Until 31 December 2022Discover the range of electric vehicles available for delivery before Christmas!

Why is there a global shortage?

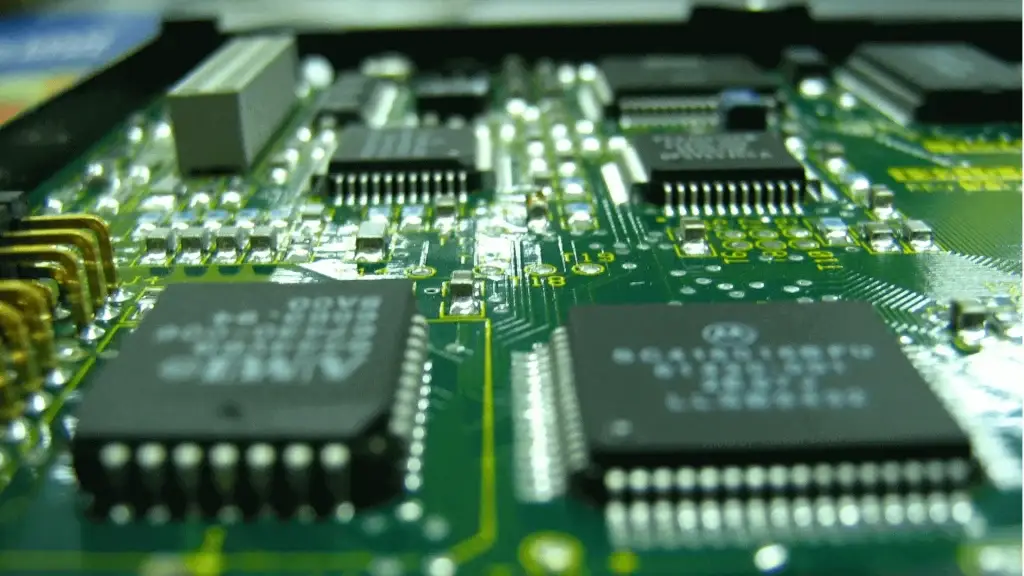

Semiconductors are electronic components They are essential to the operation of the devices we use every day. They prevent your computer from overheating and enable the chip in your smartphone to transmit information. But what is less well known is that these "miniature brains" also play a fundamental role in the construction of vehicles. In the age of "everything connected", semiconductors are essential for the deployment of assistance systems, such as ADAS (Advanced Driver Assistance Systems), or for the installation of sensors that can immediately alert the driver to engine failure and low fuel levels.

However, since 2020, there has been a The global shortage of semi-conductors is having a severe impact on the automotive sector. This phenomenon is largely linked to the global health crisis, which has led to the temporary closure of production sites, as well as a temporary drop in orders from manufacturers. At the same time, sales of electronic equipment have risen at the same pace as home closures, leading to widespread teleworking and new habits. With the economic recovery, supply has therefore fallen behind demand... Especially as the automotive market is not the only one to require supplies of semi-conductors! The high-tech and IT industries have also been hit hard.

So much so that many carmakers have been forced to suspend their production lines, at the risk of facing considerable delivery delays.

Others have decided not to bring certain models to market, despite the fact that they were long-awaited by buyers. The manufacturer Renault lamented a loss of production equivalent to 500,000 units by 2021. In the third quarter of last year, the worldwide loss of earnings for carmakers was estimated at 180 billion euros by the AlixPartners office.

Unfortunately, semiconductor design times are fairly long. On average, it takes four months to produce a usable component. Despite efforts by component manufacturers to increase production rates, the shortage is unlikely to be resolved before the end of 2022.

What impact will the shortage of semiconductors have on electric vehicles?

For the time being, the shortage has had little effect on the market for electric and hybrid vehicles, which has recorded an increase in sales of around growth of 60 % in 2021. However, vigilance is still called for. While the absence of these precious components has greatly reduced the production of internal combustion vehicles, it could be even more detrimental to the electric car segment.

In fact, hybrid and 100 % electric vehicles require two to three times as many semiconductors - almost 3,000 in the most sophisticated models!

This is logical: the type of motorisation relies heavily on power electronics. Semiconductors are used to control the flow of electricity, thanks to their insulating and conductive properties.

On the other hand electric batteriessemiconductors, freeing it from the constraints associated with lithium-ion batteries(liquid batteries), offer better results in terms of durability and energy efficiency.autonomy. But they require more components, and therefore greater investment. These are estimated at more than 7.4 billion dollars according to the British research firm IDTechEx.

The shortage of semi-conductors has highlighted carmakers' dependence on third-party industries, most of which are located in Asia. The company TSMC, whose factories are based in Taiwan, alone produces more than 50 % of the world's supplies.

However, a few players have managed to make the most of the shortage of electronic components. Hyundai, for example, has decided to produce its own semi-conductors to increase its autonomy.

For its part, Tesla has been able to take advantage of an alliance between suppliers. By adapting the compatibility of its vehicles to the different chips on the market, the electric car manufacturer can now multiply its sources of supply.

What are the consequences of the shortage for consumers?

Buyers are being hurt in a number of ways, since the shortage is leading to longer delivery times and higher prices. Manufacturers have been forced to compensate for the financial losses incurred by the drop in production by increasing their margins.

The consequences are particularly severe for managers who have to deal with the greening of their fleets, precipitated by the implementation of the LOM Act (Mobility Orientation Law). The latter requires private car fleets to include a quota of low-emission vehicles. To support their vehicle fleet electric and thus avoid penalties, companies have every interest in anticipating orders. Many of them will have to increase their annual investments or reallocate spending items by prioritising their vehicle fleets.

Today, the automotive segment accounts for just 10 % of the activity of electronic chip manufacturers. There is every chance that production will be reallocated in the future, in particular to support the growth of electric and hybrid cars.

Despite its far-reaching consequences, the semiconductor crisis has highlighted new prospects for the automotive sector. In the context of the transition to electric vehicles, which will dominate the European market by 2035, new challenges need to be met to encourage the relocation and autonomous production of electronic components.