What is an independent?

Self-employed people are distinguished from employees by the absence of an employment contract. In effect, a self-employed person is both an entrepreneur and his or her own employee. In France, the self-employed are strongly represented by the paramedical and medical sector, VTC drivers and agriculture. Nevertheless, the digitization of the working environment has led to the emergence of professions such as consultant, developer, graphic designer...

These independent professions have automobile taxation thanks to their legal status.

As a self-employed worker, you can choose from several legal forms:

- Sole proprietorship

- EIRL Limited Liability Sole Proprietorship

- The EURL limited liability company (Entreprise Unipersonnelle à Responsabilité Limitée)

- SASU Société par Actions Simplifiée Unipersonnelle (simplified one-person company)

These different statuses will enable you to deduct interest on loans, expenses linked to use and not be subject to the tax on the use of passenger vehicles for economic purposes when purchasing and using an electric vehicle.

Automobile taxation for the self-employed

When you're self-employed,autonomy is a redundant but very real word that also applies to travel. That's why the purchase of a vehicle can quickly become indispensable especially when it comes to developing your business as a self-employed entrepreneur.

Buying a car is an investment that can be a major step in your growth. It's up to you to plan the organization of this purchase in a reasoned way. Being an entrepreneur doesn't mean you can't buy a vehicle for your business, but certain tax and legal limits do apply.

The tax treatment of an electric car depends on the company's status:

- If you have a micro-business, you cannot deduct your expenses from your sales.

- If you have a legal structure other than micro-enterprise :

Vehicle operating expenses are deductible from taxable profits. Depreciation takes into account the depreciation of your vehicle over time: it can therefore be considered an expense for your company. expense for your company. Depreciation applies only to passenger cars, and is subject to a ceiling.

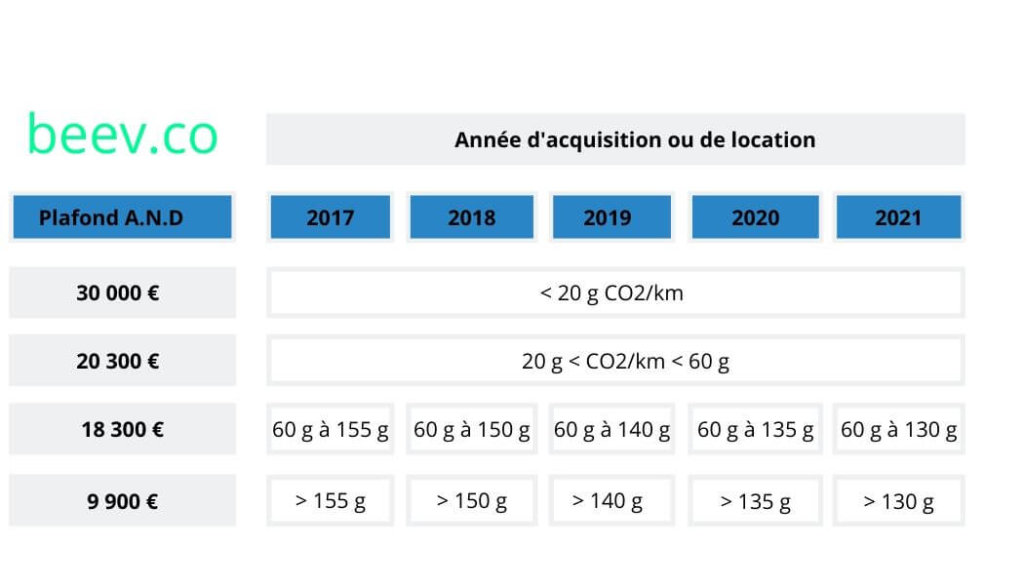

Law n°2016-1917 of December 29, 2016 has given rise to new ceilings: the depreciation base is calculated according to the year of acquisition of the vehicle and its CO2/km emission rate. So the more polluting and older your vehicle, the lower the depreciation base. This table summarizes the ceiling on depreciation for passenger cars according to the new calculation scale in the General Tax Code.

