Monday to Friday 9am - 12.30pm - 2pm - 7pm

In practical terms, what is an additional depreciation?

Additional depreciation is an exceptional tax depreciation measure for eligible productive investments that allows companies to depreciate a percentage of the value of the asset for tax purposes. It applies to certain eligible assets for certain companies.

In other words, it allows you to reduce your taxable income by x% of the cost price of your investments.

- The amount is deducted from taxable income at the rate applied.

- The tax savings achieved are definitive and can be combined with other schemes

This scheme allows companies to invest in certain categories of goods according to the priorities set by the government. Eligible investments mainly concern equipment needed for production or processing, such as machine tools, tractors, etc.

In 2020, the priorities are :

- Digital transformation in industrial SMEs

- The least polluting HGVs

- Some shipowners' equipment, etc...

The depreciation allowance must not be confused with the accounting method of depreciation. Depreciation is entirely a tax provision: it is never accounted for. It only allows the company to deduct a percentage of the value of its investment.

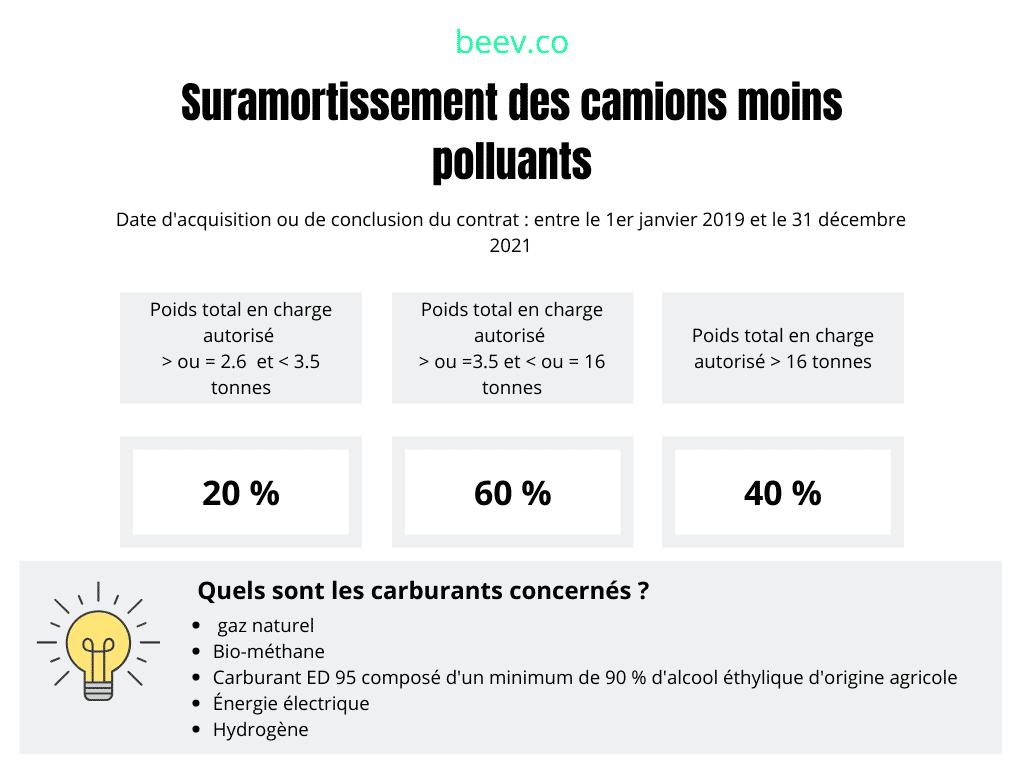

This percentage is spread over the period of use of the asset. As regards lorries, buses and coaches, the system has been revised in the 2019 Finance Act. The rates range from 20% to 60% of the original value for all assets acquired before 31 December 2021.

