Lease an electric car

Would you like to lease an electric car? Beev offers you 100% electric cars at negotiated prices, as well as recharging solutions.

Types of insurance and cover for electric cars

There are different types of cover available when you hit the road. Whether you're looking for basic protection or maximum security, understanding these different options will help you choose the best insurance for your electric vehicle.

It should be noted that insurers do not offer specific cover for electric cars. Nonetheless, some insurers recommend that owners of these vehicles take out insurance to provide better protection.

Also, when selecting a contract, make sure it includes a warranty for the battery warranty. This component is crucial to the vehicle's smooth operation. In the event of malfunctions or breakdowns, the insurance company may offer to replace or repair it.

All-risk insurance

Comprehensive insurance offers a complete range of coverages cover for the driver and his vehicle. It is the most reassuring formula available on the marketwhich makes it particularly appropriate if you've just bought a new electric car.

Here's what comprehensive insurance offers:

- Assistance,

- Terrorism coverage,

- Glass breakage coverage,

- Driver's warranty,

- Natural disaster coverage,

- All-accident damage coverage,

- Technological disaster coverage,

- Theft / fire / forces of nature coverage.

This type of insurance offers comprehensive protection and peace of mind. Whether you're at fault or not, whether the third party is identified or not, this type of insurance provides extensive coverage for you and your vehicle in the event of a claim.

What's more, this type of insurance gives you access to 0 km assistance cover. The aim of this cover is to intervene on site in the event of a breakdown, or tow your vehicle to the nearest partner garageregardless of the location of the breakdown.

Please note Without this coverage, your insurer's assistance is only available if the breakdown occurs more than 50 km from your home.

In fact, the 0 km assistance guarantee is particularly useful in the event of an electric battery failure and no charging station nearby. This warranty covers repair or replacement of the battery. In addition, coverage is also provided for material damage resulting from electrical problems.

The latter may also be available as an option in other formulas. However, it's important to note that not all insurers offer it with third-party cover, or for older vehicles.

Third-party insurance

Third-party insurance only covers damage caused to third parties (a passer-by, an additional driver, a cyclist, an occupant of the vehicle...) in the event of an accident for which you are responsibleThis type of insurance is also known as "third-party" insurance. This type of insurance is also known as civil liability.

N.B. Every vehicle on the road in France must be insured with at least third-party liability (required under Article L211-4 of the French Insurance Code).

In short, third-party insurance is the minimum minimum requiredmainly covering third-party liability, and offering basic protection in the event of an accident.

In the event of an accident for which you are at fault, you will be responsible for the costs of :

- repairing your vehicle,

- to your personal injury,

- and assistance services.

Third-party insurance may be an option in certain circumstances, particularly for drivers with limited budgetsEspecially for young drivers or those with a history of claims. But that's not all: if your car is no longer brand new, switching to third-party insurance can be advantageous, as compensation in the event of loss can be lower than comprehensive premiums.

💡Did you know? The value of a car declines considerably over time, dropping by around 75% after ten years.

Extended third-party insurance

Extended third-party insurance, also known as intermediary insurance, offers an third-party coverage without the high cost of comprehensive insurance..

This option may be designated differently by different car insurers, such as :

- Third-party plus insurance,

- Intermediary insurance,

- Extended third-party insurance,

- Third-party comfort insurance,

- Improved third-party insurance.

Most extended third-party contracts retain the essential insurance coverages while adding coverage for material risks:

- Visit fire coverage (fire or explosion),

- Visit theft coverage (vehicle theft or attempted break-in),

- Visit glass breakage coverage (accident or act of vandalism),

- The guarantee natural disaster (hail, landslides, avalanches or floods).

All in all, this type of insurance offers good value for money.

Per-kilometre insurance

km insurance is designed for drivers with low annual mileage. low annual mileage. These formulas offer savings while guaranteeing the same coverage in the event of a claim as traditional insurance.