➡️ ALSO READ - The 2022 white paper on electric vehicle taxation

How can I finance my electric car as a self-employed person?

Buying a car is an important step in the lives of many French people. But how do you make the right choice? Buying a vehicle is considered an investment. By buying an electric vehicle, you're investing in a sustainable consumer good. Depending on your budget, your profile and the vehicle to be financed, this purchase can be made in several ways.

In addition to cash purchase, there are two other popular financing methods in France. Leasing with an option to purchase (LOA) and long-term leasing (LLD).

- LOA : is a lease with an option to purchase, which allows you to lease a vehicle with the possibility, at the end of the lease contract, of acquiring the said vehicle. This method has a number of advantages, such as the possibility of buying back or terminating the lease before the end of the contract, or the possibility of getting a good deal if the vehicle is in demand at the end of the contract.

- Long-term leasing (LLD): is a long-term leasing option for business customers, enabling them to rent a vehicle for a period of 1 to 5 years. During this period, the lessee pays a fixed rent and benefits from maintenance and assistance services included in the price. Long-term leasing is beginning to develop, but remains marginal for the time being. However, this method is very popular with companies, thanks to advantages such as better budget management thanks to fixed rental payments, and the possibility of changing vehicles frequently.

Discover Mansa

Now that you know the different types of contracts, let me introduce you to Mansa!

Mansa is a young French fintech co-founded in 2019 by Ali Rami, Benjamin Cambier and Rémy Tinco. The fintech is attacking the credit sector by adapting scoring to new ways of working. The observation is as follows: the banks' risk assessment model is still based on salaried employment, the dominant work mode. To prepare a loan application, banks require recurring income from a single source, or pay slips. This is precisely what self-employed workers don't have.

To achieve this, Mansa offers a platform dedicated to self-employed workers and freelancers, with an immediate response in 10 minutes and funds available within 24 hours. Perfect, isn't it?

Tips for successful financing

Why do you think banks are so reluctant to lend to self-employed people?

Banks have developed on the CDI model, not the freelance model.

To obtain credit, you need a pay slip, a single income from a single source, a single employer and, above all, a stable income.

As a result, a freelancer/self-employed person doesn't fit into the banks' classic boxes.

The "risk" calculated by the bank is therefore very high, or worse, the freelancer is automatically rejected by bank software not adapted to these profiles.

How to maximize your chances of obtaining credit?

This is common sense advice.

Save systematically to build up a deposit or safety mattress.

Avoid overdrafts at all costs, and don't spend more than you earn.

Banks generally respect the one-third rule. This means that your monthly loan payments must correspond to ⅓ maximum of what you have in your account at the beginning of the month at the time of drawdown.

What documents do I need to provide?

The loan application is made online in 10 minutes. Our algorithm analyzes bank statements, taking into account the characteristics of the self-employed.

The documents to be provided then depend on your legal status.

Legally, we need to have proof of the self-employed person's identity, the "identity document" of the self-employed person's structure (avis de situation siren ou kbis), a document showing the structure's turnover (Attestation de chiffre d'affaires urssaf, avis d'imposition ou bilan) and the bank account on which to receive the funds.

My income dropped during covid-19. Can I still apply for a loan?

Of course we do! And that justifies our mission even more.

The raison d'être of Mansa is to help self-employed people finance themselves. It's in these times of crisis that the self-employed need us most.

But we're also careful not to endanger the self-employed, because a loan has to be repayable.

It can be difficult for freelancers It can be difficult for freelancers to obtain a loan from a traditional bank to finance a need such as the purchase of an electric vehicle, which for many French people is an important step in their lives. Today, there are a multitude of options for financing your electric car, including cash purchase, LOA or long-term leasing, as offered by Mansa, a young French fintech offering dedicated to self-employed workers and freelancers, with an immediate response in 10 minutes and funds available within 24 hours.

Now that you know how to finance your electric car as a self-employed or freelance worker: it's up to you!

Beev offers multi-brand 100% electric vehicles at the best prices, as well as recharging solutions.