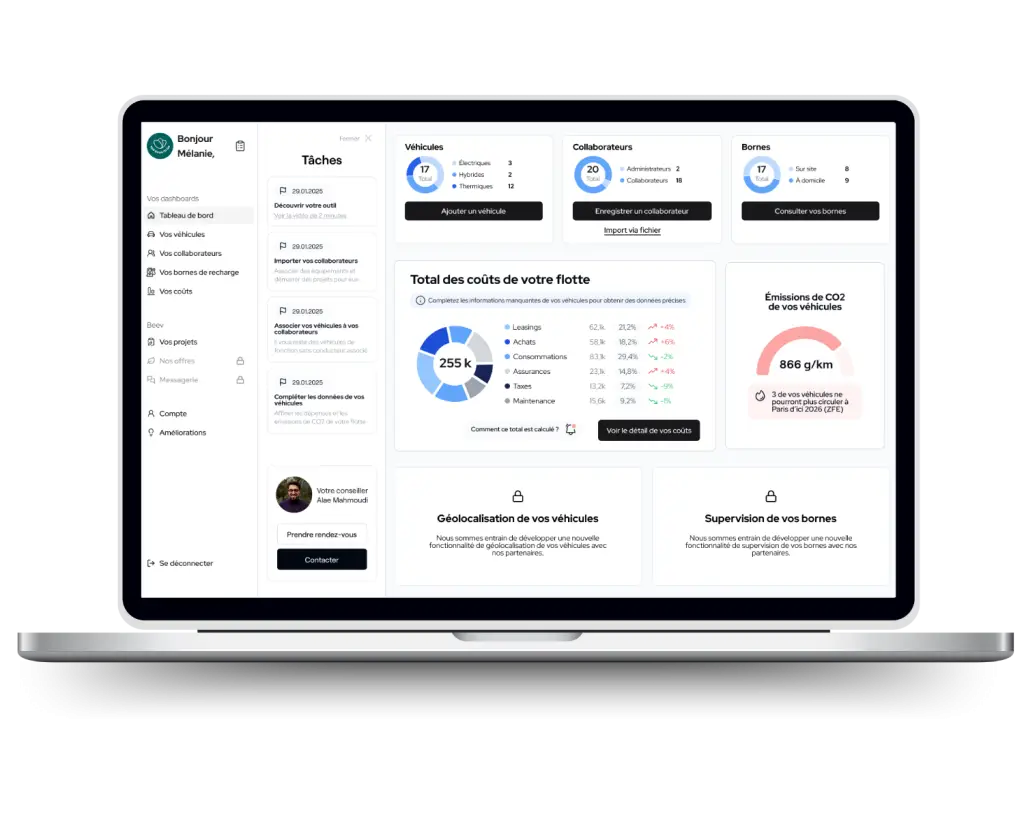

Manage your fleet easily with our dedicated tool

A fleet management tool from A to Z

- Add your fleet and employees in just a few clicks

- Plan your transition to electric vehicles and monitor your CSR objectives in real time

- Centralise your expenses

Electric vehicles: a major tax lever for businesses

Targeted exemptions and allowances

100 % electric vehicles benefit from :

- an AEN allowance of 70 % (capped at €4,582/year) from 1 February 2025

- a total exemption from TAVT

- a depreciation ceiling of €30,000, with no tax write-back

Anticipating regulatory obligations: LOM, ZFE and VFE quotas

The LOM law: mandatory progressive quotas

Since January 2025, companies with more than 100 cars have had to include at least 20 % low-emission vehicles (LEVs) in their annual acquisitions, or face penalties (€2,000 per missing vehicle).

Low Emission Zones: restricted access for combustion-powered fleets

42 French cities are now applying the EPZs. Crit'Air 3 vehicles (diesel < 2011, petrol < 2006) are banned. Only Crit'Air 0 (electric) vehicles have unrestricted access, avoiding additional logistical costs or operating losses.

Eligibility criteria for tax breaks for electric vehicles

Vehicles concerned

Only 100 % electric or hydrogen-powered vehicles registered in France are eligible for exemptions and rebates. They must meet the following criteria:

- Emissions < 20 g CO₂/km

- Ademe environmental score (eco-score) compliant at date of availability

- New vehicle or leased for at least 24 months for CEE-related schemes

Eligible companies

All companies subject to corporation tax or income tax can benefit from these schemes, whether they own or lease vehicles.

Precautions to be taken

- Eligibility for AEN allowances is fixed at the date of availability (cf. BOSS, URSSAF)

- The eco-score must be displayed on the vehicle invoice

- For depreciation, the price of the battery must be broken down separately if deductible.

Explore all our corporate fleet resources

Would you like to find out more about the tax impact, compare electric models or anticipate the regulatory constraints of 2025? Beev provides you with a complete library of high added-value content: TCO analyses, tax summaries, legislative developments (TVS, malus, ZFE, LOM law), interactive simulators and operational advice for your fleets.

Our latest white paper :

Resources on the taxation of electric mobility

- Charging stations, Fleet management, Electric cars

- Fleet management, magazine, Professionals, CSR, Electric vans, Electric cars

- Taxation of electric cars and charging stations, Fleet management, Electric cars

- Charging stations, Fleet management, Professionals

- Fleet management, Professionals

- Fleet management, magazine, Electric cars

Do you have a question about fleet electrification?

Why electrify a company fleet in 2025?

Electrification makes it possible to reduce running costs (recharging, maintenance), meet regulatory requirements (LOM law, ZFE) and improve the company's CSR image. Electric vehicles also offer greater comfort for drivers.

What are the current legal obligations?

Since 1 January 2025, companies with more than 50 employees and a fleet of more than 100 vehicles must include at least 20 % of low-emission vehicles in their annual renewals. This quota will rise to 40 % in 2027 and 70 % in 2030. There are financial penalties for non-compliance.

What financial assistance is available?

Companies can benefit from subsidies such as ADEME's "Tremplin pour la transition écologique" scheme, which finances studies, diagnostics and investment in sustainable mobility.

How is Beev supporting the electric transition?

Beev offers a personalised audit of your fleet, identifies vehicle and charging infrastructure requirements, and provides a free platform to manage your electric fleet, track costs in real time and monitor CO₂ emissions.

What are the economic advantages of an electric fleet?

Electric vehicles cost around four times less to recharge than internal combustion vehicles, and require less maintenance. What's more, they save money thanks to the financial assistance available.

How do you manage an electric fleet effectively?

We recommend using management tools such as the Beev platform, which allows you to view key vehicle data, monitor the status of charging points and optimise the fleet's energy performance.