Suramortisation of less polluting lorries in 2019

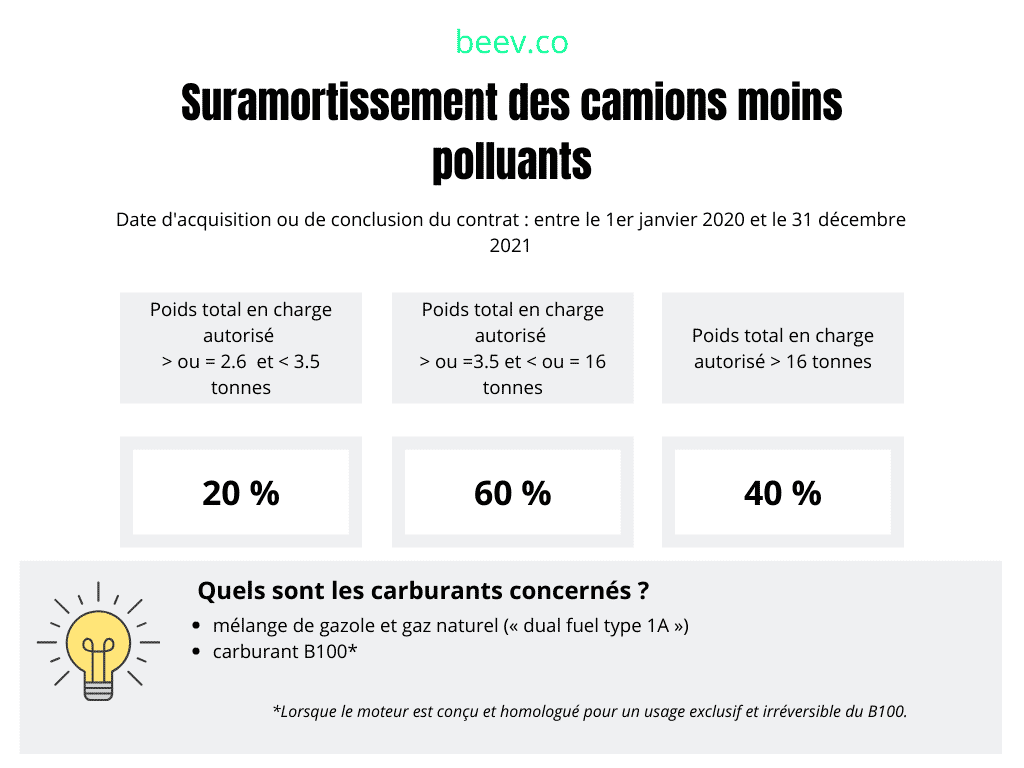

Over-amortisation of less polluting lorries in 2020

Which vehicles are covered by the additional depreciation for less polluting lorries?

L'article 61 of law no. 2019-1479 of 28 December 2019 on the finances for 2020 allows companies to deduct 20 to 60 % from the original value of vehicles with a Gross Vehicle Weight Rating (GVWR) of 2.6 tonnes or more that use exclusively one or more of the following energies:

- Natural gas and biomethane fuel

- ED95 fuel composed of a minimum of 90.0 % of ethyl alcohol of agricultural origin.

- Electrical energy

- Hydrogen

In addition, thearticle 62 of law no. 2019-1479 of 28 December 2019 on the finances for 2020 extended the exceptional deduction applicable to heavy goods vehicles and light commercial vehicles to those using :

- For their engines, a combination of natural gas and diesel (type A1 dual fuel engine)

- Or whose engines are designed and approved for the exclusive use of B100 fuel (made up of 100 % of fatty acid methyl esters).

The scheme applies to vehicles purchased or leased (hire with purchase option or finance lease). from 1 January 2020 to 31 December 2021.

Good to know: For vehicles using B100 fuel, only those whose engines are designed and approved for the exclusive and irreversible use of B100 are eligible. The exclusive use of B100 is guaranteed by technical proof provided by the manufacturers of the vehicles concerned.