There are various per-kilometre insurance options:

- payment by kilometer via a GPS box,

- connected insurance adapted to your driving style,

- packages based on the number of kilometers driven (less than 5,000 km or 8,000 km in most cases).

This type of insurance allows premiums to be paid according to mileage, making it more advantageous for occasional drivers than traditional car insurance.

However, you must be careful not to exceed the number of kilometers stipulated in the contract to avoid an increase in the premium.

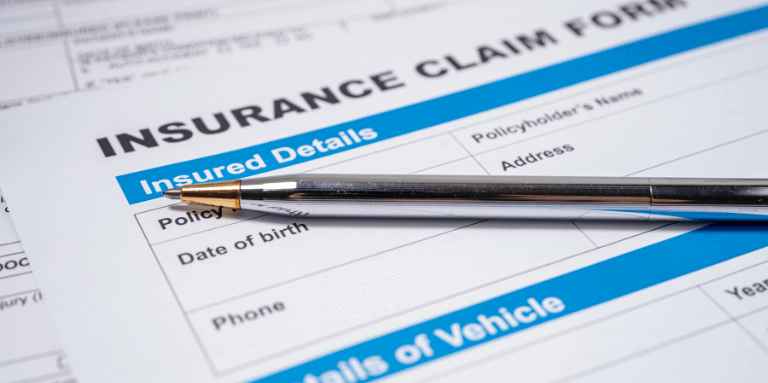

Annual cost of electric vehicle insurance

The estimated annual cost ofinsurance for an electric car ranges from around €400 for third-party cover to an average of €600 for comprehensive cover..

At presentannual insurance for an electric car averages €550with all-risk plans predominating at 93%, according to an insurance comparator.

By contrast, insuring a combustion-powered car costs an average of €650 a year. This contrasts with the cost of purchasing or leasing an leasing of an electric car which can be expensive, unlike its polluting counterpart. What's more, we also offer grants for buying an electric car.

💡Good to know : Electric vehicle insurance is exempt from the Taxe Spéciale sur les Conventions d'Assurance (TSCA) until December 31, 2024, according to the 2024 finance law.

However, the above prices vary according to a wide range of factors, which we'll look at in a moment.

Factors affecting the price of your insurance

Why does your neighbor pay less for electric car insurance than you? A mystery? Not really! The price of your car insurance depends on many factors, some of which are specific to electric cars.

Here are just a few examples:

- vehicle age,

- new or used car,

- the nature of the vehicle's use,

- type and power of car,

- where the vehicle is parked,

- the driver's geographical location,

- driver profile (new driver, experienced driver, etc.),

- the driver's driving history (including bonus-malus coefficient).

So to find the best insurance for your electric car and your budget, it's essential to take all these factors into account and use a insurance comparator.

This service allows you to quickly compare quotes from different insurance companiestaking into account the particularities of your electric vehicle and your requirements. By providing precise details, you can receive personalized quotes and compare rates from several companies to select the best option.

Practical tip : To optimize your insurance costs, it's best to equip your electric car with safety features to reduce your risk (collision warning, cruise control, sentry mode if you have a Tesla...).

Following on from that, you might be interested in this article: How can electric cars improve employee safety?

Which electric car models don't cost a lot to insure?

Initially, electric electric city cars generally offer less expensive insurance than electric electric SUVs for two main reasons:

- Modest power output, adapted to the city (minimizing the risk of major accidents),

- Relatively low maintenance costs (standard parts and easy access to mechanical components due to compact size).

For example, we have the Renault Zoe e-Techthe Dacia Springthe Peugeot e-208 or the Nissan Leafwhich stand out for their affordable insurance premiums.

Conclusion:

From now on, insurance holds no secrets for you. You know which models to choose for affordable insurance, the types of cover available, and the nuts and bolts of underwriting.

By opting for models equipped with advanced safety features, not only can you reduce the risk of accidents, but you can also benefit from more affordable insurance premiums. Nevertheless, it's essential to understand the different options available on the market to choose the model best suited to your needs and budget.

Stay tuned, the electric adventure continues on Beev !